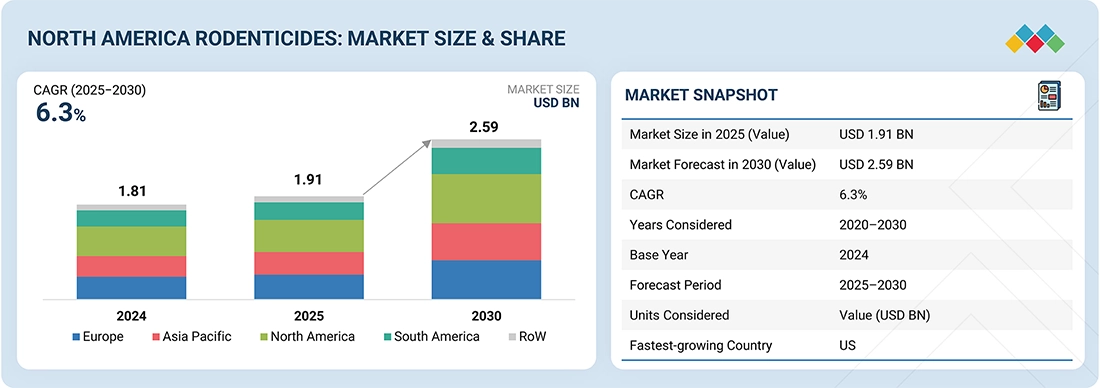

The North American rodenticides market is on a strong growth trajectory, reflecting the region’s rising need for effective rodent control solutions across urban, commercial, and agricultural environments. According to MarketsandMarkets™, the market is projected to grow from USD 1.91 billion in 2025 to USD 2.59 billion by 2030, registering a CAGR of 6.3% during the forecast period.

This expansion is being fueled by increasing urbanization, growing commercial and agricultural activities, and frequent rodent infestations in warehouses, farms, food storage facilities, and residential areas. In addition, heightened awareness of the health and economic risks posed by rodents, along with regulatory oversight and the demand for safer, more sustainable pest control solutions, continues to shape market dynamics across North America.

Rising Demand for Effective and Sustainable Rodent Control

Rodent infestations remain a persistent challenge across North America, particularly in densely populated urban areas and large-scale agricultural operations. As a result, demand for rodenticides that are effective, environmentally responsible, and compliant with regulatory standards is increasing. The adoption of integrated pest management (IPM) practices is also encouraging innovation, enabling manufacturers to develop formulations that balance performance with safety and sustainability.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=133047605

North American Rodenticides Market Segmentation:

Chemical Rodenticides Lead by Type

By type, chemical rodenticides dominate the North American market, accounting for the largest share. Anticoagulant rodenticides such as brodifacoum, bromadiolone, and difethialone are widely used due to their proven effectiveness against rats and mice in residential, commercial, and agricultural settings.

These products are available in multiple delivery formats—including pellets, blocks, and soft baits—offering flexibility and reliable performance, even against resistant rodent populations. Their compatibility with IPM programs further reinforces their leading position in the market.

Pellets Dominate by Mode of Application

When it comes to application methods, pelleted rodenticides hold the largest market share. Pellets are favored for their ease of use, precise dosing, and operational efficiency. Suitable for deployment in bait stations, along rodent runways, or in high-risk infestation zones, pellets enable targeted control across diverse environments.

Available in both anticoagulant and non-anticoagulant formulations, pelleted rodenticides offer a long shelf life and consistent results, making them the most widely adopted mode of application in North America.

Agricultural Fields Lead by End Use

By end use, agricultural fields represent the largest segment of the North American rodenticides market. Rodent infestations in farms and crop storage facilities cause extensive damage to grains, vegetables, and other agricultural products, resulting in significant economic losses and food safety concerns.

To address these challenges, rodenticides are extensively used in agricultural settings in various forms, including pellets, blocks, and soft baits. Their effectiveness, ease of application, and alignment with integrated pest-management strategies make agriculture the leading end-use segment in the region.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=133047605

The United States: Fastest-Growing Market in North America

The United States is expected to be the fastest-growing country in the North American rodenticides market throughout the forecast period. Growth is driven by rising urbanization, expanding commercial and agricultural activities, and increasing awareness of the risks associated with rodent infestations.

Frequent rodent occurrences in warehouses, food processing facilities, farms, restaurants, and residential areas are driving strong demand for reliable rodent control solutions. In addition, advanced pest-management infrastructure and stringent regulatory oversight from the U.S. Environmental Protection Agency (EPA) support the adoption of high-performance and sustainable rodenticides. Continuous innovation and the development of eco-friendly formulations further accelerate market growth in the country.

Leading North American rodenticides Companies:

The North American rodenticides market is highly competitive, with both global and regional players contributing to innovation and product development. Leading companies operating in the market include:

- Syngenta (Switzerland)

- UPL (India)

- Bell Laboratories (U.S.)

- PCT Rural (Australia)

- Animal Control Technologies Australia (Australia)

- Imtrade CropScience (Australia)

- Triox Pty Ltd (Australia)

- AG Schilling & Co (Australia)

- 4Farmers Australia (Australia)

- Farmalinx Pty Ltd (Australia)

- ZAGRO (Singapore)

- Kalyani Industries Ltd (India)

- Aimco Pesticides (India)

- Pelgar International (UK)