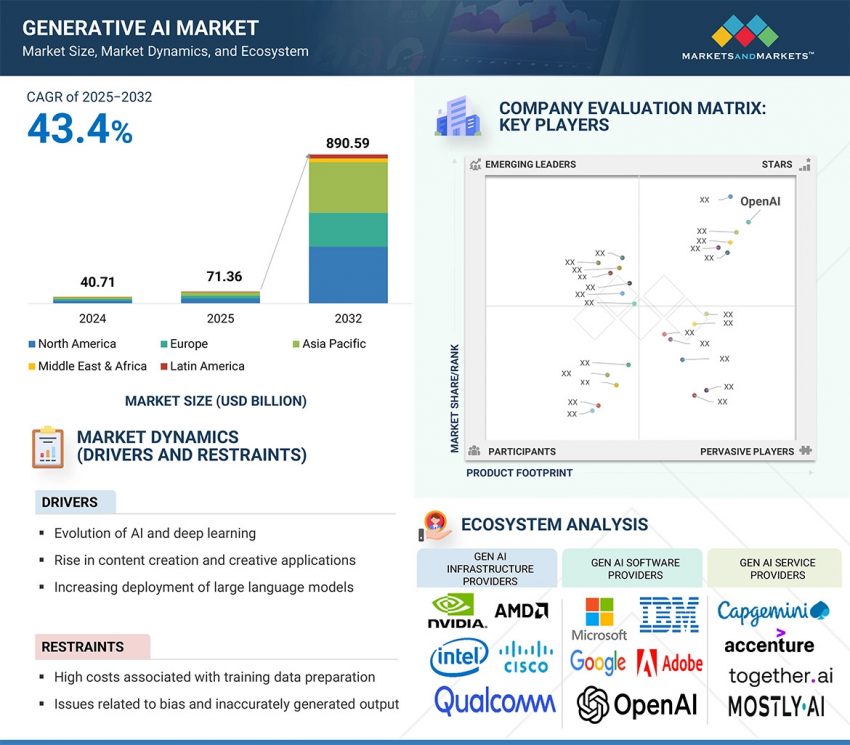

The generative AI market is projected to grow from USD 71.36 billion in 2025 to USD 890.59 billion by 2032, reflecting a robust CAGR of 43.4% throughout the forecast period.

The generative AI market is rapidly evolving into a multi-tiered commercial ecosystem, transforming how enterprises approach automation, creativity, and decision intelligence. As of 2025, the market is being driven by three key forces: foundation model delivery platforms, verticalized adoption across industries, and the rapid scaling of AI-native infrastructure. Leading providers like OpenAI, Google, and Anthropic are embedding models such as GPT-4, Claude, and Gemini into cloud-native services like Azure OpenAI, Vertex AI, and Amazon Bedrock, enabling enterprises to fine-tune, orchestrate, and deploy generative AI without heavy infrastructure overhead. This is catalyzing adoption across BFSI, retail, healthcare, manufacturing, and legal, where generative AI is being applied to use cases like fraud summarization, synthetic content creation, patient documentation, and contract analysis. Meanwhile, infrastructure demand is surging for high-bandwidth GPUs, low-latency memory systems, and vector databases optimized for retrieval-augmented generation. A new layer of differentiation is emerging through agent-based orchestration, model compression techniques, and open-weight small language models tailored to edge and on-premise environments. As global spending bifurcates between model training and inference-as-a-service, the generative AI market is entering a scale-driven phase defined by cross-layer integration, compliance-ready deployments, and high-margin platform monetization across the value chain.

Download PDF Brochure@ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=142870584

Abundance of enterprise data, model maturity, and low compute overhead to cement text as largest data modality by market share in 2025

Text is the largest data modality in the generative AI market due to its foundational role in enterprise workflows, model training availability, and monetization potential. Most enterprise knowledge—emails, reports, contracts, chat transcripts, documentation, code, and knowledge bases—exists in text form, making it the most abundant and actionable input for generative models. Language models like GPT-4, Claude, and Cohere Command are specifically trained on massive corpora of unstructured text scraped from websites, books, technical manuals, and code repositories, allowing them to deliver high-performance outputs across summarization, classification, generation, and dialogue tasks. Enterprises are integrating text-based models across high-value use cases such as customer service automation, legal drafting, financial reporting, compliance explanation, and personalized marketing, where accuracy, traceability, and semantic understanding are critical. Importantly, text generation has the lowest infrastructure burden among modalities, with lower compute and storage demands compared to video or image generation. This enables faster inference, lower latency, and easier deployment across internal and customer-facing applications. With strong ecosystem support, mature APIs, and a broad set of industry benchmarks, the text remains the default and most monetizable entry point into generative AI, capturing a major share of market investment and usage.

Demand for data diversity, cost-effective labeling, and privacy compliance to push synthetic data generation to become fastest-growing application during forecast period

Synthetic data generation is poised to emerge as the fastest-growing application in the generative AI market, driven by the urgent need for diverse, high-quality, and privacy-safe datasets across industries. Traditional data collection is slow, expensive, and often constrained by regulatory barriers such as GDPR, HIPAA, or sector-specific confidentiality norms. Generative AI offers a powerful alternative by enabling the creation of labeled, unbiased, and anonymized datasets that mimic real-world scenarios without exposing sensitive information. Use cases are exploding in domains like autonomous driving, where synthetic street environments train perception systems; finance, where synthetic transactions model fraud patterns; and healthcare, where rare disease data is simulated to train diagnostic models. Enterprise adoption is surging as synthetic data accelerates model training cycles while drastically reducing dependency on manual annotation or third-party providers. Startups like Synthesis AI, Mostly AI, and Gretel.ai are scaling enterprise-ready synthetic data platforms, while hyperscalers are embedding generation capabilities directly into MLOps pipelines. With strong alignment to both AI model performance and compliance requirements, synthetic data is no longer a niche use case—it is becoming a strategic asset powering faster, safer, and more scalable AI development.

Asia Pacific to be fastest-growing market during forecast period, fueled by government backing, hyperscaler expansion, and enterprise gen AI adoption

Asia Pacific is projected to be the fastest-growing region in the generative AI market, propelled by a convergence of state-backed AI initiatives, hyperscaler infrastructure expansion, and enterprise digital transformation across high-growth economies. Countries like China, India, South Korea, Singapore, and Japan are aggressively funding generative AI R&D, launching sovereign AI models, and rolling out national compute grids to reduce dependence on Western LLMs. India’s Digital Personal Data Protection Act and initiatives like Bhashini are accelerating vernacular AI development, while firms like Infosys and TCS are embedding generative AI into BFSI, retail, and logistics workflows. In China, companies such as Baidu and Alibaba are rapidly scaling foundation models across industrial design, ecommerce, and smart cities, backed by government incentives and compute subsidies. Hyperscalers like AWS and Microsoft are adding GPU-dense cloud regions in Mumbai, Jakarta, and Seoul to meet surging demand for inference and fine-tuning. Meanwhile, the region’s massive internet user base, multilingual content diversity, and mobile-first enterprise adoption are creating high-ROI use cases in marketing automation, AI-powered customer service, and digital twins. These dynamics position Asia Pacific as the global epicenter for generative AI scale-up over the next decade.

The major players in the generative AI market include IBM (US), NVIDIA (US), OpenAI (US), Anthropic (US), Meta (US), HPE (US), AMD (US), Oracle (US), Innodata (US), iMerit (US), Salesforce (US), Telus Digital (US), Microsoft (US), Google (US), AWS (US), Adobe (US), Accenture (Ireland), Capgemini (France), Centific (US), Fractal Analytics (US), Tiger Analytics (US), Quantiphi (US), Databricks (US), Dialpad (US), Appen (Australia), Insilico Medicine (Hong Kong), Simplified (US), AI21 Labs (Israel), Hugging Face (US), Persado (US), Copy.ai (US), Synthesis AI (US), Hypotenuse AI (US), Together AI (US), Mistral AI (France), Adept (US), Stability AI (UK), Lightricks (Israel), Cohere (Canada), Writesonic (US), Inflection AI (US), Colossyan (UK), Jasper (US), Runway (US), Inworld AI (US), Typeface (US), Upstage (South Korea), H2O.ai (US), Speechify (US), Midjourney (US), Fireflies (US), Synthesia (UK), Mostly AI (Austria), Forethought (US), Character.ai (US), Cursor (US), DeepSeek (China), XAI (US), Abridge (US), Perplexity AI (US), SambaNova (US), Scale AI (US), Labelbox (US), and HQE Systems (US).

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: [email protected]