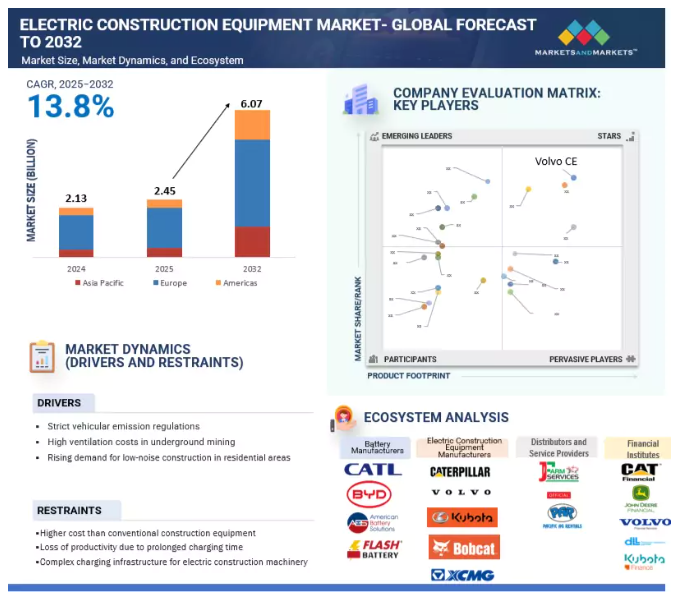

The global electric construction equipment market is expected to escalate from USD 2.45 billion in 2025 to USD 6.07 billion by 2032, achieving a CAGR of 13.8%. Driven by tough emissions laws, economic ROI, and robust infrastructure investments, adoption is soaring in both developed and emerging regions. Europe now leads in mini electric excavators, owning over 50% of market share due to firm carbon neutrality goals, while Asia Pacific commands 80%+ share in electric loaders thanks to fast urbanization and supportive policies.

The Rise of Clean Construction Machinery

Modern electric equipment, such as loaders, excavators, and dump trucks, delivers emission-free operation, reduced noise, and minimal maintenance—with upfront costs steadily dropping thanks to technology advancements and incentives. Competitive ROI (e.g., <1 year for top electric dozers), lower ventilation costs, and growing preference for quieter job sites further fuel adoption.

Key Trends Fueling Growth

- Battery Breakthroughs and Hydrogen: Lithium iron phosphate (LFP) batteries are preferred in Asia Pacific for affordability and durability, while major OEMs like Caterpillar, Komatsu, and Hitachi are pioneering hydrogen engines and fuel cells for next-generation heavy equipment.

- Product Innovation: Companies invest heavily in R&D, launching long-range, fast-charging models and hybrid variants. Hydrogen refueling infrastructure and dedicated safety standards (e.g., AIS-174 in India) are creating new market opportunities.

- Mining & Urban Applications: Electric equipment is especially attractive for mining/underground jobs, slashing ventilation costs and meeting strict environmental regulations.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=129288251

Regional Landscape and Leading Companies

| Region | Leading Products | Key Drivers |

| Europe | Mini Excavators | Carbon neutrality, infrastructure upgrades |

| Asia Pacific | Loaders, Dump Trucks | Urbanization, battery supply chain leadership, policy |

| Americas | Electric & Hybrid | Mining, tech partnerships, sustainability goals |

Top companies include Hitachi, Caterpillar, Komatsu, Volvo CE, and JCB, each expanding with zero-emission electric and hydrogen-based solutions.

Challenges and Solutions

- Initial Cost & Financing: OEMs and dealers offer incentives and financing to ease capital challenges. Technology advances are making electric equipment more affordable each year.

- Infrastructure & Training: Growth depends on jobsite charging networks and technical workforce development. Investment in training and enhanced dealer service is key to safe operation and user trust.

Frequently Asked Questions

Q: Why is electric equipment preferred in mining?

A: Electric machines reduce ventilation needs and costs by eliminating diesel fumes, making them essential for underground environments.

Q: Which battery technology dominates this market?

A: LFP (lithium iron phosphate) batteries—chosen for low cost, fast charge/discharge, and long service life.

Q: Who are the top innovators in electric and hydrogen construction equipment?

A: Hitachi, Komatsu, Caterpillar, JCB, Volvo CE, and Sany lead new product launches and pilot projects in major regions.

Next Steps: Unlock Custom Growth Insights

Ready to upgrade your construction fleet or learn about emerging innovations?

Download your free sample report, request tailored data, or speak to a market expert now—grow your leadership in electric construction equipment!

Value-Added Resources

- Visual infographics on market segments and technology trends

- Case studies: Bauma 2025 product launches, Asia Pacific battery supply chain expansion

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=129288251