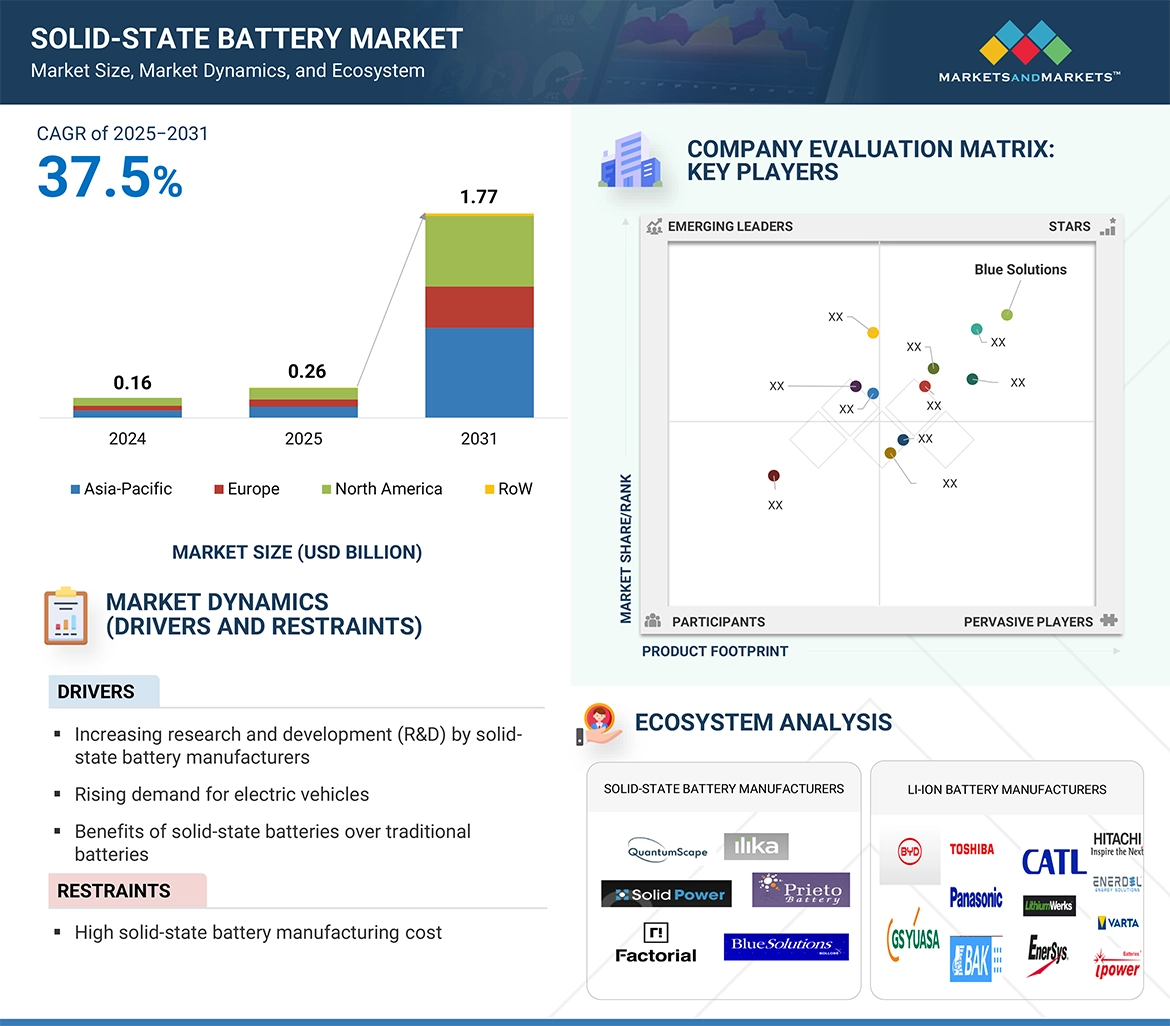

The Solid-State Battery Industry is rapidly evolving as global demand for safer, more efficient, and higher-capacity energy storage solutions intensifies. As electric vehicles, renewable energy systems, and portable electronics increasingly rely on advanced batteries, the shift from traditional lithium-ion to solid-state technology represents a pivotal transformation. At the heart of this evolution lies a complex value chain that connects material suppliers, technology developers, component manufacturers, and end-product integrators. The interplay between established industry leaders and emerging startups is accelerating the commercialization of solid-state batteries and reshaping the global energy storage landscape.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=164577856

Upstream Segment: Material Innovation and Supply Chain Development

The foundation of the solid-state battery value chain begins with the development and supply of advanced materials—solid electrolytes, cathodes, anodes, and current collectors—that define battery performance. Unlike conventional lithium-ion batteries, which use liquid electrolytes, solid-state systems depend on solid materials such as sulfides, oxides, and polymers to transport lithium ions. This has led to intense research and investment in materials science.

Companies such as Mitsubishi Chemical, Sumitomo Chemical, and BASF are key players in supplying high-purity materials and electrolyte compounds tailored for solid-state applications. Japanese and South Korean suppliers dominate the market for specialty ceramics and sulfide electrolytes, leveraging decades of expertise in advanced materials. Meanwhile, startups like Ionic Materials in the United States are developing proprietary polymer-based electrolytes that promise better conductivity and manufacturability. The upstream segment is also witnessing the formation of strategic partnerships between chemical companies and battery developers to secure raw material supply chains and scale production.

Midstream Segment: Cell Manufacturing and Technology Development

The midstream segment of the value chain encompasses the core of solid-state battery innovation—cell design, assembly, and pilot-scale production. This stage is currently the most competitive, as global companies race to overcome technical challenges and bring commercially viable products to market. The midstream layer is where both established industry giants and agile startups are vying for leadership.

Toyota remains one of the most prominent players in this segment, having invested more than a decade in developing oxide-based solid-state batteries for electric vehicles. The company’s partnership with Panasonic under the Prime Planet Energy & Solutions joint venture exemplifies how automakers are integrating battery R&D with production expertise. Similarly, Volkswagen’s strategic alliance with QuantumScape has positioned both firms as leaders in sulfide-based solid-state technology. QuantumScape’s lithium-metal battery design, which promises higher energy density and rapid charging, has become one of the most closely watched developments in the industry.

Inquiry Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=164577856

Other established manufacturers such as Samsung SDI, LG Energy Solution, and CATL are expanding their R&D efforts to include hybrid solid-state designs that combine polymer and ceramic electrolytes. These companies are leveraging their large-scale lithium-ion manufacturing experience to accelerate the transition to solid-state production lines. Their efforts are supported by major investments in pilot plants and material processing facilities across Asia, Europe, and North America.

At the same time, a growing ecosystem of startups is pushing innovation boundaries. Solid Power, backed by BMW and Ford, is developing sulfide-based solid-state cells designed for EV integration. ProLogium Technology, based in Taiwan, has achieved significant milestones in oxide-based ceramic batteries and recently entered strategic collaborations with Mercedes-Benz and VinFast. U.S.-based Factorial Energy is focusing on hybrid polymer-ceramic electrolytes to achieve a balance between performance and manufacturability, with investments from Stellantis and Hyundai. Each of these players is advancing a unique approach, creating a diverse and competitive midstream landscape that fuels rapid technological evolution.

Downstream Segment: Integration and Commercial Applications

The downstream portion of the solid-state battery value chain focuses on integrating finished cells into end-use applications such as electric vehicles, portable electronics, energy storage systems, and aerospace technologies. Electric vehicle manufacturers are currently the largest prospective consumers of solid-state batteries, driven by the need for longer range, faster charging, and improved safety. Companies like Toyota, BMW, Volkswagen, and Hyundai are already testing solid-state prototypes in their upcoming vehicle platforms.

Beyond the automotive sector, consumer electronics companies including Apple, Samsung, and Sony are exploring solid-state designs to power the next generation of smart devices, wearables, and laptops. The superior energy density and compact size of solid-state batteries make them ideal for slim, high-performance electronics. In energy storage, solid-state systems are being evaluated for grid-level applications, where their long lifespan and stability could help balance renewable energy sources such as wind and solar.

Aerospace and defense industries are also investing heavily in this technology due to its reliability under extreme conditions. NASA and the U.S. Department of Defense have funded projects exploring solid-state batteries for spacecraft and unmanned aerial systems, highlighting the versatility and strategic importance of this innovation across industries.

Emerging Startups Reshaping the Ecosystem

While multinational corporations dominate large-scale production, emerging startups continue to play a vital role in shaping the direction of the solid-state battery industry. These startups often focus on solving specific challenges such as interfacial resistance, material compatibility, or manufacturing scalability. Companies like Blue Solutions in France have commercialized polymer-based solid-state batteries for electric buses, demonstrating early market viability. Meanwhile, startups such as BrightVolt and Prieto Battery are developing micro-scale solid-state batteries tailored for IoT devices and medical sensors.

Their innovations not only expand the potential applications of solid-state technology but also create opportunities for niche markets and specialized use cases. As venture capital funding continues to flow into the sector, these startups are expected to play an increasingly critical role in accelerating the overall commercialization timeline.

View detailed Table of Content here – https://www.marketsandmarkets.com/Market-Reports/solid-state-battery-market-164577856.html

A Converging Path Toward Commercialization

The solid-state battery industry value chain represents a dynamic ecosystem where established leaders and emerging innovators are converging toward a common goal—making solid-state technology commercially viable on a global scale. From upstream material suppliers to downstream integrators, every link in the chain is witnessing unprecedented collaboration and investment.

As major automakers ramp up pilot projects, startups push technological boundaries, and governments support strategic initiatives, the industry is moving rapidly from research to real-world deployment. In the coming decade, the companies that can effectively integrate innovation, cost reduction, and scalable production will define the competitive hierarchy of the solid-state battery market—ushering in a new era of safe, high-performance, and sustainable energy storage.