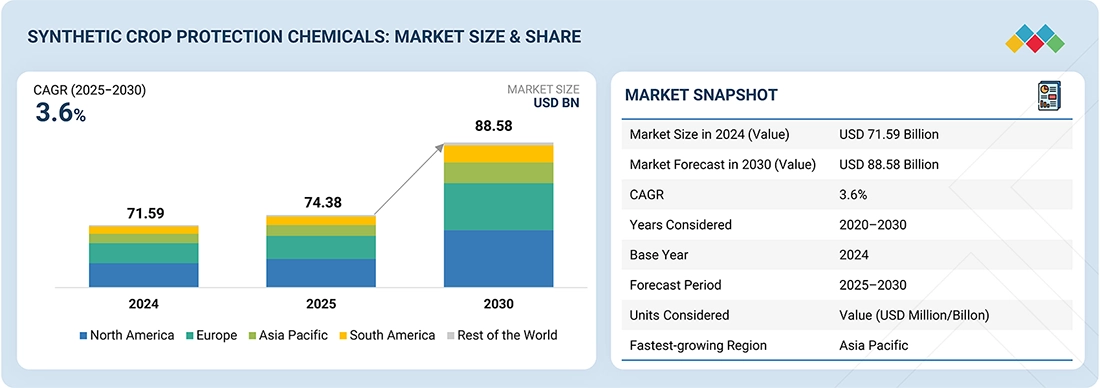

The synthetic crop protection chemicals market is projected to grow from USD 74.38 billion in 2025 to USD 88.58 billion by 2030, registering a Compound Annual Growth Rate (CAGR) of 3.6% during the forecast period. This growth is driven by escalating pressure from weeds, insects, and plant diseases across major agricultural regions, coupled with the rising demand for enhanced productivity and global food security. As pest, weed, and disease intensity increase in key crops, farmers continue to rely on proven synthetic herbicides, insecticides, fungicides, and bactericides to maintain yield stability and profitability.

The expansion of commercial farming in emerging economies, along with advances in active ingredient innovation, formulation technologies, and precision application systems, has further accelerated adoption. Despite regulatory pressures and sustainability debates, synthetic crop protection chemicals remain the backbone of modern crop protection strategies, supporting large-scale agriculture, yield reliability, and economic viability worldwide.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=262431586

Cereals & Grains Segment: A Dominant Market Driver

The cereals & grains segment is estimated to account for a notable market share within the type segment of the synthetic crop protection chemicals market.

Crops such as corn, wheat, and barley form the foundation of global food and feed systems, making them highly dependent on reliable pest, weed, and disease control solutions. Farmers extensively use synthetic herbicides, insecticides, and fungicides to manage biological threats while complying with strict regulatory and residue standards.

This segment continues to benefit from:

- Advanced formulation technologies

- Seed treatment innovations

- Improved foliar application systems

- Integration with precision agriculture tools

- Alignment with integrated pest management (IPM) programs

Rising cropping intensity, sustainability-focused farming practices, and continuous product innovation are reinforcing the strategic importance of cereals and grains in the synthetic crop protection ecosystem.

Seed Treatment: The Fastest-Growing Mode of Application

Within the mode of application segment, seed treatment is poised to grow at the highest rate in the synthetic crop protection chemicals market.

Seed treatment technologies enable early-stage protection against:

- Soil-borne pests

- Fungal and bacterial diseases

- Nematodes

By delivering active ingredients directly to the seed, this approach ensures:

- Targeted chemical delivery

- Reduced overall chemical usage

- Strong alignment with resistance management strategies

- Compatibility with integrated pest management (IPM) frameworks

Technological advances in coating systems, formulation stability, and adhesion technologies have significantly improved the reliability and performance of synthetic seed treatments. As precision farming adoption increases and sustainability-driven agricultural models expand, seed treatment is emerging as a key growth frontier in synthetic crop protection.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=262431586

Regional Outlook: Europe as a Strategic Stronghold

Europe is estimated to account for a significant share of the global synthetic crop protection chemicals market.

The region’s dominance is supported by:

- A highly advanced agricultural sector

- Stringent regulatory frameworks

- Strong focus on food safety and crop quality standards

- Extensive use of integrated pest management systems

- Widespread adoption of precision application technologies

Countries such as France, Germany, Italy, Spain, and the UK maintain robust commercial farming systems that rely on synthetic crop protection solutions to manage pest, weed, and disease pressures. Europe’s strong R&D infrastructure and active product registration environment enable continuous innovation and deployment of advanced synthetic chemistries, particularly in cereals, oilseeds, and specialty crops.

Leading Synthetic Crop Protection Chemicals Companies:

The synthetic crop protection chemicals market is characterized by the presence of major multinational corporations and strong regional manufacturers, including:

- Bayer AG (Germany)

- Syngenta Group (Switzerland)

- BASF SE (Germany)

- Corteva Agriscience (United States)

- FMC Corporation (United States)

- UPL Limited (India)

- ADAMA Agricultural Solutions Ltd. (Israel)

- Sumitomo Chemical Co., Ltd. (Japan)

- Nufarm Limited (Australia)

- China National Chemical Corporation (China)

- Jiangsu Yangnong Chemical Co., Ltd. (China)

- Shandong Weifang Rainbow Chemical Co., Ltd. (China)

- Zhejiang Wynca Chemical Group Co., Ltd. (China)

- Nanjing Red Sun Co., Ltd. (China)

- Hailir Pesticides & Chemicals Group Co., Ltd. (China)

These companies continue to invest in R&D, sustainable chemistry, digital agriculture, precision delivery systems, and resistance management technologies, shaping the future of synthetic crop protection globally.

Strategic Outlook

Despite regulatory complexity and sustainability pressures, synthetic crop protection chemicals remain central to global agricultural systems. Their role in ensuring:

- Yield stability

- Food security

- Large-scale productivity

- Commercial farming efficiency

- Resistance management

- positions them as an indispensable component of modern agriculture.

Looking ahead, the market will increasingly be defined by precision application technologies, smarter formulations, sustainability-aligned innovations, and integration with digital farming ecosystems, ensuring the continued relevance and growth of synthetic crop protection solutions worldwide.