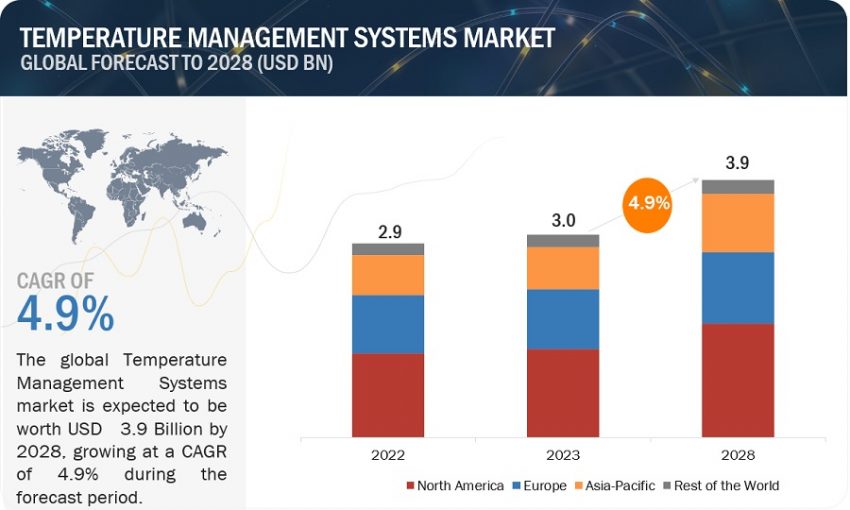

The global temperature management systems market was valued at $3.0 billion in 2023 and is projected to reach $3.9 billion by 2028, growing at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2028. This research includes an analysis of industry trends, pricing, patents, conference materials, key stakeholders, and consumer behavior.

The market growth is driven by the increasing prevalence of chronic and infectious diseases, a rising number of surgical procedures, an uptick in hypothermia cases, emerging market opportunities, and growing product launches and agreements among market players.

Market Dynamics

Drivers

Increasing Hypothermia Cases: Hypothermia, caused by environmental exposure, drug intoxication, or metabolic or nervous system dysfunction, occurs when body temperature falls below 35°C. It can lead to severe complications or death if not managed properly. The need to reduce hypothermia incidence is propelling the demand for temperature management systems.

Restraints

Lack of Awareness in Developing Countries: Proper use of temperature management systems requires specialized training. Many healthcare professionals are unaware of the latest advancements, limiting the adoption of these technologies. Low compliance rates and barriers such as lack of legislation, information, funding, equipment, and competence are more pronounced in developing regions, hindering market growth.

Opportunities

Increasing Contracts and Agreements: Market players are entering into strategic agreements to enhance their product offerings and expand their geographic reach. For example, in July 2023, ZOLL Medical Corporation and BrainCool entered an agreement for the exclusive distribution of the BrainCool System in the US and Europe, aiming to expand further into Asian markets.

Challenges

Product Recalls: Quality issues leading to product recalls can negatively impact customer satisfaction and company performance. Examples include Smiths Medical’s recall of NORMOFLO Irrigation Fluid Warmers and 3M Company’s recall of Bair Hugger surgical warming blankets, both due to safety concerns.

Market Segmentation

By Product

- Patient Warming Systems: This segment is expected to drive market growth due to numerous product launches and agreements. For instance, in June 2023, Dragerwerk AG launched the Babyroo TN300, a new patient warming system for newborns.

- Patient Cooling Systems

- Accessories for Patient Warming/Cooling Systems

By Application

- Perioperative Care: This segment is anticipated to dominate due to the rising number of hypothermia cases and the need to manage intraoperative hypothermia to prevent surgical complications.

- Acute Care

- Newborn Care

- Other Applications

By Medical Specialty

- General Surgery

- Cardiology

- Neurology

- Pediatrics

- Thoracic Surgery

- Orthopedic Surgery

- Other Specialties

By Region

- North America: Expected to lead the market due to the growing geriatric population, increasing chronic disease incidence, and a rising number of surgical procedures.

- Europe

- Asia Pacific

- Rest of the World

Prominent Companies

Key players in the temperature management systems market include:

- 3M Company (US)

- GE Healthcare (US)

- Dragerwerk AG & Co. KGAA (Germany)

- Asahi-kasei Corporation (Japan)

- Becton, Dickinson and Company (US)

Recent Developments

- June 2023: Dragerwerk AG launched the FDA-cleared Babyroo TN300, an open warmer for newborns.

- July 2023: Asahi-kasei Corporation entered an exclusive distribution agreement with BrainCool for the BrainCool System in the US and Europe.

- January 2022: ICU Medical completed the acquisition of Smiths Medical, creating a leading infusion therapy company with significant market presence.

- July 2022: Gentherm acquired Jiangmen Dacheng Medical Equipment Co., Ltd., enhancing its patient temperature management solutions portfolio.

Conclusion

The temperature management systems market is set for steady growth driven by technological advancements, strategic agreements, and the increasing need to manage hypothermia in medical settings. Despite challenges like lack of awareness and product recalls, opportunities in emerging markets and strategic collaborations are expected to drive the market forward.