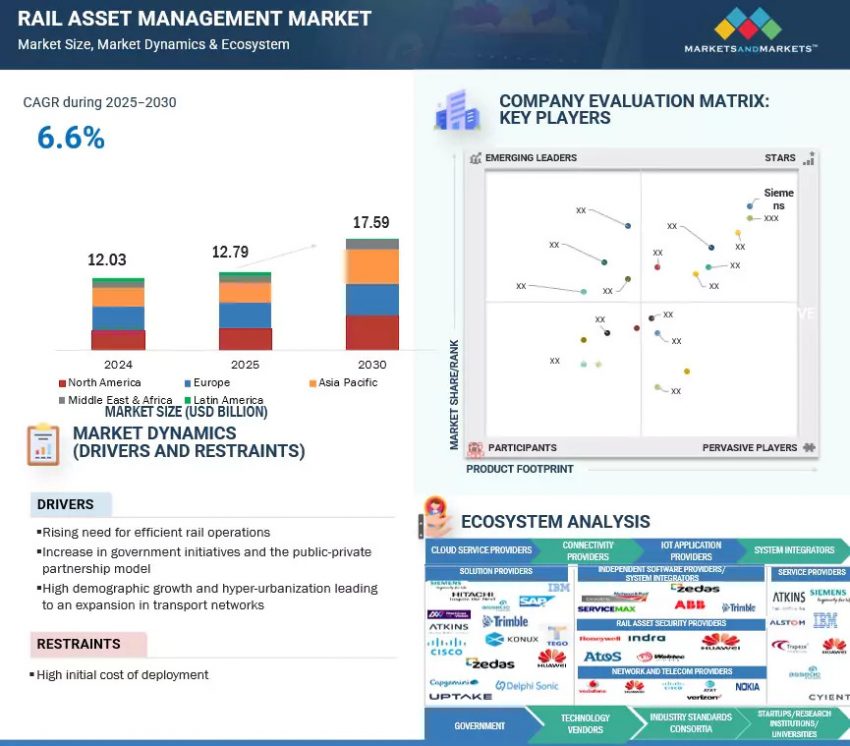

According to MarketsandMarkets™, the global rail asset management market is projected to increase from USD 12.79 billion in 2025 to USD 17.59 billion by 2030, growing at a CAGR of 6.6% during the forecast period.

The key driving factor in the rail asset management market is high demographic growth and hyper-urbanization, leading to an expansion in transport networks. Hyper-urbanization is another word for building smart cities with rapid infrastructural development and advanced capital investments. The global urban population is rising considerably, which would eventually increase urban congestion and create the need for expansion and development of transport networks and comprehensive management. The exponentially growing urban population has intensified the need to develop infrastructure and deploy solutions for effective rail asset management in urban areas.

Download PDF Brochure@ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=222416351

What Is Rail Asset Management?

Rail asset management encompasses integrated systems and solutions designed to monitor, maintain, and optimize all types of rail assets—rolling stock (trains), tracks, signaling systems, electrification infrastructure, and more. It features modules for:

- Asset Performance Management

- Condition Monitoring and Predictive Maintenance

- Security, Analytics, and Network Management

- Asset Planning and Scheduling

- Workforce and Incident Management

These solutions ensure railways are safer, more reliable, and run at optimal operating costs—all while enhancing service quality for passengers and freight operators.

Rail Asset Management Industry Growth Factors:

- Rapid urbanization and smart city initiatives demanding scalable and reliable rail transport.

- Increasing investments in AI, IoT, and automation for real-time asset monitoring and predictive maintenance.

- The need to extend the lifecycle and performance of aging infrastructure under increasing passenger and freight demand.

- Active policy push and digitalization programs across Asia-Pacific, led by countries such as China, India, Australia, and Singapore

The solutions segment is expected to hold the largest market size during the forecast period

Based on offering, the solutions segment of the rail asset management market is projected to hold the largest market size during the forecast period. The overall rail industry is heavily asset-intensive. This factor leads to the demand for effective rail asset management solutions for these assets. A significant amount is invested annually in the procurement and management of a range of physical rail assets, including rolling stock, track, signals, switches, platforms, and overhead wiring. Rail assets need to be understood as long-term investments and have to be managed accordingly to ensure optimum performance and low lifecycle costs. Increasing passenger and freight demand across the rail industry has led to an increasing strain on aging asset infrastructure and new investment requirements. This further encourages rail asset management vendors to focus on delivering improved service levels, often with reduced funding. The solutions segment in the rail asset management market is segmented into asset performance management, analytics, asset planning and scheduling, security, workforce management, network management, and others (incident management, warranty management, and material management).

By application, the infrastructure segment is expected to witness the fastest growth during the forecast period

By application, the rail asset management market has been segmented into two segments: rolling stock and infrastructure. The rail infrastructure segment is one of the key applications, focused on monitoring, maintenance, optimization, and digital management of fixed railway assets. Hence, this segment stands to be crucial in ensuring network safety, reliability, and long-term performance. With the growing need for efficient operations and safety compliance, railway operators have embraced modern technologies such as IoT sensors, AI-powered predictive analytics, and digital twin models to monitor track conditions, detect early faults, and optimize maintenance schedules.

The Middle East & Africa will record the fastest growth during the forecast period

The MEA comprises major countries such as the United Arab Emirates (UAE), Saudi Arabia, Nigeria, Egypt, Qatar, South Africa, and Libya. The key countries, such as the UAE, South Africa, Nigeria, and Qatar, are regions with high growth potential in this region. They are expected to majorly contribute to the region’s overall market size. Countries in the region have witnessed the high adoption of technologies due to the solid fiscal balances and strong investments in the ICT sector. The growing population in this region is a key driver for the growth of the railway infrastructure in this report. There is significant scope for rail asset management solutions in this region due to the increasing demand for the development of railway infrastructure. The evolution from reactive maintenance to an advanced predictive model has helped rail operators in this region to improve service reliability, cost-efficiency, and maintenance practice, thereby boosting the rail asset management market.

Top Companies in Rail Asset Management Market:

Major vendors in the rail asset management market include Alstom (France), Cisco (US), Wabtec (US), SAP (Germany), IBM (US), Hitachi (Japan), Huawei (China), Capgemini (France), Siemens (Germany), Bentley Systems (US) , DXC (US), Trapeze Group (Canada ), Atkins (UK), Accenture (Ireland), ZEDAS (Germany), and Trimble (US).

Future Outlook and Opportunities

- Data-Driven Railways: Predictive maintenance will replace reactive repairs, optimizing asset usage and reducing downtime.

- Digital Twins and AI Integration: Real-time simulation and modeling will transform asset planning and incident management.

- Sustainability: Enhanced asset management supports lower emissions, improved energy efficiency, and digital compliance with environmental regulations.

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: [email protected]