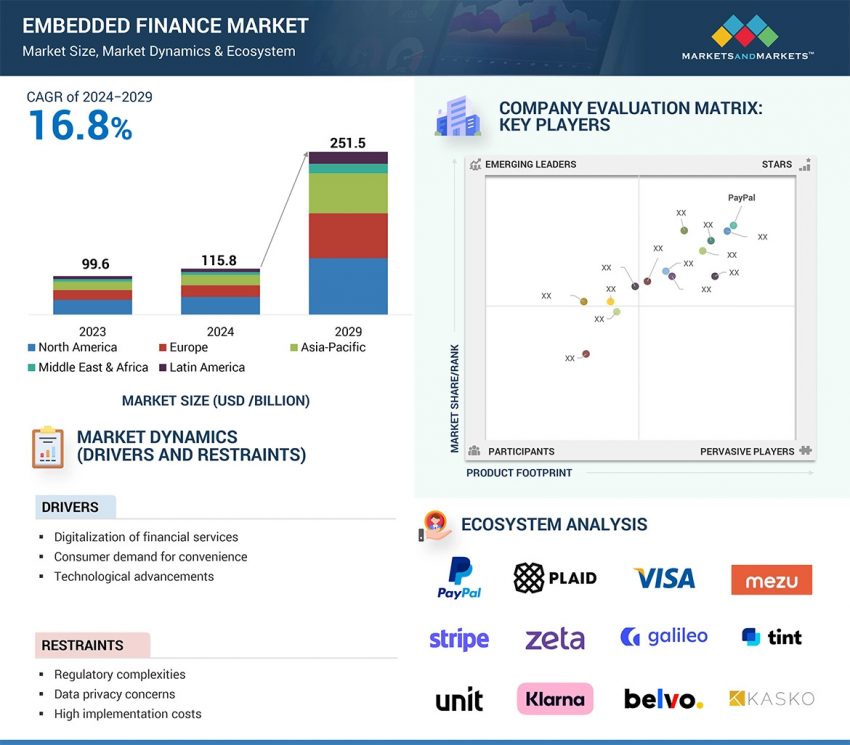

The embedded finance market is projected to grow from USD 115.8 billion in 2024 to USD 251.5 billion by 2029, registering a CAGR of 16.8% during the forecast period.

The embedded finance market is experiencing a massive disruption because of the development of technologies such as API, AI, blockchain, etc. This capability allows companies to incorporate financial services into their platforms, delivering consistent and unique solutions. Furthermore, demand for new complex, value-added, readily available services that can be offered in real-time has pressured firms in almost all industries to embrace embedded finance. This shift helps non-financial firms to provide banking, lending, insurance, and payment services, which fortifies customer relations and generates more revenues. This market is divided into segments based on different aspects, such as the type, business model, and industry. Type includes solutions such as embedded payments, embedded lending, embedded insurance, embedded investment/wealth management, and others such as issuance and deposits. The business model includes both B2B and B2C. The industry segment focuses on retail & eCommerce, healthcare, education, telecom, transportation, mobility and logistics, travel & hospitality, and other industries, namely real estate, energy, media & entertainment, and agriculture. These segments collectively offer a comprehensive overview of the evolving embedded finance landscape and its potential business implications.

Download PDF Brochure@ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=126584658

By 2029, the Embedded Finance market is expected to have a robust growth trajectory in terms of value.

Substantial growth in the embedded finance market is driven by the rising digitalization of financial services and the emergence of customized solutions across diverse industries. The seamless integration of financial services into non-financial platforms is being facilitated by technologies such as APIs and artificial intelligence, which are playing a crucial role in this transformation. Sectors such as healthcare, eCommerce, and transportation are increasingly adopting embedded payments, lending, and insurance to improve customer experiences and streamline operations. This expansion is driven by both B2B and B2C models, as businesses collaborate with fintech providers to integrate financial services into their ecosystems. Customer relationships are being strengthened, new revenue opportunities are being unlocked, and the transformative power of embedded finance is being leveraged through these efforts by companies.

Based on industry, the healthcare sector is expected to have the highest growth rate during the forecast period.

The growing need for hassle-free, patient-focused payment solutions has led to the incorporation of embedded finance solutions into healthcare platforms. Digital health technologies, such as telemedicine and wearable devices, are driving the integration of payment, lending, and insurance options in the healthcare sector. Regulatory support for innovation in fintech and healthcare, along with the demand for affordable and precise billing systems, is speeding up adoption for embedded finance solutions. Moreover, collaborations between fintech companies and healthcare providers are making way for tailored financial products, enhancing patient access to care while simplifying embedded finance provider revenue cycles. These factors are driving the widespread adoption of embedded finance in the healthcare industry, supporting the growth rate of the embedded finance market and underscoring its transformative potential in the healthcare sector.

North America is expected to account for the largest market share in 2023.

The Embedded Finance market has been studied in North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

North America’s embedded finance market accounts for the largest share in 2023 and is expected to grow in the forecasted period. Fintech innovation is giving way to a thriving market in North America. Companies are now directly incorporating financial services, such as payments, lending, and insurance, directly into their core offerings. Companies such as Stripe, PayPal, and Plaid, which provide comprehensive solutions to enable other businesses to integrate financial capabilities efficiently, are leading the embedded finance sector in the United States. Canada is witnessing growth in the embedded finance market, with companies like Shopify integrating payment and financing options into their eCommerce platform, thus improving the customer experience. The US embedded finance market is more mature, whereas Canada is catching up and the market growth would be facilitated by its robust technology ecosystem and supportive regulation.

Prominent companies include Stripe, Inc. (US), PayPal Holdings, Inc. (US), Amazon.com, Inc. (US), Plaid, Inc. (US), Klarna Bank AB (Sweden), FIS (US), Visa Inc. (US), Cross River Bank (US), Zeta Services Inc. (US), Marqeta, Inc. (US), Wise Payments Limited (UK), Goldman Sachs (UK), JPMorgan Chase & Co. (US), Alipay+ (China), Unit Finance Inc. (US), Solaris SE (Germany), Parafin, Inc. (US), Belvo (Mexico), Kasko Ltd. (UK), Tint Technologies Inc. (US), Mezu, Inc. (US), Fortis Payment Systems (US), Additiv AG (Switzerland), Galileo Financial Technologies, LLC (US), Trevipay (US).

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: [email protected]