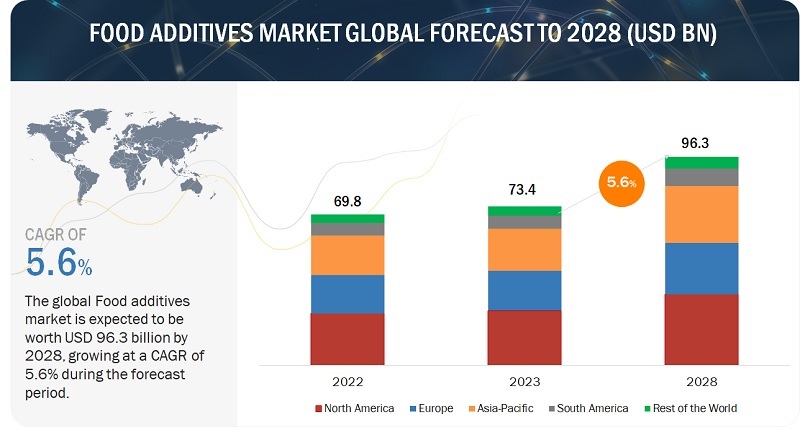

The global food additives market is estimated to be valued at USD 73.4 billion in 2023 and is projected to reach USD 96.3 billion by 2028, growing at a CAGR of 5.6% during the forecast period. This growth is fueled by shifting consumer preferences, increased consumption of processed foods, and the growing need for extended shelf life. As the food industry evolves to meet diverse consumer demands, additives have become essential for enhancing flavor, texture, appearance, and overall product quality.

- Health & Wellness Trends: Demand for organic, low-calorie, and functional foods is encouraging innovation in additive formulation.

- Clean Label Movement: Consumers prefer transparency in ingredients, pushing companies toward natural and minimally processed additives.

- Processed Food Boom: Urbanization and busy lifestyles are driving the consumption of packaged and convenience foods, which rely on additives for quality and longevity.

- Regulatory Influence: Stringent regulations by the FDA, EFSA, and other authorities are reshaping the additive landscape, favoring natural over synthetic.

- Natural Additives: Growth in plant-derived preservatives, colorants, and flavorings.

- Plant-Based & Vegan Formulations: Additives supporting texture, taste, and stability in meat alternatives and dairy substitutes.

- AI in Product Development: AI tools are now helping companies optimize additive blends for taste, texture, and nutritional profile.

- Sustainability in Sourcing: Ethical and eco-friendly sourcing of additive ingredients is becoming a competitive differentiator.

Natural Additives to Register the Fastest Growth by Source

The natural segment is expected to witness the highest growth rate within the market. Rising health awareness among consumers is driving demand for clean-label and minimally processed food products. This trend has led to increased use of natural additives derived from fruits, vegetables, and plants. Concerns over the potential health effects of synthetic additives are further accelerating this shift. To meet demand, manufacturers are investing in innovative natural additive solutions that align with sustainability and transparency goals. With tighter regulations and consumer expectations for healthier options, the natural segment is poised to play a central role in the market’s expansion.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=270

Liquid Additives Hold the Second-Largest Market Share by Form

The liquid form of food additives holds the second-largest market share, driven by its versatility and ease of use across various applications. Liquid additives are preferred for their convenience in blending, precise dosing, and homogenous mixing, especially in products like beverages, sauces, and dressings. Their ability to enhance sensory attributes and support the development of innovative flavor profiles contributes to their growing demand. As consumers continue to seek out bold and exotic taste experiences, the role of liquid additives in food and beverage formulation remains vital.

Beverages Segment Dominates by Application

The beverages segment commands a significant share of the food additives market. The rising demand for functional, fortified, and natural beverages has spurred the increased use of additives to enhance taste, texture, and nutritional value. The popularity of ready-to-drink products and continued innovation in plant-based and functional drinks have further driven additive demand in this category. As health-conscious consumers seek novel and enriched beverage options, this segment continues to be a key area of application for food additives.

Asia Pacific to Lead Market Growth with Highest CAGR

The Asia Pacific region is projected to register the highest CAGR in the global food additives market. Rapid economic development across the region has increased consumer purchasing power, fueling demand for processed and packaged foods. Food additives are essential in this landscape for their roles as preservatives, stabilizers, thickeners, and texture enhancers. Moreover, rising awareness about clean-label and natural products is boosting the adoption of plant-based additives. The growing popularity of vegetarian diets and sustainable food choices also supports this trend. In addition, the region’s rich culinary heritage and preference for authentic flavors have created demand for additives that maintain and enhance traditional tastes. Strict food safety regulations and the need for compliant additive solutions further reinforce the region’s significance in the global market.

Leading Food Additives Companies:

Key players in this market include Cargill, Incorporated (US), BASF SE (Germany), ADM (US), IFF (US), Kerry Group PLC (Ireland), Ingredion (US), Tate & Lyle (UK), Givaudan (Switzerland), Darling Ingredients Inc. (US), Chr. Hansen Holding A/S (Denmark), Novozymes (Denmark), Ashland (US), Cp Kelco (US), Glanbia PLC (US), and Sensient Technologies Corporation (US).

Other prominent players in the market also include Ajinomoto Co., Inc. (Japan), Biospringer (France), Palsgaard (Denmark), Lonza (Switzerland), Fooding Group Limited (China), Evonik Industries AG (Germany), Kalsec Inc. (US), Dohler Group (Germany), Lallemand Inc. (Canada), AB Mauri (UK), and Laffort (France).

Key Questions Addressed by the Food Additives Market Report:

- How will the growth of natural and dietary fiber additives impact consumer health trends?

- What are the key innovations driving sustainability in the food additives industry?

- How does the increasing demand for clean-label products influence additive sourcing choices?

- Why is the market for food additives expected to grow faster after 2024?

- What role do major players like IFF and Cargill play in shaping future market opportunities?