The global antifreeze proteins market size is valued at USD 10 million in 2023 and projected to reach USD 50 million by 2028, expanding at an impressive CAGR of 37.2%. What was once a niche biological discovery has become a commercial powerhouse, with antifreeze proteins (AFPs) now driving innovation in frozen foods, cosmetics, and pharmaceuticals.

The Science Behind the Surge

Antifreeze proteins naturally occur in fish, insects, plants, bacteria, and fungi, allowing them to survive in sub-zero conditions. These proteins work by binding to ice crystals and preventing them from growing, a property that industries are harnessing to preserve freshness, texture, and quality.

In frozen foods, AFPs help maintain taste and consistency during storage and transportation. In cosmetics, they’re valued for their ability to protect skin cells from cold stress and aging. The medical field uses them for cryopreservation—essential in storing cells, tissues, and vaccines without damage.

Get Custom Data to Solve Your Business Challenges

What’s Fueling the Growth

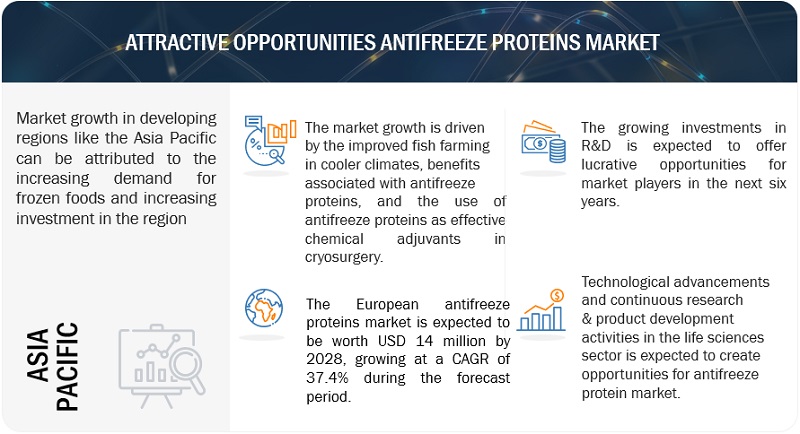

Several factors are driving the strong momentum of the antifreeze proteins market trends. Health-conscious consumers are increasingly seeking products that combine nutrition, quality, and sustainability. Frozen food producers and pharmaceutical manufacturers are adopting AFPs to enhance shelf life and stability.

Companies like Unilever are also investing heavily in R&D to stay ahead. The brand’s USD 96.92 million Foods Innovation Centre in the Netherlands is a key example of how global leaders are channeling resources toward advancing AFP applications across product categories.

Market Structure and Competitive Landscape

The antifreeze proteins market share remains highly consolidated, with five leading players—Nichirei Corporation, A/F Protein Inc., Kaneka Corporation, Unilever, and Sirona Biochem—holding over half of the global market. These companies are capitalizing on the growing demand for functional, natural, and temperature-resilient ingredients by expanding production and forming research partnerships.

Key Drivers, Restraints, and Opportunities

Rising awareness of the benefits of AFPs continues to be a major market driver. These proteins’ unique ability to inhibit ice crystal formation makes them indispensable in ensuring food safety, product stability, and health protection.

However, the market faces challenges. The high cost of production and R&D remains a major restraint. Extracting AFPs from natural sources is complex and resource-intensive, often involving advanced technologies and specialized research setups.

On the opportunity front, emerging markets like India and Brazil are rapidly adopting products that rely on AFPs, from vaccines to frozen snacks. These regions present vast growth potential for manufacturers and distributors as demand for quality and convenience products rises.

Market Segmentation Highlights

Among AFP types, Type III marine collagen stands out for its wide use in cosmetics and medical applications. The liquid form of AFPs, though smaller in volume, is seeing steady demand growth in cryopreservation and skincare. The medical segment dominates usage, while insect-derived AFPs are expected to grow fastest as technology advances in sustainable protein extraction.

Regional Insights

North America leads the antifreeze proteins companies landscape, supported by its strong R&D infrastructure, growing consumer demand for frozen and packaged foods, and innovation-friendly ecosystem. With leading market players headquartered in the region, North America is poised to maintain its dominance through 2028.

The Future Outlook

The antifreeze protein industry is at an exciting crossroads of science and sustainability. As advancements in biotechnology reduce production costs and diversify sources, AFPs are expected to become a staple across food, healthcare, and beauty sectors. The next few years will see these proteins transition from specialized compounds to mainstream ingredients that redefine product performance and preservation.

Make an Inquiry to Address your Specific Business Needs

Frequently Asked Questions (FAQs)

- What are antifreeze proteins and how do they work?

Antifreeze proteins (AFPs) are naturally occurring molecules found in certain fish, insects, plants, bacteria, and fungi. They work by binding to ice crystals and preventing them from growing, allowing organisms—and now commercial products—to remain stable and effective in freezing conditions. - Which industries use antifreeze proteins the most?

AFPs are widely used in the food, cosmetic, and medical industries. In food, they prevent ice crystal formation in frozen products; in cosmetics, they protect skin from cold damage; and in medicine, they aid in cryopreservation of tissues, cells, and vaccines. - What factors are driving the growth of the antifreeze proteins market?

Growth is fueled by the rising demand for high-quality frozen foods, anti-aging skincare products, and advanced medical preservation solutions. Increasing consumer awareness about nutrition and sustainability also supports this upward trend. - What challenges does the antifreeze proteins industry face?

The main challenges are high production and research costs, along with limited availability of sustainable, non-animal sources. Additionally, vegan trends are pushing the industry to develop plant- or microbe-derived AFPs to reduce reliance on fish-based sources. - Which regions are leading in antifreeze protein development?

North America currently leads the global market due to strong research capabilities, major industry players, and growing demand for frozen foods and cosmetics. Europe and Asia-Pacific are also emerging as significant markets with expanding R&D initiatives. - Who are the key players in the antifreeze proteins industry?

Major market participants include Nichirei Corporation, A/F Protein Inc., Kaneka Corporation, Unilever, and Sirona Biochem. These companies are investing heavily in innovation to enhance production efficiency and application diversity.