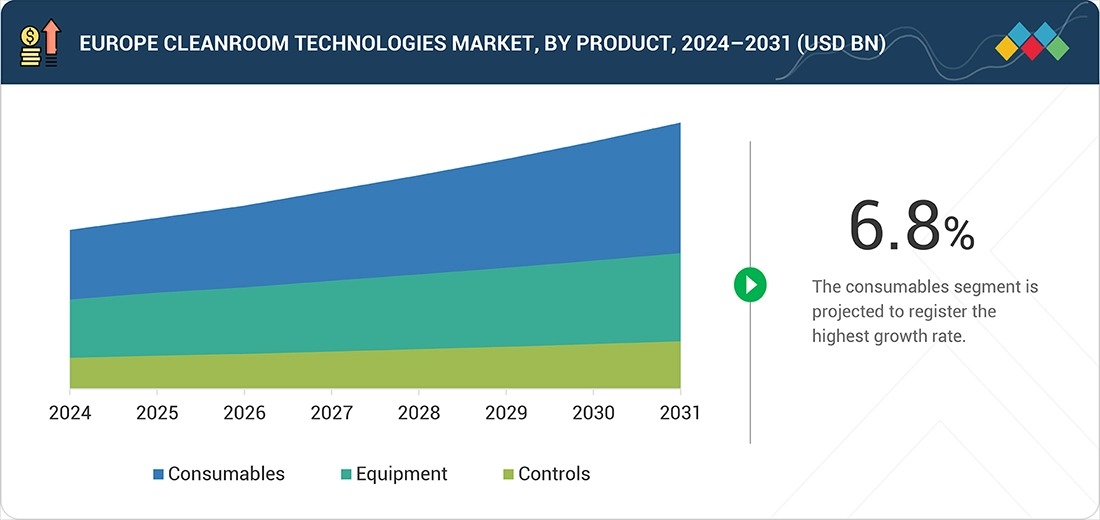

The Europe cleanroom technologies market is projected to reach USD 3.61 billion by 2031, up from USD 2.60 billion in 2026, growing at a CAGR of 6.8% during the forecast period.

The development of cleanroom technologies in Europe is driven by the expansion of high-precision industries, the need to comply with increasingly stringent regulations, and rising investments in the manufacturing sector. Demand from the pharmaceutical and biotechnology industries is particularly strong, owing to the growing production of biologics, vaccines and sterile injectables manufactured under EU GMP-compliant cleanroom environments. In addition, Europe’s robust semiconductor, microelectronics and aerospace sectors are accelerating adoption due to their requirement for ultra-low-contamination production environments.

The European cleanroom technologies market is primarily driven by growth in the pharmaceutical, biotechnology and semiconductor industries, all of which require strict contamination control and adherence to EU GMP and ISO standards. Increasing production of biologics, vaccines and advanced therapy medicinal products (ATMPs) is further supporting market growth. The expanding role of contract development and manufacturing organisations (CDMOs) has doubled the need for sophisticated cleanroom environments. Europe’s established electronics and aerospace industries, combined with the gradual replacement of ageing facilities and a shift towards modular, automated and energy-efficient cleanroom systems, are also contributing to increased adoption across the region.

Trends and Disruptions Impacting Customers’ Customers

The market is increasingly characterised by rapid digitalisation. The adoption of Industry 4.0 technologies—such as real-time sensors, cloud-based monitoring and predictive analytics—is improving regulatory compliance and operational uptime. There is also a growing preference for modular and pre-engineered cleanrooms, with turnkey solutions enabling faster time-to-operation while reducing capital expenditure (CAPEX).

Demand from the pharmaceutical, biotechnology (biologics, vaccines and ATMPs) and CDMO sectors continues to rise, driving the need for flexible and validated sterile environments. New investments in the pharmaceutical and biotechnology industries are accelerating adoption of ultra-low-contamination systems, advanced HVAC and filtration technologies, and sustainability-focused solutions. These include energy-efficient HVAC systems, low-carbon materials and lifecycle cost optimisation across the entire cleanroom value chain.

Driver: Increasing Demand for Biologics and a Booming Biopharmaceutical Industry

The cleanroom technologies market is significantly driven by rising demand for biologics, vaccines and advanced therapies, alongside the rapid growth of Europe’s biopharmaceutical industry. These products require extremely sterile, contamination-free environments throughout development and manufacturing. Biologics and cell and gene therapies are particularly sensitive to microbial and particulate contamination, prompting manufacturers to invest in higher-grade cleanrooms, isolators, advanced HVAC systems and real-time environmental monitoring.

As biopharmaceutical companies expand production capacity, construct new GMP facilities and increasingly outsource manufacturing to CDMOs, demand for state-of-the-art modular cleanrooms, automated decontamination systems and enhanced filtration technologies continues to rise. This trend is contributing significantly to overall market growth across Europe.

Restraint: High Operational Costs Associated with Cleanrooms

High operational costs remain a major restraint on the cleanroom technologies market. Maintaining compliance with GMP and ISO standards requires rigorous cleaning, sterilisation and continuous environmental monitoring, resulting in substantial energy consumption—particularly from HVAC systems—as well as frequent filter replacement. These costs are compounded by the need for skilled labour, specialised consumables, and ongoing validation and compliance activities.

Such financial burdens disproportionately affect small and medium-sized manufacturers, leading some organisations to postpone upgrades, limit cleanroom access, or seek lower-cost alternatives. As a result, technological advancement and market expansion can be slowed.

Opportunity: Growing Focus on Energy-Efficient Cleanrooms

The increasing emphasis on energy-efficient and sustainable cleanrooms presents a significant growth opportunity. Pharmaceutical and medical device manufacturers are seeking solutions that reduce operational costs while supporting sustainability targets and compliance with strict EU climate and energy regulations.

To address rising energy consumption from HVAC, filtration and air-handling systems, companies are investing in high-efficiency HEPA and ULPA filters, smart airflow management, low-energy HVAC systems, heat-recovery units and IoT-enabled environmental monitoring. Europe’s transition towards greener manufacturing practices, corporate ESG commitments and the need to modernise outdated cleanroom infrastructure are key factors driving demand for sustainable cleanroom designs.

Challenge: Customisation of Cleanroom Designs

The growing demand for highly customised cleanroom designs tailored to specific workflows, regulatory requirements and facility layouts is increasing design complexity, project timelines and costs. Unlike standard modular systems, customised cleanrooms require extensive engineering input, bespoke HVAC designs, specialised materials and multiple validation cycles.

This level of customisation can strain production capacity, reduce standardisation and complicate scalability and global deployment—particularly for suppliers operating across regions with varying regulatory frameworks. Longer lead times, higher costs and operational bottlenecks make it challenging for cleanroom technology providers to deliver fast and cost-effective solutions.

Market Ecosystem

The Europe cleanroom technologies market comprises an interconnected ecosystem of cleanroom constructors, modular cleanroom manufacturers, HVAC and filtration suppliers, and component providers such as panels, doors, pass-throughs and fan filter units (FFUs). This ecosystem supports industries including pharmaceuticals, biotechnology, semiconductors, aerospace and advanced manufacturing, and is reinforced by contamination-control solution providers and testing and validation service companies.

Regulatory authorities (EU GMP, ISO 14644), CDMOs, engineering consultants and technology integrators play a critical role in ensuring compliance, automation and digital monitoring. Increasing demand for rapid deployment, modular solutions, energy efficiency and full lifecycle support has intensified collaboration among equipment manufacturers, turnkey contractors and service providers across Europe.

Cleanroom Technologies Market, by Product

In 2025, the consumables segment held the largest share of the cleanroom technologies market. Consumables dominated due to expanding pharmaceutical, biotechnology and medical device sectors, which require continuous contamination control to achieve regulatory approval. Growing production of biologics, sterile injectables and advanced electronics has increased demand for gloves, gowns, wipes, disinfectants and contamination-free packaging.

The shift towards enhanced hygiene protocols and single-use systems in bioprocessing has further boosted consumable usage. The recurring need for replacement consumables, combined with their cost-effectiveness and contamination-control benefits, continues to drive strong demand across Europe.

Cleanroom Technologies Market, by Type

In 2025, modular cleanroom technology dominated the European market. This growth is driven by the need for rapid, flexible and cost-effective cleanroom deployment across pharmaceutical, biotechnology, medical device and advanced manufacturing sectors. Modular cleanrooms offer faster installation, scalability and ease of reconfiguration.

Global investments in CDMOs, vaccine manufacturing and cell and gene therapy facilities are accelerating adoption, supported by shorter construction timelines and predictable validation processes. Modular designs minimise downtime, reduce capital expenditure and simplify compliance with GMP and ISO standards, making them preferable to traditional cleanroom construction.

Cleanroom Technologies Market, by End User

The pharmaceutical industry is the dominant end-user segment due to stringent contamination-control requirements. Production of biologics, vaccines, sterile injectables and advanced therapies continues to drive demand. Regulatory pressure from agencies such as the EMA and FDA is pushing manufacturers to upgrade and expand cleanroom infrastructure.

Rising prevalence of chronic diseases, growth in personalised medicine and increased global clinical trial activity have heightened the need for high-grade cleanrooms. Investment in CDMOs and pharmaceutical manufacturing hubs across Europe is further accelerating adoption of advanced cleanroom technologies.

Germany: Fastest-Growing Market in Europe

Germany is the fastest-growing country in the European cleanroom technologies market, supported by its strong pharmaceutical, biotechnology and medical device industries. Increasing production of biologics and vaccines, alongside EU and national funding for microelectronics and semiconductor manufacturing, is driving cleanroom demand.

Germany’s focus on precision engineering, automation and digitalised manufacturing is accelerating adoption of advanced, modular and energy-efficient cleanroom systems. Strict regulatory standards, a well-established CDMO ecosystem and the modernisation of older facilities position Germany as a key growth market in Europe.

Key Market Players

-

Exyte GmbH (Germany)

-

Bouygues Group (France)

-

Ardmac (Ireland)

-

Colandis GmbH (Germany)

-

ABN Cleanroom Technology (Belgium)

-

Octanorm Vertriebs-GmbH (Germany)

-

Camfil (Sweden)

-

Parteco SRL (Italy)

-

Airplan (Spain)

-

Weiss Technik (Germany)

-

Atlas Environments Limited (UK)

-

Asgatech Holding Ltd. (Ireland)

-

CRT Cleanroom-Technology GmbH (Germany)

Recent Developments

-

December 2024: Camfil (Sweden) launched the Megaflow Pro ULPA Series, expanding its cleanroom filtration portfolio. The new products target next-generation pharmaceutical, semiconductor and biotechnology applications across Europe, Asia-Pacific and North America.

-

November 2024: ABN Cleanroom Technology (Belgium) introduced the SmartCleanroom 4.0 Platform, integrating IoT-based monitoring, predictive airflow control and automated contamination-response systems. The platform strengthens ABN’s position in digital cleanroom solutions for high-growth sectors such as cell and gene therapy.

-

October 2024: Connect 2 Cleanrooms (UK) launched an upgraded CleanCube Modular Cleanroom Series, featuring enhanced ISO-classified modular units, improved airflow zoning, energy-efficient HVAC modules and rapid-assembly frameworks for biopharmaceutical, medical device and semiconductor manufacturing.