Executive Summary

The thermocouple sensors market is projected to witness robust growth through 2030, driven by increasing demand across diverse industries including manufacturing, automotive, aerospace, energy, and consumer electronics. Thermocouple sensors are widely utilized for temperature measurement in environments requiring reliability, durability, and real-time monitoring. As industries embrace automation, data analytics, and precision control systems, the role of thermocouple sensors has become pivotal in ensuring quality control and operational efficiency.

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=522

The rising inclusion of temperature control systems in food safety management , increasing adoption of Industry 4.0 and IoT, and increasing penetration of temperature sensors in advanced & portable healthcare equipment is expected to propel the temperature sensor market in the next five years. However, continuous price reductions and intense competition among manufacturers will likely pose challenges for industry players.

Market Dynamics

The primary driver of growth in the thermocouple sensors market is the expanding industrial sector, where accurate temperature monitoring is critical for safety and product quality. Thermocouple sensors are ideal for high-temperature environments such as furnaces, kilns, engines, and turbines due to their simplicity, robustness, and cost-effectiveness.

Another significant driver is the increasing adoption of smart manufacturing systems. As factories become more digitized, real-time temperature data from thermocouples is integrated into cloud platforms and AI-driven monitoring systems for predictive maintenance and process optimization.

Thermocouple sensors are also benefiting from the surge in renewable energy applications. Wind turbines, solar thermal plants, and energy storage systems require continuous thermal management. This demand is stimulating innovation in rugged and miniaturized thermocouple designs suitable for harsh and space-constrained environments.

However, the market faces challenges including limited accuracy compared to resistance temperature detectors (RTDs), signal degradation over long wire lengths, and increasing competition from alternative sensor technologies. Nevertheless, the cost-efficiency and versatility of thermocouples ensure their continued relevance, especially in applications where durability under extreme temperatures is a priority.

Market Segmentation

The thermocouple sensors market can be segmented based on type, application, configuration, and end-use industries.

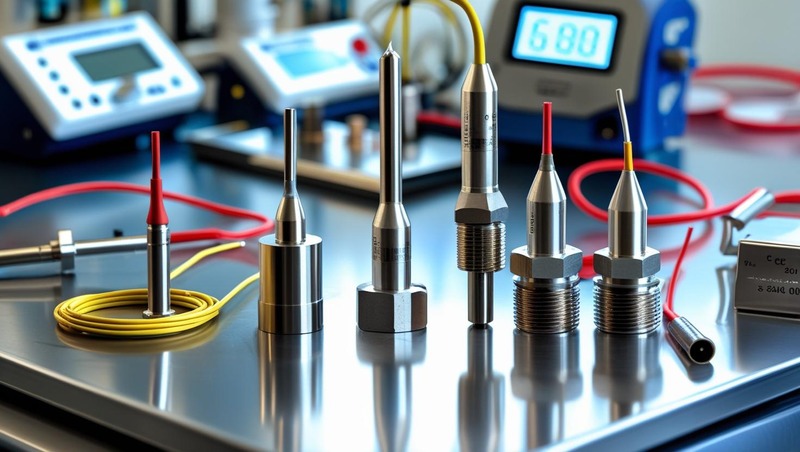

By type, the market is dominated by Type K thermocouples, followed by Type J, Type T, and Type N variants. Type K sensors are widely preferred due to their wide temperature range, reliability, and relatively low cost. For high-temperature industrial applications, Type R and Type S thermocouples are also seeing increasing adoption, particularly in metallurgy and chemical processing industries.

In terms of configuration, grounded thermocouples are used in applications where fast response time is required, while ungrounded and exposed junctions are selected based on the environment and insulation needs.

By application, temperature measurement remains the core function, with advanced use cases emerging in thermal profiling, calibration systems, combustion control, and environmental monitoring.

End-use industries such as manufacturing, automotive, aerospace, chemicals, energy, and healthcare are contributing heavily to market revenues. In the manufacturing segment, thermocouples are vital for furnace and mold temperature control. The automotive industry uses thermocouples for engine testing, emissions control, and battery temperature regulation in electric vehicles. In aerospace, the need for high-temperature monitoring in jet engines and aircraft systems continues to drive demand.

Regional Analysis

North America holds a significant share of the thermocouple sensors market, owing to its advanced manufacturing sector and strong presence of aerospace and defense industries. The U.S. remains the largest contributor in the region, backed by stringent industrial safety regulations and increased investment in automation.

Europe follows closely, with countries like Germany, the UK, and France leading adoption. The push for energy efficiency and sustainable manufacturing practices aligns well with the use of thermocouples for thermal monitoring and control.

Asia-Pacific is poised to witness the fastest growth through 2030. China, Japan, South Korea, and India are emerging as hotbeds of industrial activity, particularly in electronics manufacturing, automotive production, and renewable energy. Government initiatives promoting smart factories and industrial IoT are accelerating the integration of temperature sensors across production lines.

Latin America, the Middle East, and Africa are gradually increasing their adoption of thermocouple sensors, especially in mining, oil & gas, and energy production sectors. Infrastructure development and the modernization of industrial facilities in these regions present new growth opportunities.

Competitive Landscape

The thermocouple sensors market is moderately consolidated, with key players focusing on product innovation, miniaturization, material improvement, and digital integration to maintain competitive advantage. Companies are also expanding their global presence through mergers, partnerships, and regional distribution networks.

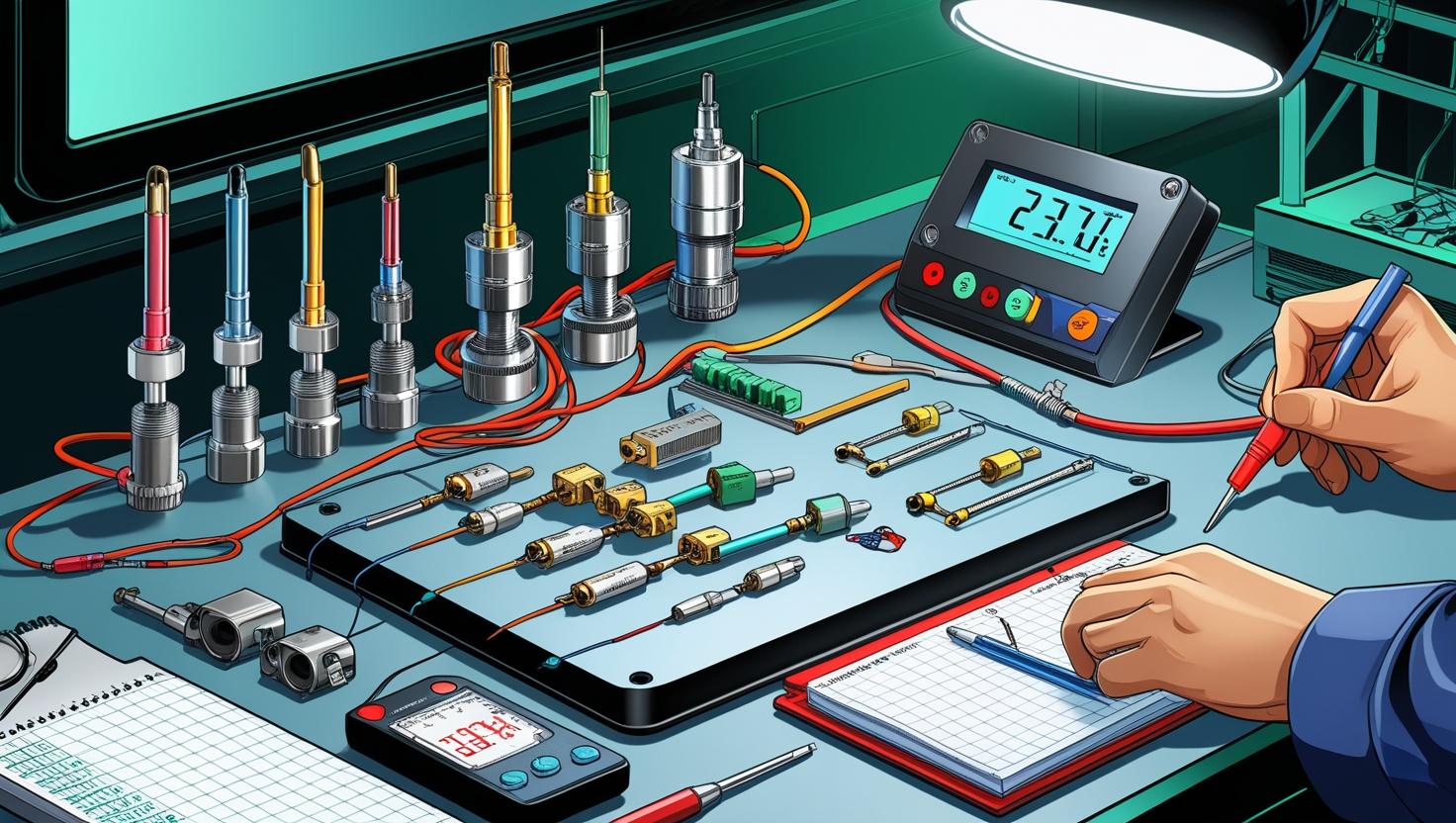

Prominent players in the market include Omega Engineering, Fluke Corporation, Watlow Electric Manufacturing Company, Honeywell International, TE Connectivity, Durex Industries, and Thermo Electric Company. These companies offer a wide range of thermocouples designed for specific use cases, ranging from high-accuracy laboratory sensors to rugged industrial probes.

The competitive landscape is also witnessing the entry of niche players specializing in custom thermocouple assemblies, wireless thermocouple solutions, and IoT-enabled temperature monitoring systems. As customization and integration with control systems become more valuable to end-users, vendors offering full-stack sensor and data analytics solutions are seeing increased demand.

Technological Advancements

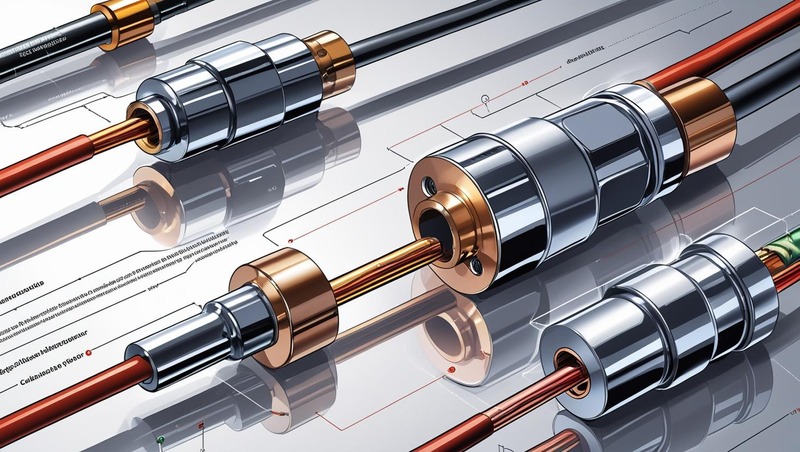

Advancements in materials science are enabling thermocouples to withstand higher temperatures and more corrosive environments. In particular, new sheath materials and insulation coatings are being developed to extend sensor life and performance in demanding conditions.

Digitalization is another critical trend. Thermocouples are now integrated with wireless transmitters, smart connectors, and real-time monitoring dashboards that allow operators to track temperature remotely. These advancements are especially valuable in industries like oil & gas and mining, where accessibility is limited.

AI and predictive analytics are transforming how thermocouple data is used. Through machine learning models, temperature data can now be analyzed to identify patterns and predict equipment failure, allowing manufacturers to schedule maintenance and avoid unplanned downtime.

Another emerging trend is the use of thermocouples in compact electronic devices. With the growing importance of thermal management in smartphones, wearables, and medical devices, miniaturized thermocouples are finding new applications where space is at a premium.

Industry Trends and Strategic Insights

The growing role of thermocouples in electric vehicle (EV) production is noteworthy. EV batteries are highly sensitive to temperature, and thermocouples are widely used in battery management systems, charging stations, and thermal safety systems. As EV adoption rises globally, so will the demand for reliable and compact thermocouple sensors.

Sustainability and energy efficiency goals are influencing purchasing decisions across industries. Thermocouples help track thermal energy usage, optimize fuel combustion, and maintain operational efficiency, aligning with these goals. Industrial customers are now looking for sensor solutions that support environmental compliance and reduce energy waste.

Standardization and modular design are gaining momentum. Modular thermocouple systems that can be easily replaced or upgraded without redesigning the whole system are in high demand. These solutions reduce downtime and make maintenance simpler and more cost-effective.

From a strategic standpoint, suppliers are increasingly offering value-added services such as calibration, data integration, remote diagnostics, and system design support. These services not only strengthen customer relationships but also enhance the lifetime value of each deployment.

Challenges and Risks

Despite the strong growth outlook, the thermocouple sensors market faces several challenges. One of the most persistent issues is signal interference and noise over long distances, which can affect measurement accuracy. While signal conditioning circuits and protective sheaths help, this remains a technical hurdle, especially in large-scale industrial environments.

Thermocouples also tend to have lower precision and stability over time compared to other sensor types like RTDs. For highly sensitive applications requiring extreme accuracy, RTDs or infrared sensors may be preferred.

Another challenge is the commoditization of basic thermocouple designs. As the technology becomes more mature, price pressures are increasing, especially in markets with multiple low-cost manufacturers. To remain competitive, vendors must focus on differentiation through performance, customization, and system-level integration.

Cybersecurity is emerging as a concern in digitally connected manufacturing environments. As thermocouples become part of larger IIoT networks, ensuring secure data transmission and protection from tampering will be essential.

Future Outlook

The thermocouple sensors market is positioned for steady growth, driven by long-term structural trends in industrial automation, energy management, and smart manufacturing. By 2030, thermocouples will not only be a critical component of industrial control systems but also integral to data-driven strategies in energy conservation, quality control, and predictive maintenance.

Emerging applications in renewable energy, electric vehicles, and wearable technology will expand the market beyond its traditional industrial base. Innovation in sensor design, materials, and connectivity will unlock new use cases and value propositions.

For manufacturers, the future lies in offering thermocouple solutions that are not only reliable and cost-effective but also intelligent, connected, and tailored to specific industry needs. As the manufacturing landscape becomes more complex and competitive, thermocouple sensors will serve as both a vital component and a strategic differentiator.

The thermocouple sensors market is on a strong growth path, fueled by technological innovation, industrial transformation, and rising demand for precision temperature monitoring. While the market faces challenges such as accuracy limitations and competition from other sensor technologies, the sheer versatility, affordability, and adaptability of thermocouples will ensure their continued relevance through 2030 and beyond.

Manufacturers, investors, and stakeholders looking to capitalize on the smart industry movement should consider thermocouple sensors not just as components, but as integral enablers of next-generation manufacturing efficiency and control.