In a world increasingly powered by artificial intelligence and machine learning, the demand for computing systems that can mimic the efficiency and flexibility of the human brain is accelerating. Enter neuromorphic computing—a frontier technology that’s catching the eye of forward-thinking investors for its potential to revolutionize AI hardware, reduce power consumption, and enable smarter edge devices. With a growing list of commercial applications and increasing interest from tech giants and research institutions alike, the neuromorphic computing market is no longer a niche bet—it’s becoming a strategic opportunity.

What Is Neuromorphic Computing?

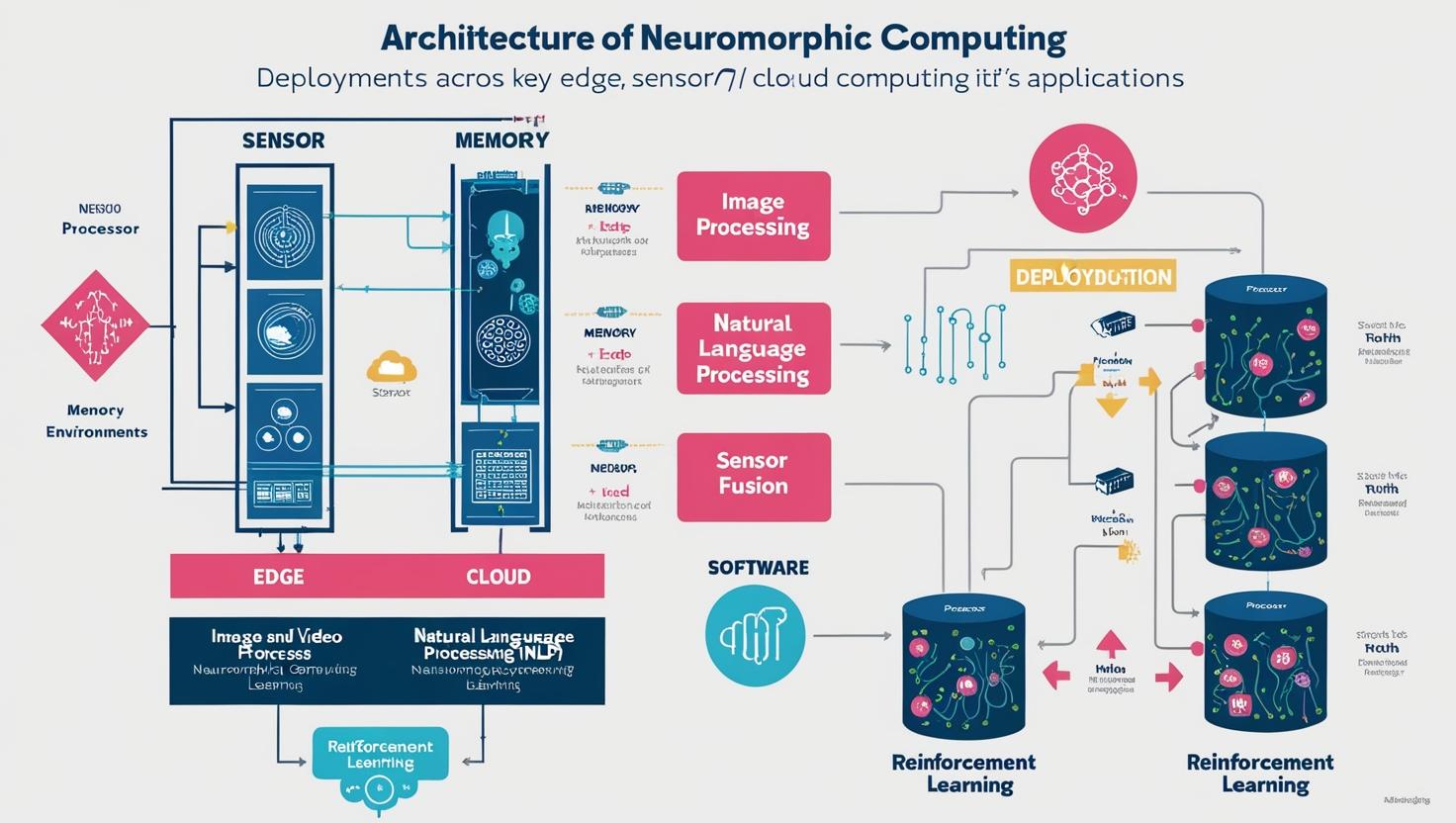

Neuromorphic computing refers to the design of computer systems that emulate the architecture and functionality of the human brain. Unlike traditional von Neumann architectures that separate memory and processing units, neuromorphic chips integrate these components, enabling faster processing and lower energy consumption. They use spiking neural networks (SNNs) that transmit information using electrical spikes—just like biological neurons—resulting in systems that are more adaptive, efficient, and capable of learning in real time.

Why It’s Gaining Attention

One of the primary reasons investors are turning their attention to neuromorphic computing is its potential to solve major limitations in current AI systems. While GPUs and TPUs dominate today’s AI hardware landscape, they are power-hungry and struggle with real-time processing in edge environments. Neuromorphic chips, on the other hand, offer ultra-low power consumption, making them ideal for energy-sensitive applications such as IoT devices, autonomous vehicles, wearable health monitors, and robotics.

Moreover, the neuromorphic model excels in event-based processing, which means it only uses power when it receives input, much like how the human brain responds selectively to stimuli. This is a critical advantage for applications where efficiency and responsiveness are key.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=227703024

Market Momentum and Forecasts

Although still in early stages of commercialization, the neuromorphic computing market is projected to grow rapidly in the coming decade. The neuromorphic computing industry is expected to grow from USD 28.5 million in 2024 and is estimated to reach USD 1,325.2 million by 2030; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 89.7% from 2024 to 2030, driven by increasing demand for brain-inspired computing in edge AI, defense, healthcare, and robotics.

Key companies operating in the neuromorphic computing industry are Intel Corporation (US), IBM (US), Qualcomm Technologies, Inc. (US), Samsung Electronics Co., Ltd. (South Korea), Sony Corporation (Japan), BrainChip, Inc. (Australia), SynSense (China), MediaTek Inc. (Taiwan), NXP Semiconductors (Netherlands), Advanced Micro Devices, Inc. (US), Hewlett Packard Enterprise Development LP (US), OMNIVISION (US), among others.

have already made significant R&D investments. Meanwhile, a number of startups are entering the space with unique IP and new chip architectures, presenting early investment opportunities in a field ripe for disruption.

Strategic Applications Fueling Demand

Investors are particularly drawn to neuromorphic computing because of its cross-sector potential. In healthcare, neuromorphic systems can process complex biomedical signals on edge devices, enabling real-time diagnostics with minimal latency. In defense and aerospace, neuromorphic chips can power autonomous navigation and decision-making in unpredictable environments. In consumer tech, neuromorphic processors could lead to truly intelligent personal assistants that understand and adapt to user behavior with minimal energy draw.

As smart cities, connected cars, and intelligent edge devices continue to expand, neuromorphic hardware could become a key enabler of ubiquitous, efficient AI—a critical need as the limitations of conventional silicon become more apparent

Challenges and Risk Factors

Despite its promise, neuromorphic computing is still an emerging field with a number of technical and market challenges. The ecosystem lacks mature software tools and standards, making it difficult for developers to build scalable applications. Adoption is also hindered by a lack of widespread understanding of SNNs compared to traditional deep learning models.

From an investment standpoint, there is a high degree of technological uncertainty, and many startups in the space are in pre-revenue or early-revenue stages. However, for investors with a long-term horizon and an appetite for innovation-driven risk, neuromorphic computing presents a compelling, high-upside opportunity.

Conclusion: A High-Risk, High-Reward Bet on the Future of AI

As the world moves toward more intelligent, decentralized, and power-efficient computing, neuromorphic technology could redefine what’s possible in AI and edge processing. For investors, this market offers a first-mover advantage in a space that could become foundational to the next generation of computing. While the road to widespread adoption may be long and complex, the potential returns—both technological and financial—could be extraordinary.

Frequently Asked Questions (FAQ)

Neuromorphic Computing Market for Investors

1. What is neuromorphic computing in simple terms?

Neuromorphic computing is a brain-inspired approach to computer architecture. It mimics the structure and function of the human brain using spiking neural networks (SNNs), enabling faster, more efficient, and more adaptive processing compared to traditional computing systems.

2. Why is neuromorphic computing relevant for investors now?

Investors are eyeing neuromorphic computing because it addresses current limitations in AI hardware—particularly in energy consumption and real-time processing. As AI expands into edge devices and autonomous systems, demand for efficient, adaptive computing platforms is expected to surge.

3. How big is the neuromorphic computing market?

The neuromorphic computing industry is expected to grow from USD 28.5 million in 2024 and is estimated to reach USD 1,325.2 million by 2030; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 89.7% from 2024 to 2030. Growth is driven by advancements in AI, the proliferation of edge devices, and increasing R&D by major players like Intel, IBM, and BrainChip.