The data center chip market growth is at the forefront of the digital transformation era, driven by the explosive growth of cloud computing, artificial intelligence (AI), edge computing, and hyperscale infrastructure. As global data traffic continues to surge, data centers are becoming more powerful, intelligent, and energy-efficient—opening up significant new opportunities for next-generation chip technologies. From custom accelerators to power-optimized processors, the future of data center chips is dynamic, diversified, and full of potential.

AI and Machine Learning Workloads Demand Specialized Chips

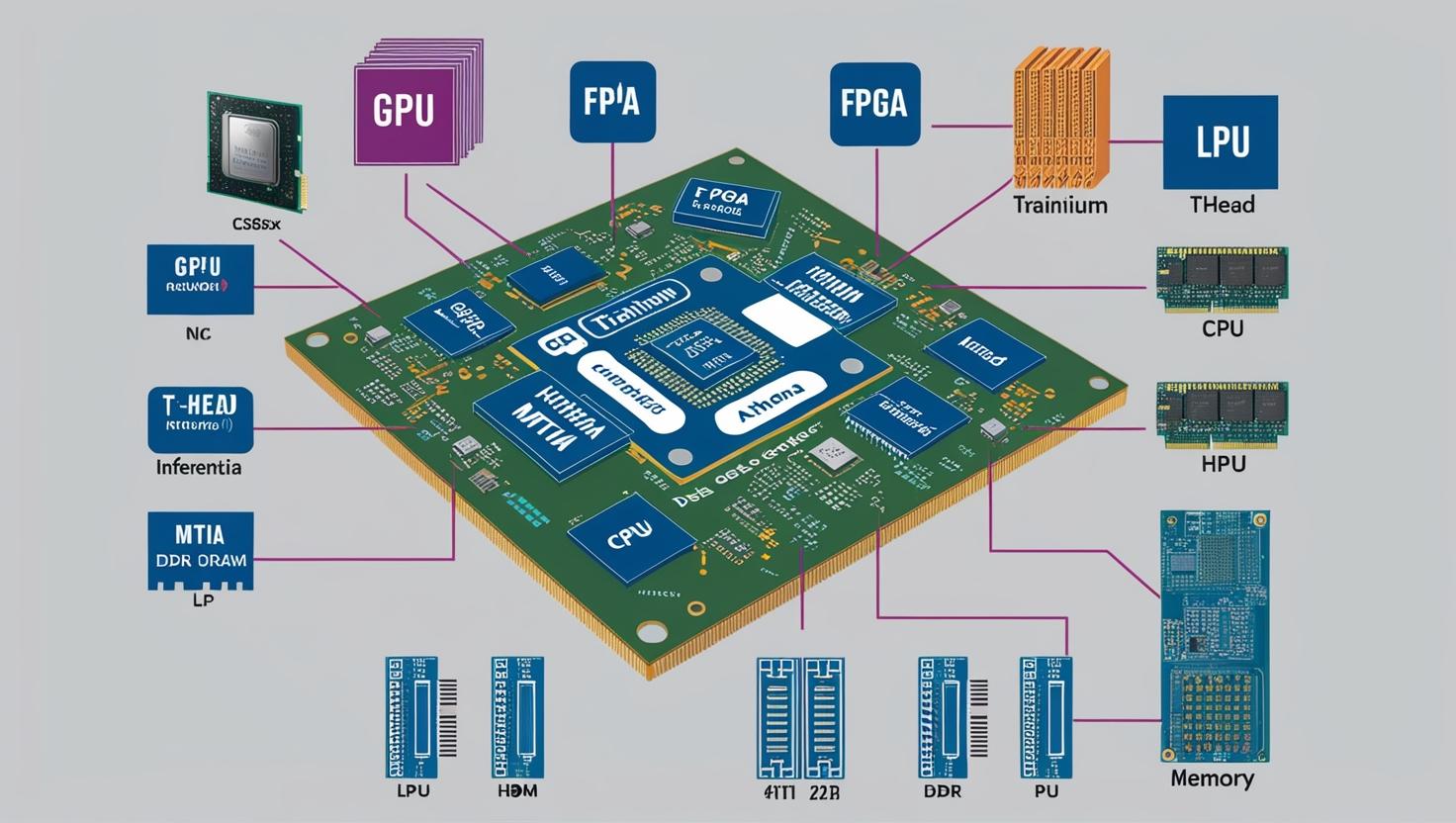

The most prominent opportunity in the data center chip market comes from the rise of AI and machine learning (ML) workloads. Traditional CPUs struggle with the parallel processing demands of deep learning and large-scale inference tasks. This has led to a surge in demand for graphics processing units (GPUs), tensor processing units (TPUs), and AI-specific accelerators.

Chipmakers like NVIDIA, AMD, Intel, and emerging players such as Graphcore and Cerebras are developing dedicated AI chips optimized for training and inference, offering faster processing, lower latency, and improved energy efficiency. These chips are now essential for cloud providers and enterprises deploying AI-as-a-service platforms.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=39999570

Growth in Hyperscale and Cloud Data Centers

The rapid expansion of hyperscale data centers, operated by giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, has created demand for customized chip architectures. These providers are increasingly designing application-specific integrated circuits (ASICs) and system-on-chips (SoCs) tailored for their specific workloads, such as storage, networking, or security.

For example, AWS’s Graviton chips (based on Arm architecture) and Google’s Tensor Processing Units are reshaping the data center chip landscape by focusing on performance-per-watt optimization, cost efficiency, and vertical integration. This trend presents a significant opportunity for chip designers and fabless semiconductor firms that can offer adaptable and energy-efficient solutions.

Global data center chip industry

The global data center chip industry is expected to grow from USD 206.96 billion in 2025 to USD 390.65 billion by 2030, growing at a CAGR of 13.5% from 2025 to 2030.

Edge Computing and Micro Data Centers

The shift toward edge computing is creating new opportunities for smaller, power-efficient chips designed for distributed micro data centers. These chips must be capable of real-time data processing, low-latency communication, and secure computation in space-constrained environments.

Startups and established players alike are racing to provide low-power AI chips, edge accelerators, and RISC-V based processors that can bring high performance to the edge while minimizing energy consumption. As smart cities, autonomous vehicles, and IoT networks grow, edge data center chips will become a critical component of the computing ecosystem.

Sustainability and Energy Efficiency as Market Drivers

With data centers accounting for a growing share of global electricity usage, there is increasing pressure to improve energy efficiency. This is leading to a strong market push for chips that deliver higher performance per watt, especially as AI and blockchain workloads demand more power.

Chip designers are responding with innovations in heterogeneous computing, chiplet architecture, and liquid cooling integration. Companies that can deliver sustainable chip solutions—including those with dynamic power management, intelligent workload allocation, and energy-aware design—will be in a strong position to capture emerging demand from environmentally conscious operators.

Security-Focused Chip Architectures

As cyber threats to data centers grow in sophistication, there’s an urgent need for chips that prioritize hardware-level security. This includes features such as secure enclaves, encrypted memory, and real-time threat detection baked directly into the silicon.

Opportunities are emerging for semiconductor companies to develop chips that support confidential computing, secure boot protocols, and post-quantum cryptography readiness. Demand is especially high in industries like finance, defense, and healthcare where data protection is paramount.

Open-Source and Customizable Architectures

The open-source hardware movement, particularly around RISC-V, is enabling new players to enter the market with custom designs tailored for specific workloads. This democratization of chip design is opening up niche opportunities for modular, customizable data center chips, especially in academic, startup, and regional cloud provider environments.

The flexibility of RISC-V and other open architectures allows companies to innovate rapidly and build domain-specific accelerators without being locked into proprietary ecosystems, potentially reducing cost and speeding up deployment cycles.

Geopolitical Trends and Regionalization of Chip Supply Chains

As geopolitical tensions and supply chain vulnerabilities increase, many countries are seeking to localize chip production and reduce reliance on foreign fabs. This trend is opening new opportunities for regional semiconductor development, including data center chips designed and fabricated within national borders.

Governments are offering subsidies, tax incentives, and funding for R&D to support domestic chip industries, presenting a major growth opportunity for firms that can align with these national strategies and deliver high-performance data center silicon solutions.

Conclusion: A High-Growth Market with Strategic Potential

The data center chip market is entering a new era defined by specialization, sustainability, and scale. From AI-specific processors and edge accelerators to energy-efficient SoCs and security-centric architectures, the demand for advanced chip technologies is rapidly expanding.

As digital workloads continue to diversify, chipmakers that can deliver performance, efficiency, and customization will be best positioned to capitalize on the emerging opportunities in this multi-billion-dollar industry. Whether through collaboration, vertical integration, or open-source innovation, the next decade offers unprecedented potential for growth in the data center chip space.