The engine of the global shift towards electrification and sustainable energy is the battery, and the machinery that produces these power sources is undergoing a radical transformation. As we move further into 2025, the landscape of battery production is being reshaped by an insatiable demand for higher performance, lower costs, and greater sustainability. The machines at the heart of this industrial revolution are evolving from simple assembly lines into highly sophisticated, intelligent, and adaptable systems, paving the way for the next generation of energy storage. The trends shaping the future of this critical sector are not merely incremental improvements but fundamental shifts in technology and manufacturing philosophy.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=168163488

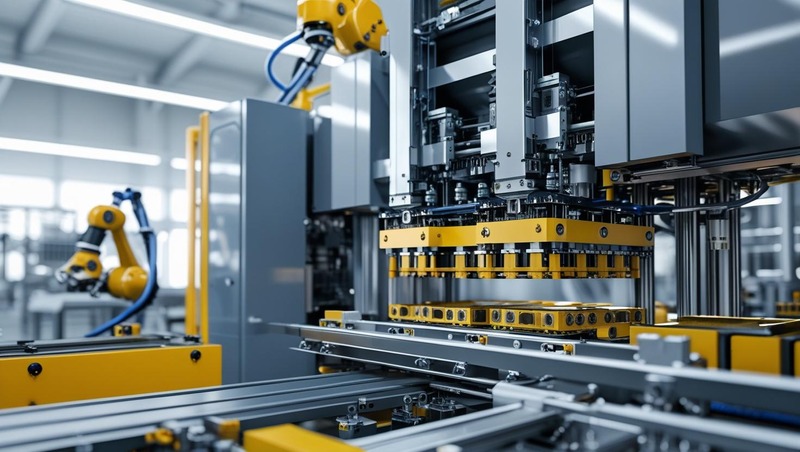

A primary driver of innovation in battery production machinery is the global expansion of gigafactories. Spurred by the exponential growth of the electric vehicle market and grid-scale energy storage, these massive manufacturing plants require production lines that are faster, more reliable, and more efficient than ever before. This has led to a surge in demand for automated, high-throughput equipment for every stage of the manufacturing process, from electrode mixing and coating to cell assembly and final testing. The sheer scale of these operations necessitates machinery that can operate 24/7 with minimal downtime, pushing manufacturers to integrate advanced robotics and high-precision quality control systems to ensure uniformity and reduce costly scrap rates.

The development of next-generation battery chemistries is also dictating the future design of production equipment. While lithium-ion technology currently dominates, the industry is on the cusp of a significant shift towards solid-state batteries. These batteries, which replace flammable liquid electrolytes with solid materials, promise a leap in energy density and safety. However, they also present entirely new manufacturing challenges, requiring machinery capable of handling brittle ceramic or polymer electrolytes and ensuring perfect interfaces between solid components. Alongside solid-state, emerging technologies like sodium-ion batteries are gaining traction as a lower-cost, more sustainable alternative, necessitating the development of flexible production lines that can adapt to different materials and cell architectures.

Furthermore, the principles of Industry 4.0 are becoming deeply embedded in battery manufacturing. The integration of artificial intelligence, machine learning, and the Internet of Things (IoT) is transforming production floors into smart, interconnected ecosystems. In 2025 and beyond, AI-driven analytics will be crucial for optimizing process parameters in real-time, predicting machinery maintenance needs before failures occur, and enhancing quality control to microscopic levels. This digital transformation enables the creation of a “digital twin” for both the battery and the production line, allowing for virtual simulation and optimization, which drastically shortens development cycles and improves overall efficiency.

Finally, sustainability is no longer an afterthought but a core driver of innovation in battery production machinery. A significant trend is the move towards greener manufacturing processes, such as dry electrode coating, which eliminates the need for toxic solvents and energy-intensive drying ovens, thereby reducing the factory’s carbon footprint. Moreover, as the first wave of electric vehicle batteries reaches the end of its life, machinery is being specifically designed to facilitate a circular economy. This includes automated disassembly systems and advanced equipment for recovering and refining critical raw materials like lithium, cobalt, and nickel, enabling them to be reintroduced into the production loop and creating a more secure and environmentally responsible supply chain.

Frequently Asked Questions (FAQs) on the Battery Production Machine Market

- What is the battery production machine market?

The battery production machine market refers to the global industry focused on the manufacturing, development, and sale of specialized machinery and equipment used to produce different types of batteries—especially lithium-ion batteries. This includes machines for electrode coating, cell assembly, electrolyte filling, formation, testing, and packaging. - What are the key drivers of the battery production machine market?

Major drivers include the growing demand for electric vehicles (EVs), the rapid adoption of renewable energy storage systems, government policies supporting local battery manufacturing, and increasing consumer electronics usage. Technological advancements and the need for automation and higher production efficiency also fuel market growth. - Which battery types are commonly supported by production machines?

Battery production machines are primarily designed for lithium-ion batteries but are increasingly being adapted to accommodate emerging battery chemistries such as solid-state, lithium iron phosphate (LFP), sodium-ion, and lithium-sulfur batteries. - What role does automation play in battery manufacturing?

Automation is critical in battery production to ensure precision, reduce human error, enhance product consistency, and boost production speed. Automated systems, including robotics and AI-integrated tools, are now standard in modern battery manufacturing lines. - How are government policies influencing the battery production machine market?

Governments worldwide are providing subsidies, tax incentives, and infrastructure support to promote local battery manufacturing. Policies like the U.S. Inflation Reduction Act, Europe’s Green Deal, and China’s industrial plans are encouraging investments in battery gigafactories, thereby increasing demand for production machinery. - What are the major components of battery production equipment?

Key equipment includes electrode coating machines, calendaring machines, slitting and winding machines, electrolyte filling machines, formation and testing systems, and packaging units. Each plays a crucial role in specific stages of battery production.

See More Latest Semiconductor Reports:

Lithium-ion Battery Market by Battery Type (NMC, LFP, LCO, LTO, LMO, NCA), Cell Type (Prismatic, Pouch, Cylindrical), Capacity (<50 kWh, 50-100 kWh, >100 kWh), Energy Storage (Residential, Utilities) Consumer Electronics, Medical – Global Forecast to 2033

Photovoltaics Market by Material (Silicon, CIGS, CdTe, Perovskite, Organic Photovoltaic, Quantum Dot), Component (Modules, Inverters, BOS), Installation Type (Ground-mounted, Building-integrated, Floating), Cell Type and Region – Global Forecast to 2030

SCADA in Renewable Energy Market by Hardware (PLCs, Remote Terminal Units, HMIs, Communication Systems), Software (On-premises, Cloud-based), Services (Professional, Managed), Sector Type (Solar, Wind, Hydropower) and Region – Global Forecast to 2030