The automotive synthetic leather market is undergoing rapid transformation as global automakers increasingly turn to synthetic, cost-effective, and sustainable materials for vehicle interiors. Synthetic leather — including PU-based, PVC-based, and bio-based variants — has become an essential material for seats, door trims, dashboards, steering-wheel covers, headliners, and other cabin surfaces. Its durability, affordability, design versatility, and animal-free appeal position it as a superior alternative to natural leather, especially in mass and mid-segment vehicles. As automotive production rises worldwide, the automotive synthetic leather market is poised for sustained growth.

Market Size & Forecast

According to MarketsandMarkets, the global synthetic leather market is valued at USD 71.93 billion in 2024 and is projected to reach USD 93.25 billion by 2029, registering a CAGR of 5.3% during 2024–2029. While the overall market covers multiple application industries, the automotive synthetic leather market is one of the key contributors to this growth trend, driven by continuous demand for premium yet cost-efficient interior materials.

Automakers are increasingly integrating synthetic leather in entry-level and mid-segment vehicles at scale, and even luxury OEMs are adopting advanced PU and bio-based materials as consumer preference shifts toward animal-free and sustainable interiors.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=6616309

Why Synthetic Leather is Winning in Automotive

The rising demand for automotive synthetic leather is driven by four major factors:

-

Cost Efficiency

Synthetic leather offers the appearance and feel of natural leather at a significantly lower cost, supporting automakers in competitive pricing efforts. -

Durability & Performance

PU-based synthetic leather is resistant to wear, moisture, heat, and abrasion — ideal for the high-use automotive cabin environment. -

Design Flexibility

Synthetic leather enables versatile colors, textures, and finishes that align with evolving interior-styling trends. -

Sustainability & Animal-Free Appeal

Growing consumer interest in ethical and environmentally conscious materials is leading to higher demand for vegan and bio-based automotive interiors.

These benefits collectively strengthen the competitive edge of synthetic leather in automotive applications.

Automotive Synthetic Leather Market: Key Growth Drivers

The automotive synthetic leather market is being shaped by multiple growth forces:

-

Increasing global automotive production, especially in Asia Pacific

-

Rising consumer preference for affordable luxury interiors

-

Strategic cost optimization by automotive OEMs

-

Surge in EV production, which places greater emphasis on modern interior aesthetics

-

Technological developments in PU and bio-based synthetic materials

At the same time, synthetic leather offers supply-chain stability compared to natural leather, which is subject to volatile availability and pricing.

Opportunities and Emerging Trends

The next phase of growth in the automotive synthetic leather market will be significantly influenced by:

-

Bio-based synthetic leather adoption as OEMs commit to sustainability targets

-

Premium PU materials that match or surpass natural leather in comfort and breathability

-

Vegan-interior branding, driven by younger and sustainability-focused car buyers

-

Electrification of mobility, as EV makers emphasize futuristic and eco-friendly cabin experiences

Investments in eco-friendly raw materials and recycling systems will provide long-term competitive advantages for material suppliers.

Request Sample: https://www.marketsandmarkets.com/requestsampleNew.asp?id=6616309

Challenges to Address

Despite strong momentum, the automotive synthetic leather market faces several challenges:

-

Environmental footprint of PU/PVC manufacturing (improving but still evolving)

-

Limited large-scale recycling infrastructure

-

Perception barriers among buyers who associate luxury with genuine leather

Resolving these issues through next-generation bio-materials and circular economy initiatives will be critical.

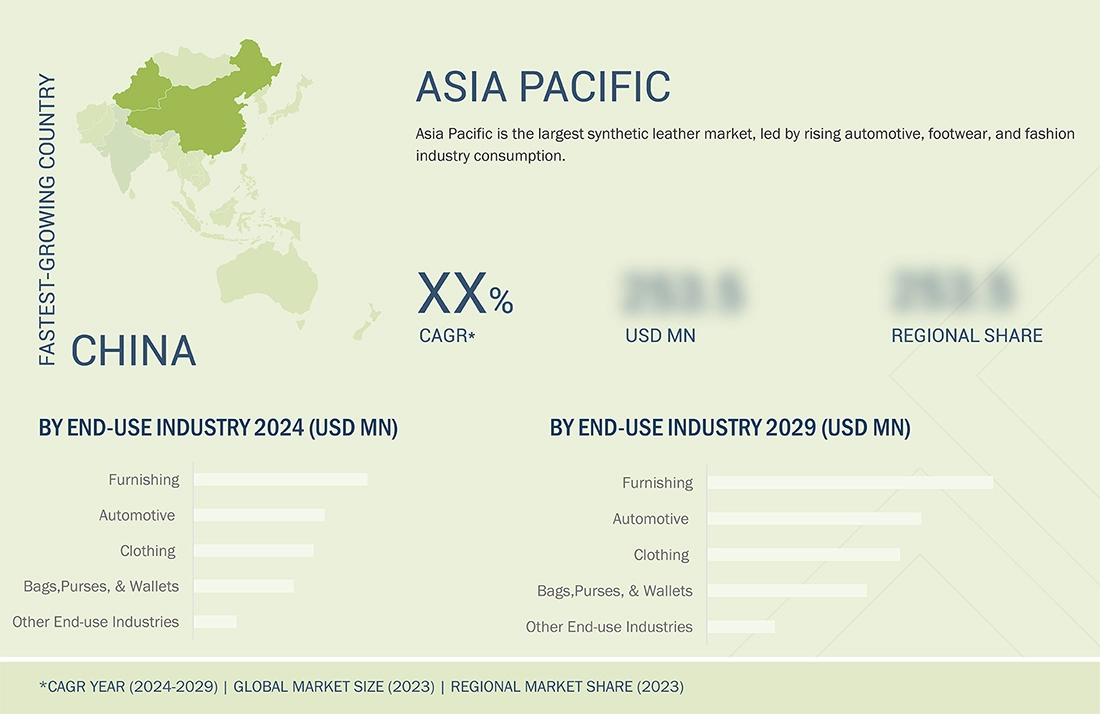

Regional Analysis

The Asia Pacific region is expected to dominate the automotive synthetic leather market through 2029, supported by:

-

Strong automotive manufacturing hubs (China, India, Japan, South Korea)

-

Competitive production costs

-

Growing middle-income populations and increasing vehicle ownership

Meanwhile, Europe and North America are driving demand for high-performance and sustainable synthetic leather solutions — particularly in premium vehicle and EV segments.

Key Companies in the Automotive Synthetic Leather Ecosystem

The global competitive landscape is led by companies investing heavily in product innovation and sustainable manufacturing. Major names include:

-

Kuraray Co., Ltd.

-

San Fang Chemical Industry Co., Ltd.

-

Teijin Limited

-

Mayur Uniquoters Limited

-

Nan Ya Plastics Corporation

-

Filwel Co., Ltd.

-

Zhejiang Hexin Holdings Co., Ltd.

These companies supply synthetic leather to major automotive OEMs worldwide and are rapidly expanding product portfolios to include bio-based and recyclable variants.

Outlook for 2025–2030

The automotive synthetic leather market is expected to enter a maturity phase characterized by:

-

Higher penetration in both mass-market and premium vehicles

-

Broad acceptance of vegan and sustainable interiors

-

Continuous improvements in durability, breathability, and thermal comfort

-

Strong growth in Asia Pacific with premium-grade adoption rising in Europe and the Americas

Companies that innovate in sustainable raw materials, cost-efficient manufacturing, and high-performance surface characteristics will lead the next decade of competition.

The automotive synthetic leather market is positioned for strong and sustained growth as the automotive sector evolves toward affordable luxury, sustainability, and material innovation. With a projected rise in global demand for stylish, durable, and eco-friendly automotive interiors, synthetic leather is set to become a defining material for the future of vehicle cabin design.

Whether for OEMs, tier-1 suppliers, material manufacturers, or investors — the road ahead is full of opportunity. The winners will be those who invest in next-generation synthetic leather technologies that balance performance, cost, and sustainability at scale.