The valve positioners market growth is experiencing significant growth as industrial automation continues to advance across sectors. Valve positioners, which control actuators to accurately position control valves, are critical for precise fluid handling in manufacturing, energy, chemical processing, and water treatment industries. By ensuring valves operate with precision and speed, positioners enhance operational efficiency, reduce process variability, and contribute to overall system reliability.

Industrial Automation Driving Market Expansion

One of the primary drivers of the valve positioners market is the widespread adoption of automation technologies. Process industries increasingly rely on automated systems to maintain operational efficiency, reduce human error, and achieve energy savings. Valve positioners play a pivotal role in these systems by enabling accurate and responsive valve control. As industries adopt Industry 4.0 practices, there is a growing preference for smart positioners that provide digital diagnostics, remote calibration, and real-time performance monitoring. This shift allows operators to optimize control loops, improve safety, and reduce maintenance costs.

Technological Advancements Shaping the Market

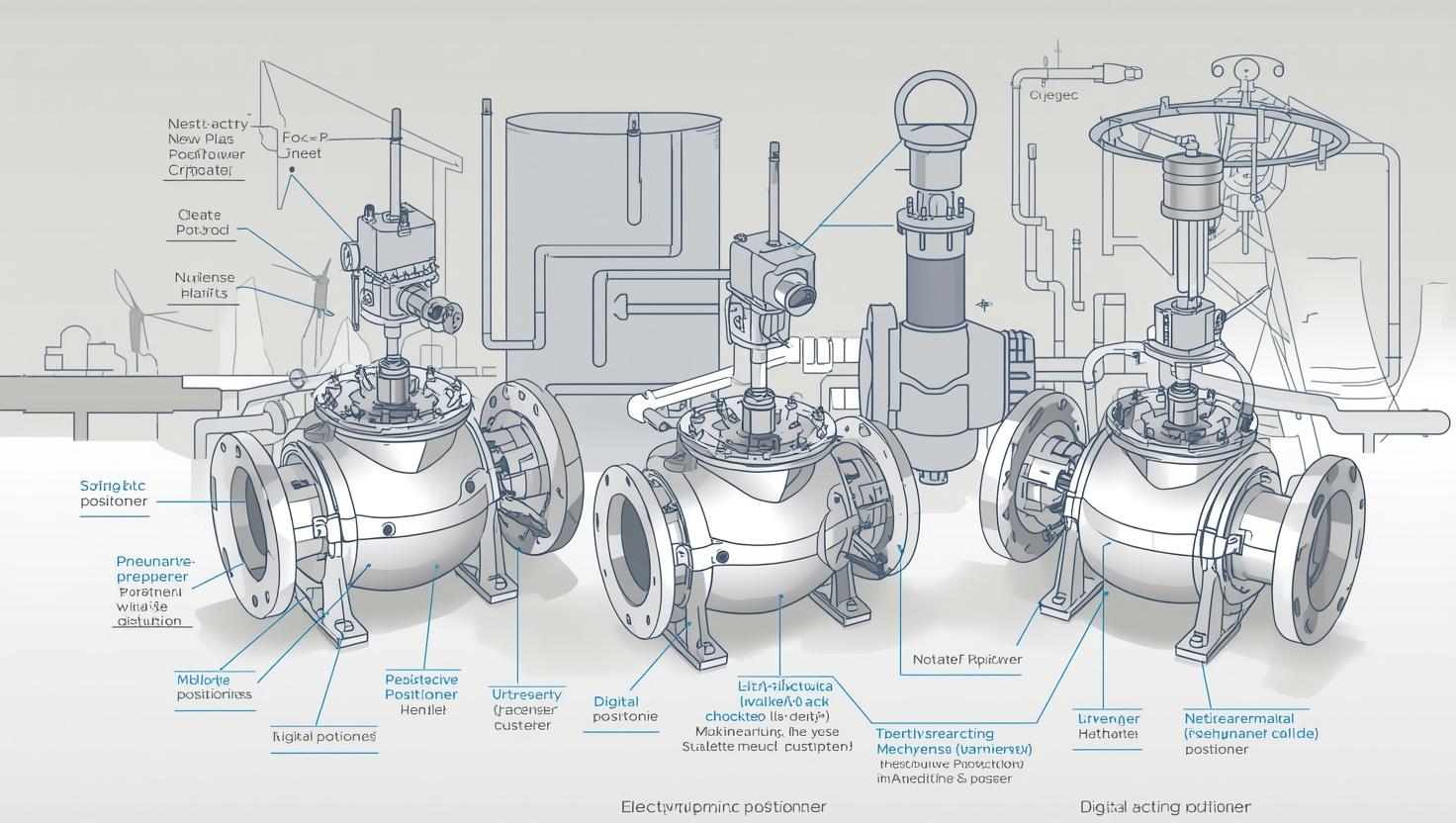

The valve positioners market is witnessing technological evolution from traditional pneumatic systems to advanced electro-pneumatic and digital solutions. Pneumatic positioners remain prevalent due to their reliability and cost-effectiveness, especially in hazardous environments. Electro-pneumatic positioners combine electronic controls with pneumatic actuation, offering faster response times and improved accuracy. Digital valve positioners represent the cutting edge, enabling communication with industrial networks, predictive maintenance, and integration with IoT platforms. These innovations allow operators to detect anomalies early, optimize valve performance, and increase the lifespan of control systems.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=138950854

Applications Across Industries

Valve positioners find applications across a broad range of industries. In the oil and gas sector, positioners regulate flow in pipelines, refineries, and upstream facilities, ensuring safe and efficient operation. The power generation industry relies on valve positioners to control steam and water flows, supporting both safety and energy efficiency objectives. Chemical and petrochemical plants benefit from precision control in complex processes, while water and wastewater treatment facilities use positioners to manage fluid flows with accuracy and reliability. Additionally, sectors such as pharmaceuticals, food and beverages, and industrial manufacturing leverage positioners to maintain product quality, safety, and regulatory compliance.

Regional Dynamics and Growth Opportunities

Geographically, the Asia-Pacific region is experiencing rapid market growth due to industrialization, expanding process industries, and increasing investment in automation technologies. Countries like China, India, and South Korea are driving demand for both new installations and retrofits of existing systems. North America continues to hold a significant market share, supported by advanced manufacturing facilities, stringent safety regulations, and adoption of smart automation technologies. Europe remains focused on upgrading legacy systems and integrating digital solutions to improve efficiency and sustainability.

Challenges and Market Opportunities

While the market demonstrates strong growth, challenges remain. The upfront cost of advanced smart positioners can be higher compared to traditional pneumatic models. Integration with legacy systems may require additional investment in compatible control frameworks or retrofitting older valves. However, these challenges present opportunities for vendors to offer value-added services such as calibration, predictive maintenance, and retrofit solutions. The increasing focus on reducing energy consumption and downtime provides a strong business case for adopting advanced positioners, which can deliver long-term cost savings and operational efficiency.

Future Outlook

The valve positioners market is poised for sustained growth as industries continue to modernize and digitize their operations. Smart positioners with digital communication capabilities, diagnostics, and predictive maintenance functionalities are expected to dominate new installations. Manufacturers who can provide interoperable, reliable, and easy-to-integrate solutions are likely to capture significant market share. For investors, companies that combine hardware innovation with software and analytics capabilities represent attractive opportunities, as these offerings align with the broader trends of Industry 4.0, industrial IoT, and process optimization.

Valve Positioners Market FAQ

1. What is the valve positioners market?

The valve positioners market includes devices that precisely control the position of industrial valves, ensuring optimal flow, pressure, and temperature management in automated systems. Positioners are essential for industries such as oil & gas, power generation, chemicals, water treatment, pharmaceuticals, and food & beverage, where precision and reliability are critical.

2. What types of valve positioners are available?

The market is segmented into pneumatic, electro-pneumatic, and digital valve positioners. Pneumatic models are widely used for reliability in harsh environments. Electro-pneumatic solutions provide improved accuracy and faster response times. Digital positioners are the most advanced, offering remote monitoring, diagnostics, predictive maintenance, and integration with industrial IoT systems, making them particularly attractive for modern automation setups.

3. Which industries are driving market growth?

The fastest-growing sectors include oil & gas, where precise flow control is critical; power generation, for efficient steam and water management; chemical and petrochemical industries, where complex processes demand accurate control; and water & wastewater treatment, pharmaceuticals, and food & beverage, which prioritize precision, compliance, and operational efficiency.

4. Why is the market attractive for investors?

The valve positioners market is growing steadily due to increased automation, Industry 4.0 adoption, and the push for energy efficiency. Investors benefit from multiple revenue streams including new installations, retrofits of legacy systems, and aftermarket services like calibration and predictive maintenance. Smart digital positioners also offer high-margin opportunities due to their advanced features and integration with IIoT platforms.

5. What are the key market trends?

Smart automation is driving demand for digital valve positioners with real-time diagnostics and connectivity. Predictive maintenance, remote calibration, and integration with process control systems are increasingly important. Additionally, regions such as Asia-Pacific are experiencing rapid adoption due to industrial expansion, while North America and Europe focus on retrofitting legacy systems and optimizing existing infrastructure.

6. What challenges exist in this market?

Initial costs of digital and electro-pneumatic positioners can be high compared to traditional pneumatic models. Integration with older systems may require additional investment. However, these challenges are offset by long-term efficiency gains, reduced downtime, and lower energy costs, making advanced positioners a sound investment for forward-looking industries.