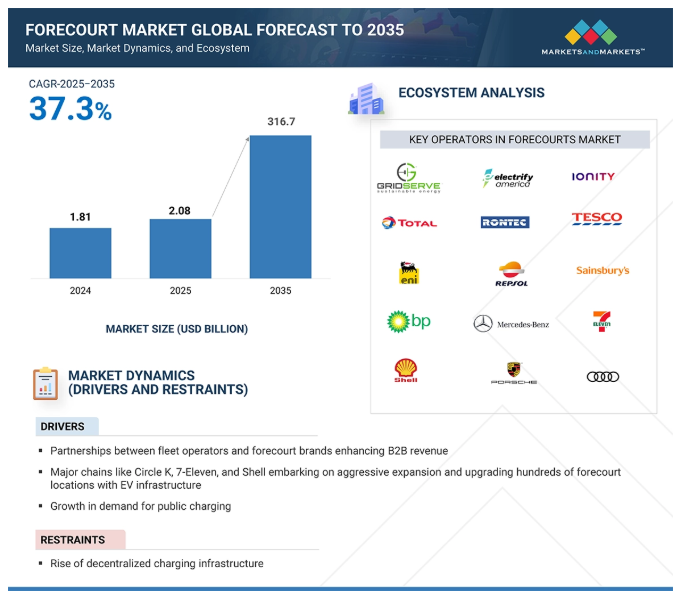

The forecourts market is projected to grow from USD 7.0 billion in 2024 to USD 316.7 billion by 2035 at a CAGR of 37.3%.

Forecourt operators are expected to move toward electrification, offering value-added services to customers and leveraging new revenue streams such as energy storage and energy arbitrage to maximize opportunities and revenue potential in an increasingly competitive market. Forecourt operators leverage revenue by offering F&B options, wellness centers, logistics hubs, car wash, and SPA & salon services, among others, to customers. Moreover, operators are exploring advanced models like “power-as-a-service” and grid-connected charging points, enabling them to sell surplus energy back to the grid. This creates a new income stream and raises the profitability of charging point installations.

The backbone of forecourt monetization is rapidly shifting to charging infrastructure, poised for the highest revenue contribution as widespread EV adoption and seamless interoperability across networks drive up utilization. This surge in charging customers simultaneously expands the lucrative value-added services segment, which broadly covers convenience store sales, car wash, and various food services, with its growth fundamentally stemming from consumer preferences for convenience and consolidated experiences. Moreover, significant revenue potential lies in energy storage services, where solutions enable forecourts to engage in energy trading and regulatory balancing, unlock new monetization avenues such as ‘power as a product’ and emergency backup, and deploy BESS to counteract volatility in energy procurement effectively.

Energy storage service (BESS and V2G) to register highest growth

Energy storage services—specifically BESS and V2G—are likely to become integral pillars of revenue for forecourts by 2035. From optimized energy usage and grid services to resilience and cost savings, the financial and operational benefits are multifaceted. Energy storage services also offer a resilience advantage. Power outages, grid instability, and increasing energy price volatility can disrupt EV charging services and convenience operations. BESS can mitigate these risks by providing backup power and voltage regulation. There is revenue potential for selling the storage energy from BESS at the forecourt, which is energy arbitrage. This involves leveraging the fluctuating wholesale electricity prices by charging the battery during off-peak hours when electricity is cheaper and then discharging and selling that stored energy back to the grid during peak demand periods when prices are considerably higher. This intelligent buying and selling of electricity directly capitalizes on price volatility, turning the forecourt into an active participant in the energy market. Furthermore, BESS enables peak shaving, allowing forecourts to reduce their consumption from the grid during high-cost peak hours by drawing power from their stored reserves, thereby lowering their operational expenses and increasing overall profitability.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=11572899

Highway to hold significant share in energy storage service (BESS and V2G) segment

Energy consumption in forecourts on highways is typically higher than in urban forecourts due to the demand for fast charging, lighting, HVAC, and other retail operations. By deploying BESS, operators can reduce peak demand charges, store off-peak electricity, and increase overall energy efficiency. These systems also enable seamless power supply during grid outages, ensuring uninterrupted service, which is particularly critical for highways where backup options may be limited.

Additionally, V2G infrastructure at forecourts on highways offers a unique opportunity to connect to a high volume of EVs, especially from fleets such as logistics trucks, ride-share vehicles, and buses. These vehicles often stop for extended periods, making them ideal candidates for V2G interaction. With aggregated battery capacity from dozens or hundreds of EVs, forecourts can participate in demand response markets and generate revenue from ancillary services. Fleet operators also benefit by monetizing idle battery capacity during downtimes.

North American forecourts market to witness tremendous growth

The North American forecourts market is anticipated to experience significant growth through 2035, driven by EV adoption, supportive policy, and technological innovation. Urban and rural developments, combined with retail reinvention and advanced energy integration, are reshaping the role of forecourts. From fueling points, they are evolving into intelligent, multi-service mobility hubs.

Moreover, technological innovation is a defining feature of the North American forecourts market growth. Cloud-based systems, EV fleet management platforms, integrated POS-retail platforms, and real-time energy monitoring software are being deployed. Operators are investing in data analytics to optimize pricing strategies, inventory turnover, and energy consumption. This digital advancement enhances operational efficiency and profitability, enabling even medium-sized players to scale rapidly across state lines.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=11572899