The global racing simulator market is projected to surge from $0.5 billion in 2024 to $1.1 billion by 2030, accelerating at a robust CAGR of 15.6% during the forecast period, according to the latest research from MarketsandMarkets. This explosive growth signals a fundamental shift in the automotive and gaming landscape, where virtual racing is no longer just entertainment it’s becoming serious business for training, esports, and automotive development.

What’s driving this momentum? The convergence of cutting-edge technology, the meteoric rise of competitive esports, and an increasingly sophisticated consumer base demanding authentic racing experiences. But the most intriguing question isn’t just how fast this market is growing it’s why industry giants and startups alike are betting big on virtual cockpits.

Racing Simulator Industry: From Gaming Niche to Mainstream Phenomenon

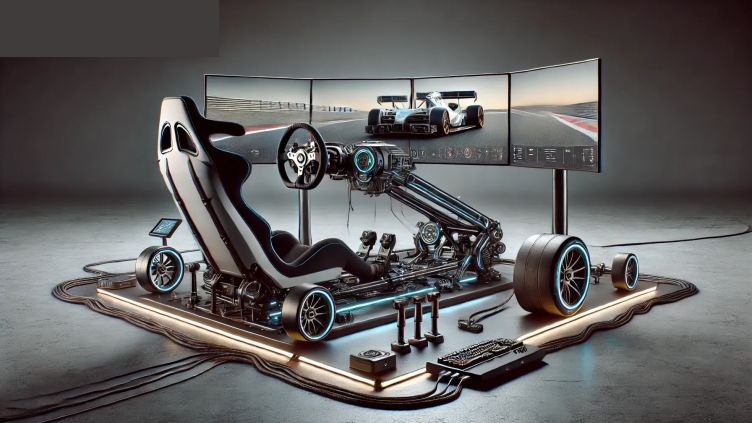

The Racing Simulator Industry has evolved dramatically from its hobbyist roots into a legitimate sector commanding attention from automotive manufacturers, professional racing teams, and technology innovators. What was once confined to basement gaming setups has transformed into professional-grade equipment that mirrors real-world racing conditions with stunning accuracy.

The racing simulator market is dominated by established players such as CXC Simulation (US), Trak Racer (Australia), Vi-Grade GmbH (Germany), SIMXPERIENCE (US), VEsaro (UK), and Simworx Pty Ltd (Australia). These Racing Simulator Companies are locked in fierce competition, each pushing the boundaries of realism through advanced motion platforms, high-definition graphics, and virtual reality integration.

The technology leap has been staggering. Today’s simulators deliver force feedback steering, hydraulic motion systems, and VR headsets that immerse drivers in photorealistic environments technology that’s increasingly indistinguishable from actual track time.

Racing Simulator Market Size: Breaking Down the Numbers

The Racing Simulator Market Size tells a compelling story of accessibility meeting aspiration. The market’s expansion from half a billion to over a billion dollars in just six years reflects multiple converging trends:

Hardware Innovation: From compact entry-level simulators designed for home use to full-scale professional rigs that cost as much as luxury cars, the product range has diversified dramatically. Components like advanced steering wheels, hydraulic pedal sets, gearbox shifters, and motion cockpits are becoming increasingly sophisticated while prices for entry-level systems continue to drop.

Software Sophistication: Racing simulation software now replicates real-world physics with uncanny precision. Tire degradation, weather effects, vehicle dynamics, and track conditions are modeled with algorithms developed alongside professional racing teams.

Esports Explosion: Competitive sim racing has emerged as a legitimate career path. Major tournaments feature prize pools rivaling traditional motorsports, and professional drivers now use simulators for training between races. The crossover has become so seamless that sim racers are transitioning to real-world racing and succeeding.

Racing Simulator Market Share: Regional Dynamics and Growth Hotspots

North America is experiencing increased adoption driven by attractive prize pools in sim racing events that attract vast audiences, while the region leads in technological innovation with cutting-edge racing simulator technologies. The region benefits from a robust ecosystem of technology providers and a culture deeply invested in both motorsports and gaming.

Europe follows closely, leveraging its rich motorsports heritage and strong automotive industry connections. Meanwhile, Asia Pacific represents the fastest-growing segment, with countries like China, India, and Japan embracing sim racing as both entertainment and professional training tools.

The Racing Simulator Market Share distribution reveals interesting patterns:

- By Application: Home and personal use dominates volume, but commercial applications including professional racing teams, automotive R&D centers, and entertainment venues command premium pricing and higher margins.

- By Simulator Type: Entry-level and compact simulators lead in unit sales, targeting gaming enthusiasts and casual users. However, medium-level and full-scale simulators are growing fastest, driven by serious hobbyists and professional applications.

- By Sales Channel: Online channels are gaining ground rapidly, with direct-to-consumer sales bypassing traditional retail. This shift enables companies to offer customization options and maintain closer customer relationships.

Why Racing Simulator Companies Are Accelerating Investment

Racing Simulator Companies are investing heavily in R&D for good reason. The applications extend far beyond entertainment:

Automotive Testing: Car manufacturers use simulators for vehicle development, testing handling characteristics and driver interfaces without expensive physical prototypes.

Professional Training: Racing teams rely on simulators for driver development, track familiarization, and setup optimization saving millions in testing costs.

Driver Education: Simulators provide safe environments for teaching advanced driving techniques, emergency response, and vehicle dynamics.

Entertainment Venues: Sim racing centers are proliferating in shopping malls, entertainment complexes, and dedicated facilities, offering pay-per-use experiences.

The technology arms race continues. Companies are incorporating artificial intelligence for adaptive difficulty, cloud gaming for reduced hardware requirements, and haptic feedback suits that simulate G-forces. The line between virtual and reality blurs further with each innovation.

What’s Fueling the Racing Simulator Market Growth?

Several powerful drivers are propelling the market forward:

Accessibility Revolution: High-quality simulators are no longer limited to wealthy enthusiasts. Entry-level systems starting under $500 deliver surprisingly authentic experiences, democratizing access to virtual racing.

Esports Legitimacy: Major racing series now host official esports championships. F1, NASCAR, Le Mans, and other premier competitions have embraced virtual racing, lending credibility and attracting sponsorship dollars.

Technological Convergence: Advances in VR, motion platforms, force feedback, and graphics processing have reached a tipping point where simulators deliver genuinely convincing experiences.

Professional Validation: When Formula 1 drivers train on simulators and sim racers compete successfully in real racing, the stigma of “just gaming” evaporates.

The Road Ahead: Where the Racing Simulator Market Is Headed

Looking toward 2030, the Racing Simulator Market trajectory suggests several inflection points. First, expect continued convergence between gaming, professional training, and automotive development. The same simulator that entertains consumers on weekends may validate vehicle dynamics for manufacturers on weekdays.

Second, anticipate platform consolidation. As the market matures, expect mergers and acquisitions as companies seek scale and integrated offerings spanning hardware, software, and content.

Third, watch for mainstream adoption milestones. When simulators become common in driving schools, automotive dealerships, and community centers, the market will have truly arrived.

For industry professionals tracking this space, the message is clear: the Racing Simulator Market represents far more than a gaming niche. It’s a serious industry experiencing serious growth, backed by serious technology and serious money.

Deep Dive into Market Intelligence

For businesses and investors seeking comprehensive analysis of the Racing Simulator Market dynamics, MarketsandMarkets offers detailed insights into segment forecasts, competitive landscapes, and strategic opportunities. The full research report provides granular data on simulator types, component analysis, regional breakdowns, and company deep dives essential intelligence for stakeholders navigating this high-velocity market.

The report examines key questions shaping industry strategy: Which simulator configurations will dominate by 2030? How will pricing dynamics evolve as technology matures? Which geographic markets offer the highest return potential? What partnerships and business models will separate winners from also-rans?

The Bottom Line

The Racing Simulator Market’s projected 15.6% CAGR through 2030 positions it among the fastest-growing segments in the broader gaming and automotive technology landscape. With established players investing aggressively and new entrants bringing fresh innovation, competition will intensify.

For motorsports enthusiasts, the golden age of accessible, authentic racing simulation has arrived. For businesses, the opportunity window is wide open but closing fast as the market matures. And for the Racing Simulator Industry as a whole, the checkered flag waves not at the finish line, but at the starting grid of even greater growth ahead.

For complete market forecasts, competitive analysis, and strategic insights, explore the full Racing Simulator Market research report at MarketsandMarkets.