As the global economy increasingly pivots toward digital-first operations, data centers have emerged as the critical infrastructure supporting everything from cloud computing and social media to AI-driven analytics and e-commerce. At the core of these data centers are powerful semiconductor components—data center chips—that serve as the computational engines enabling rapid data processing, storage, and retrieval. The data center chip market is poised for robust growth as emerging technologies like Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), and 5G drive an exponential rise in data consumption and computing workloads.

The Role of Data Center Chips in Modern Computing

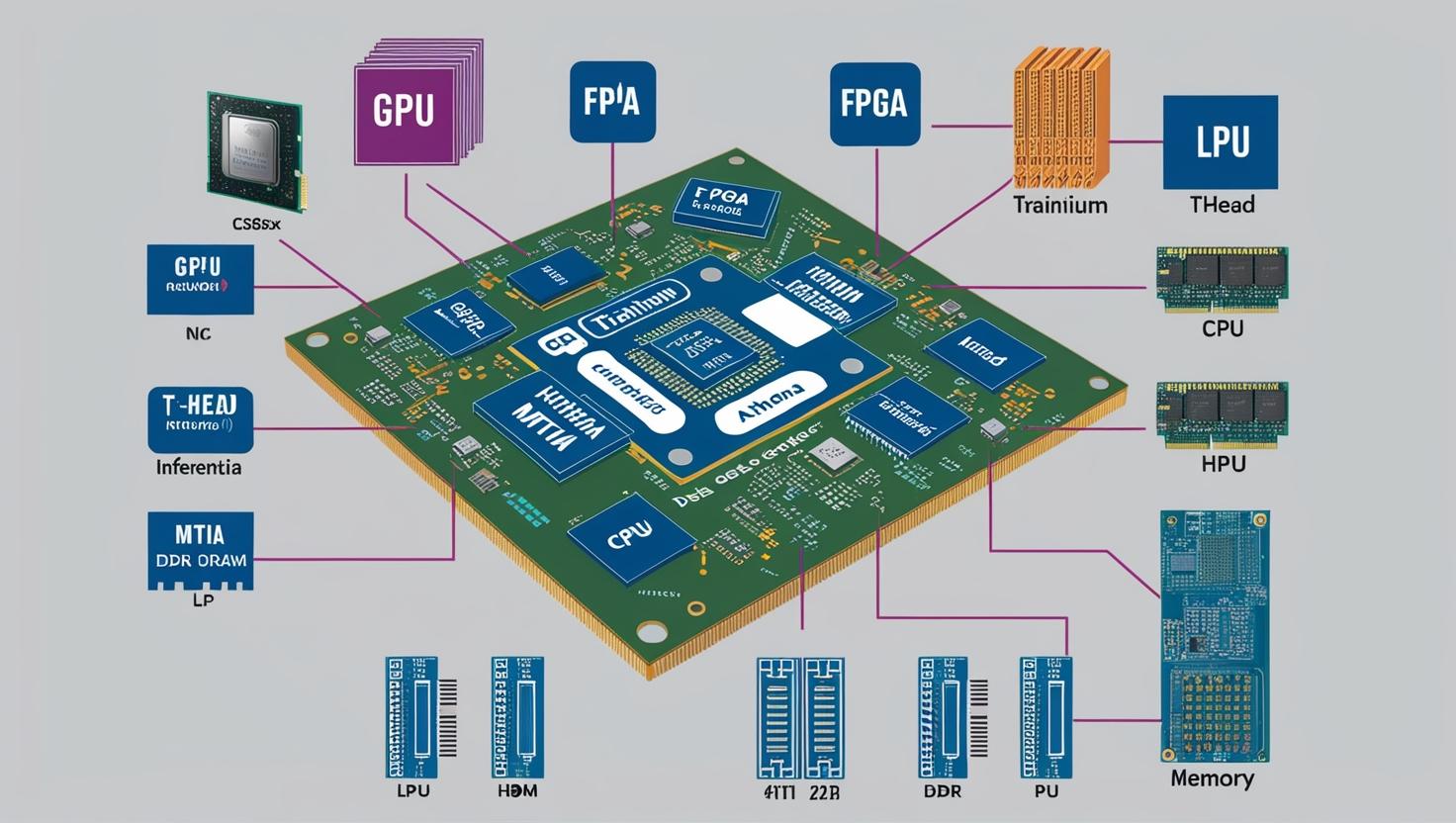

Data center chips form the backbone of processing units in massive server farms worldwide. They consist of Central Processing Units (CPUs), Graphics Processing Units (GPUs), Field Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs). While CPUs have traditionally dominated server infrastructure, the rise of parallel processing for AI and high-performance computing has boosted the demand for GPUs and custom ASICs. These specialized chips are now critical for supporting workloads like neural network training, deep learning inference, cryptographic applications, and blockchain processing.

Moreover, as enterprises and hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud expand globally, data center chip innovation is at the heart of optimizing server efficiency, energy consumption, and computational throughput.

Key Growth Drivers of the Data Center Chip Market

The growth trajectory of the data center chip market is shaped by several interrelated factors. First and foremost, the proliferation of AI-driven applications—particularly Generative AI models such as large language models (LLMs)—requires massive processing capabilities. This has led to soaring demand for AI accelerators like GPUs and specialized AI chips such as Tensor Processing Units (TPUs) designed by Google.

Secondly, the migration of enterprise workloads to the cloud has accelerated the need for efficient, scalable data centers with high-performance chips. The development of edge computing, where data is processed closer to the source, has also fueled demand for chips that balance performance with low latency and energy efficiency.

The growing adoption of 5G networks further compounds data traffic, prompting investments in next-generation data center chips capable of handling greater throughput with improved heat dissipation and reliability.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=39999570

Technological Advancements Shaping the Market

One of the most significant technological trends in the data center chip market is the shift toward heterogeneous computing architectures. Rather than relying solely on CPUs, data centers now use a mix of CPUs, GPUs, FPGAs, and AI accelerators to achieve optimal workload-specific performance. This approach enhances efficiency and reduces bottlenecks in processing massive datasets.

Additionally, the use of advanced manufacturing nodes—such as 5nm and 3nm process technologies—enables the development of smaller, faster, and more power-efficient chips. Chiplet-based designs, popularized by AMD and others, are also gaining traction. These modular designs allow data center operators to mix and match processing elements based on workload needs, improving flexibility.

Another critical advancement is the implementation of liquid cooling solutions for data centers, allowing processors to operate at peak performance without overheating. This synergy between chip design and infrastructure innovation is key to supporting the rising demands of AI, metaverse applications, and decentralized finance (DeFi) systems.

Major Players in the Data Center Chip Market

The global data center chip market is dominated by a mix of semiconductor giants and specialized players. Industry leaders include:

-

Intel Corporation: Continues to lead with its Xeon server processors, focusing on AI acceleration and security.

-

Advanced Micro Devices (AMD): Gaining market share with its EPYC series, known for high core counts and energy efficiency.

-

NVIDIA Corporation: Dominates the AI data center chip segment with its GPU offerings like A100 and H100 accelerators.

-

Marvell Technology: Known for specialized data processing units (DPUs) and storage controllers.

-

Broadcom: Offers networking processors critical for managing data center interconnectivity.

-

Google (Alphabet Inc.): Designs custom TPUs optimized for AI workloads within Google Cloud infrastructure.

-

Amazon Web Services (AWS): Develops Graviton processors based on Arm architecture for its EC2 instances.

These companies are investing heavily in R&D to maintain their competitive edge as new entrants and startups target niche applications within the data center ecosystem.

Challenges and Constraints

Despite the growth prospects, the data center chip market faces several challenges. The ongoing global semiconductor supply chain disruptions, although improving, continue to impact the availability of certain high-performance chips. Furthermore, geopolitical tensions and export restrictions on advanced chip technologies could reshape supplier relationships, particularly with the growing rivalry between the U.S. and China in the semiconductor domain.

Additionally, data centers are under pressure to become more energy-efficient. With increasing scrutiny on carbon emissions and sustainability, chip manufacturers must prioritize energy-optimized designs without compromising processing power.

Future Outlook

The global data center chip industry is expected to grow from USD 206.96 billion in 2025 to USD 390.65 billion by 2030, growing at a CAGR of 13.5% from 2025 to 2030. Emerging trends such as quantum computing integration with classical data centers, AI-driven automated chip design (EDA tools powered by AI), and software-defined hardware architectures are set to revolutionize how data center infrastructure evolves.

The shift toward custom silicon—where large technology companies design proprietary chips for their specific workloads—is another trend gaining momentum. Companies like Apple, AWS, and Google are showcasing the benefits of this approach, pushing the envelope in terms of speed, efficiency, and tailored compute performance.

As the foundation of global digital infrastructure, the data center chip market plays a pivotal role in shaping the future of computing, AI, and digital transformation. With continuous innovation in semiconductor technology, growing demand for cloud services, and the advent of sophisticated AI workloads, the significance of advanced data center chips has never been greater. The coming decade will likely witness unprecedented advancements in chip design, opening up new possibilities for intelligent computing at scale.

Frequently Asked Questions (FAQs)

1. What are data center chips?

Data center chips are specialized semiconductor components—such as CPUs, GPUs, FPGAs, and ASICs—used to process, store, and manage data in data centers. They form the core of computing infrastructure for cloud services, AI workloads, and enterprise applications.

2. Why is the demand for data center chips increasing?

The demand is driven by rapid growth in cloud computing, AI and machine learning applications, big data analytics, and the expansion of IoT and 5G networks. These trends require powerful chips capable of handling intensive computational workloads.

3. What types of chips are commonly used in data centers?

Common types include Central Processing Units (CPUs), Graphics Processing Units (GPUs), Field Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs). Each serves different workloads based on performance, flexibility, and energy efficiency needs.

4. How does AI impact the data center chip market?

AI workloads, especially training large models, require specialized processors like GPUs and AI accelerators. Companies are increasingly adopting custom-designed chips (e.g., TPUs by Google, AI-focused GPUs by NVIDIA) to meet these demands efficiently.

5. Which industries rely on data center chips the most?

Industries such as IT & telecom, financial services, e-commerce, healthcare, media & entertainment, and automotive heavily depend on data centers powered by advanced chips.