The global warehouse floor is undergoing a silent revolution—and it’s worth $125.4 billion.

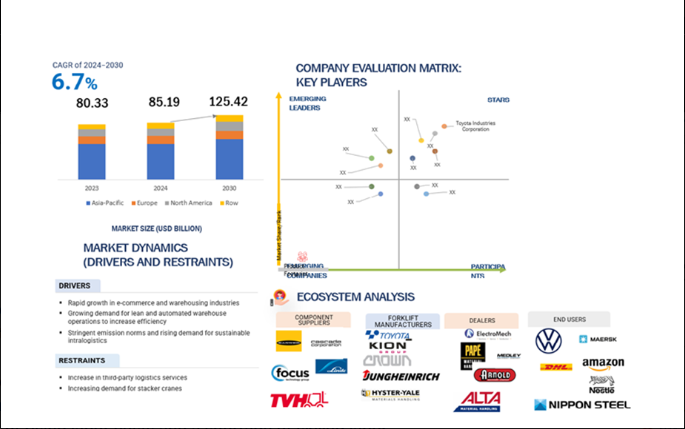

While supply chains grab headlines for disruptions, a more transformative shift is happening in warehouses, distribution centers, and manufacturing facilities worldwide. The global forklift market is accelerating at breakneck speed, projected to rocket from $85.2 billion in 2024 to a staggering $125.4 billion by 2030—representing a robust 6.7% compound annual growth rate, according to new research from MarketsandMarkets.

This isn’t just incremental growth. It’s a fundamental reshaping of how materials move through the modern economy, driven by the explosive rise of e-commerce, aggressive decarbonization mandates, and breakthrough innovations in electric propulsion and autonomous technology that are making traditional internal combustion forklifts obsolete.

The Perfect Storm Driving Forklift Truck Market Demand

Three powerful forces are converging to supercharge the forklift truck market:

E-Commerce Explosion: The pandemic permanently altered consumer behavior, creating insatiable demand for warehouse space and the equipment to operate it efficiently. Every new fulfillment center requires dozens—sometimes hundreds—of forklifts to keep goods flowing from dock to shelf to delivery truck.

Electrification Mandate: Environmental regulations are forcing rapid retirement of diesel and propane-powered units. Electric forklifts now command over 70% market share in many regions, with lithium-ion battery technology eliminating the range anxiety and charging downtime that once plagued electric models. Fleet operators are discovering that electric units deliver lower total cost of ownership despite higher upfront investment.

Labor Crisis Solution: With warehouse worker shortages reaching critical levels, autonomous and semi-autonomous forklifts are transitioning from experimental curiosity to operational necessity. The autonomous forklift segment alone is projected to surge from $2.73 billion in 2025 to $5.07 billion by 2032, growing at 9.3% CAGR.

Who’s Leading the Charge?

The forklift industry is experiencing its most dynamic period in decades. Major players are racing to electrify their fleets, integrate AI-powered safety systems, and develop automation-ready platforms that can seamlessly integrate with warehouse management systems.

Third-party logistics providers (3PL) are emerging as the dominant end-use segment, followed closely by food and beverage operations where hygiene standards favor electric over combustion engines. The automotive sector, traditionally a forklift stronghold, continues expanding capacity as electric vehicle manufacturing ramps up globally.

Asia Pacific dominates the forklift market share, driven by China’s massive manufacturing base and India’s rapidly expanding logistics infrastructure. However, North America and Europe are seeing the fastest adoption rates for premium electric and autonomous models.

Technology Shifts Reshaping the Forklift Industry

The forklift trucks market is no longer just about lifting capacity and durability. Today’s units are sophisticated IoT-enabled machines that generate terabytes of operational data, predict maintenance needs before breakdowns occur, and communicate with entire warehouse ecosystems.

Key innovation areas include:

- Lithium-ion batteries replacing traditional lead-acid, enabling opportunity charging and eliminating battery swap downtime

- Telematics systems providing real-time fleet management and operator behavior monitoring

- Collision avoidance technology using sensors and cameras to prevent accidents and reduce insurance costs

- Narrow-aisle designs maximizing warehouse storage density in land-constrained urban markets

What Industry Professionals Need to Know

For supply chain executives, warehouse managers, and logistics planners, the message is clear: the forklift market size isn’t just growing—it’s fundamentally transforming. Decisions made today about fleet composition, power systems, and automation readiness will determine competitive positioning for the next decade.

Fleet electrification is no longer optional in most markets. Regulations in Europe, California, and increasingly across Asia are mandating zero-emission warehouse equipment. Companies still operating large ICE forklift fleets face obsolescence risk and potential compliance penalties.

Meanwhile, the labor equation is shifting. Autonomous forklifts once struggled with complex environments and edge cases. Today’s AI-powered systems handle 80-90% of routine material movement tasks, freeing human operators for exception handling and complex maneuvers that require judgment.

The Road Ahead

As the forklift industry navigates this growth trajectory through 2030, several factors will determine which companies capture market share and which fall behind. Battery technology continues improving, with solid-state batteries promising even greater energy density and faster charging. 5G connectivity is enabling real-time remote diagnostics and predictive maintenance. And the integration of forklifts into broader warehouse automation ecosystems—working alongside automated storage systems, conveyor networks, and robotic picking systems—is creating new requirements for interoperability and standardization.

The $125.4 billion question facing the industry: Can traditional forklift manufacturers adapt quickly enough to compete with tech-forward new entrants bringing software-first approaches to material handling?

For complete market forecasts, regional analysis, competitive landscape deep-dives, and exclusive insights into the technologies reshaping the forklift market, explore the full MarketsandMarkets research report. The comprehensive analysis covers market segmentation by tonnage capacity, application, class type, end-use industry, propulsion system, and operation mode across all major global regions.