The global transition toward electric mobility is fundamentally reshaping the automotive industry. Central to this transformation is the Automotive Battery Management System (BMS) — a critical technology that ensures the safety, performance, and longevity of electric vehicle (EV) batteries. As electric and hybrid vehicles gain mainstream traction, the demand for sophisticated BMS solutions is rising sharply, propelling the Automotive BMS market into a phase of sustained and robust growth.

With increasing global investments in clean transportation, advancements in lithium-ion and solid-state batteries, and growing regulatory support for zero-emission vehicles, The global automotive battery management system market is estimated to be USD 6.53 billion in 2025 and is projected to reach USD 15.65 billion by 2030, registering a CAGR of 19.1% during the forecast period.

What is an Automotive Battery Management System?

An Automotive Battery Management System is an electronic control unit that monitors and manages a rechargeable battery in electric and hybrid vehicles. It ensures safe and optimal operation of the battery pack by performing vital functions such as:

- Monitoring battery state of charge (SoC) and state of health (SoH)

- Balancing voltage across cells

- Managing thermal conditions

- Detecting faults and providing protection

- Communicating with other vehicle systems (e.g., motor controller, powertrain)

As batteries become more powerful and complex, the role of BMS in maintaining safety, efficiency, and reliability becomes even more critical—especially in vehicles with high voltage systems.

Automotive Battery Management System Market Drivers

Electric Vehicle (EV) Boom

The most influential driver of the automotive BMS market is the rapid growth of electric vehicles. Governments worldwide are incentivizing EV adoption through subsidies, tax breaks, and strict emissions regulations. Automakers, in response, are investing heavily in EV development and battery technology.

Technological Advancements in Battery Chemistry

Lithium-ion batteries remain the dominant energy storage technology in electric vehicles, but the industry is rapidly exploring new materials, including lithium iron phosphate (LFP) and solid-state batteries. These emerging chemistries present new challenges in cell balancing, thermal management, and safety monitoring — all of which require more sophisticated BMS solutions.

In particular, the shift toward solid-state batteries is expected to significantly influence BMS development, as these batteries operate under different conditions and require highly adaptive control strategies.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=15321159

Safety Regulations and Standards

Battery safety is non-negotiable in electric vehicles, and BMS plays a central role in preventing overcharging, overheating, and short circuits. Governments and regulatory bodies are enforcing strict standards for battery safety and performance, including UN 38.3, ISO 26262, and SAE J2464.

As compliance becomes mandatory, automakers are integrating BMS technologies that meet or exceed these safety standards, driving additional demand for certified and customizable BMS platforms.

Automotive Battery Management System Market Segmentation and Trends

By Vehicle Type

Battery management systems are being adopted in a wide range of vehicles — from passenger EVs and hybrid electric vehicles (HEVs) to commercial electric trucks, buses, and even two- and three-wheelers. The passenger vehicle segment currently leads the market, but commercial and light-duty vehicles are expected to see the fastest growth due to electrification in last-mile delivery and public transportation.

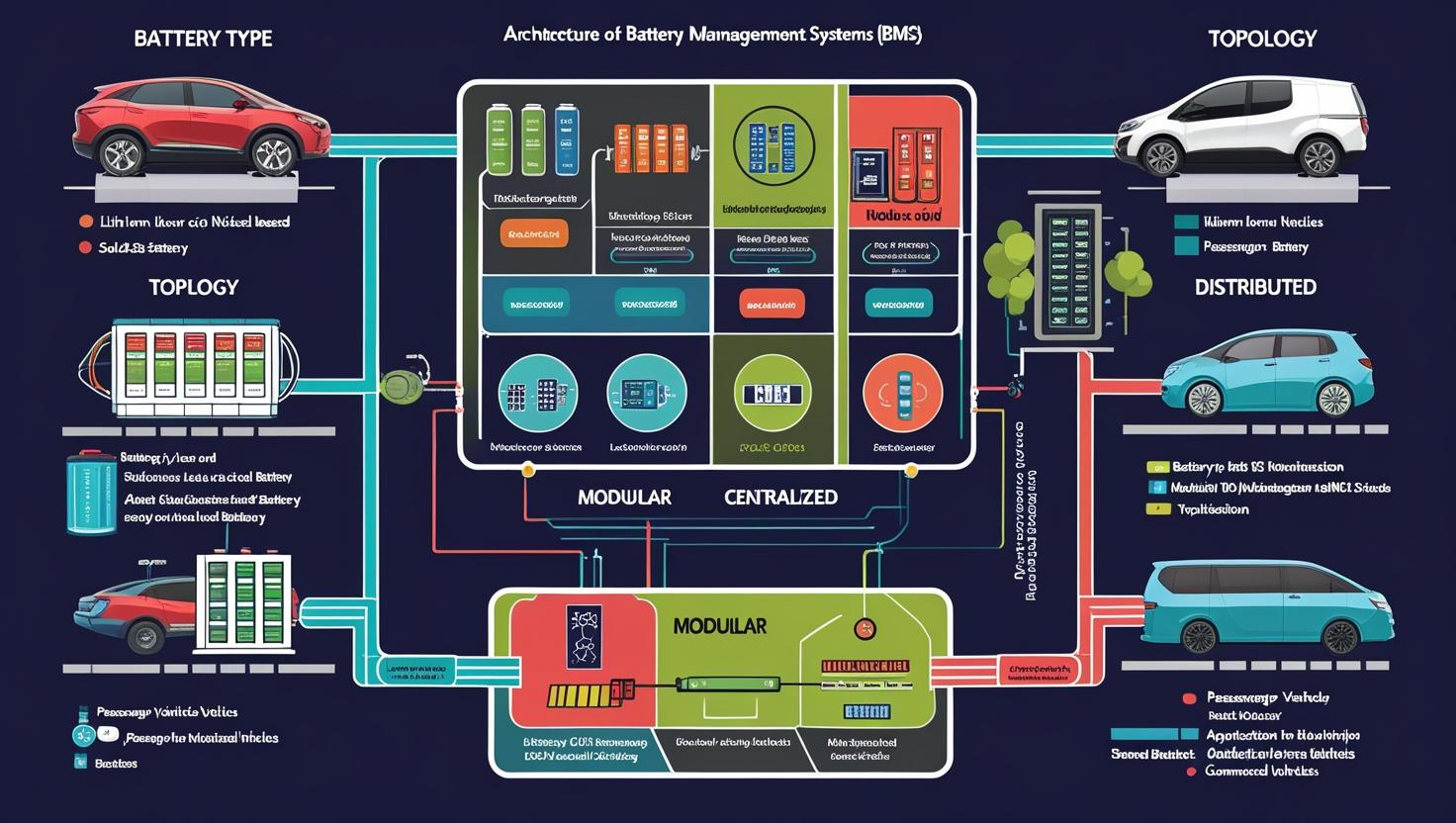

By Topology

There are three main BMS topologies: centralized, distributed, and modular. Modular and distributed BMS architectures are gaining popularity for their scalability and enhanced fault tolerance, particularly in larger battery packs used in SUVs, trucks, and buses.

By Region

Asia-Pacific currently dominates the global automotive BMS market, led by countries such as China, Japan, and South Korea, which are home to many of the world’s top battery manufacturers and EV producers. Europe and North America are also witnessing strong growth, fueled by supportive policies, green mobility targets, and rising consumer demand for electric vehicles.

Competitive Landscape

The automotive BMS market is highly competitive and includes a mix of established players and innovative startups. Key companies operating in this space include:

Key companies operating in the automotive battery management system market include Element Eberspächer (Germany), Sensata Technologies, Inc. (US), LG Energy Solution (South Korea), Ficosa Internacional SA (Spain), and AVL (Austria).

These companies are focusing on integrating wireless BMS, AI-driven analytics, and cloud connectivity into their solutions to meet the evolving needs of automakers and battery OEMs.

Challenges in the Market

Despite its growth potential, the automotive BMS market faces several challenges. Ensuring interoperability across various battery chemistries and vehicle platforms remains a complex task. Cost pressures, especially in the low-end EV segment, are pushing manufacturers to balance performance with affordability. Additionally, the global semiconductor shortage and supply chain disruptions have impacted BMS production and availability in recent years.

Another emerging concern is cybersecurity, as connected BMS platforms become targets for hacking and data breaches. Protecting communication between the battery, vehicle systems, and the cloud is becoming a priority for developers.

Future Outlook

The future of the automotive BMS market looks promising, with innovation set to accelerate in areas like wireless BMS technology, predictive battery analytics, and edge computing for real-time decision-making. These advancements will not only improve vehicle range and safety but also enable features like battery-as-a-service (BaaS) and vehicle-to-grid (V2G) integration.

As the automotive sector continues to move toward a fully electrified future, the battery management system will be one of the most important enablers of that transformation. By 2030, BMS technology is expected to evolve from a supporting component to a strategic asset in every electric vehicle.

With electric vehicles gaining rapid market share and battery technologies advancing at an unprecedented pace, the automotive battery management system market is set for robust and sustained growth through 2030. The critical role of BMS in ensuring battery safety, efficiency, and performance makes it a cornerstone of the future mobility ecosystem. Companies that invest in BMS innovation today will be best positioned to lead in tomorrow’s electric vehicle marketplace.

Frequently Asked Questions (FAQ)

Automotive Battery Management System (BMS) Market

1. What is an Automotive Battery Management System (BMS)?

An Automotive Battery Management System (BMS) is an electronic system that manages and monitors the battery packs in electric and hybrid vehicles. It ensures safe, reliable, and efficient battery operation by controlling charging, discharging, temperature, voltage, and overall health of the battery.

2. Why is BMS important in electric vehicles (EVs)?

The BMS is crucial in EVs because it ensures the battery operates within safe limits. It maximizes battery life, improves energy efficiency, prevents overheating or overcharging, and provides real-time data to other vehicle systems. Without a BMS, EV batteries would be prone to failure, safety hazards, and performance degradation.

3. What is driving the growth of the Automotive BMS market?

The market is growing due to the rapid adoption of electric vehicles, government policies supporting clean energy, advancements in battery technology, and the need for better safety and efficiency. The transition from fossil fuel vehicles to EVs is making BMS an essential technology in automotive design.

4. How big is the automotive BMS market expected to get by 2030?

The automotive BMS market is projected to grow at a CAGR of 19.1%, reaching a market value of several billion USD by 2030. Growth is being driven primarily by the electric vehicle boom and stricter safety and efficiency standards.