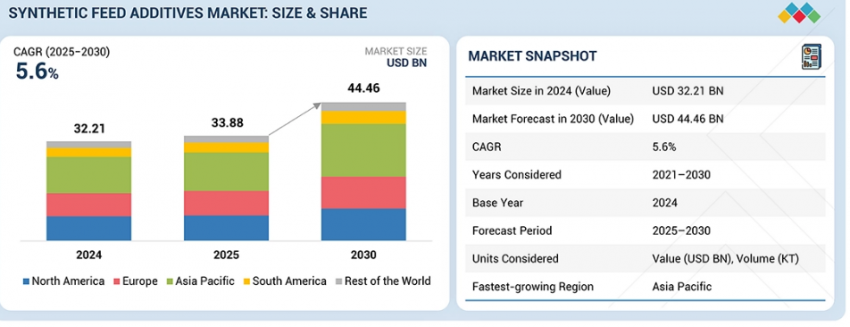

The Global Synthetic Feed Additives Market continues to expand steadily as livestock producers prioritize scientifically formulated nutrition to enhance animal performance and productivity. According to the latest industry report, the market is projected to grow from USD 33.88 billion in 2025 to USD 44.46 billion by 2030, registering a CAGR of 5.6% during the forecast period.

Rising Demand for Performance-Driven Animal Nutrition

The market’s growth is closely linked to increasing global consumption of meat, dairy, poultry, and aquaculture products. As demand for high-quality and affordable animal protein rises, producers are under pressure to enhance feed efficiency, animal health, and productivity.

Synthetic feed additives such as amino acids, phosphates, vitamins, acidifiers, enzymes, mycotoxin detoxifiers, flavors and sweeteners, antibiotics, minerals, antioxidants, nonprotein nitrogen, and preservatives play a critical role in modern livestock nutrition. These additives improve growth rates, strengthen immunity, support gut health, and optimize feed conversion ratios.

With growing awareness around antibiotic resistance and regulatory restrictions, livestock producers are increasingly adopting balanced, science-backed feed formulations that promote sustainable animal production.

United States Leads Growth Momentum

The United States is emerging as a key market within the global synthetic feed additives industry. Its highly industrialized livestock production systems and performance-focused approach to nutrition are major growth drivers.

US producers are increasingly investing in advanced feed technologies to enhance growth performance, improve disease resistance, and reduce antibiotic dependency. The presence of leading feed manufacturers and strong research and development infrastructure further supports market expansion in the country.

Swine Segment Expected to Witness Fastest Growth

Among livestock categories, the swine segment is projected to experience the fastest growth in demand for synthetic feed additives.

Swine production faces increasing challenges related to digestive health issues, infections, and the need to reduce antibiotic usage. This has led to higher adoption of amino acids, enzymes, and swine-specific feed additives that enhance gut health and overall performance.

As global pork consumption continues to rise, swine producers are turning to science-based nutrition strategies to improve feed efficiency and reduce operational costs while maintaining herd health.

Request Custom Data to Address your Specific Business Needs

Dry Form Segment Gains Strong Traction

Based on form, the dry segment is expected to grow significantly over the forecast period.

Dry feed additives offer multiple advantages, including greater stability, ease of handling, longer shelf life, and better compatibility with feed manufacturing processes. They can be uniformly blended with minimal risk of degradation during storage and transportation, making them highly preferred by feed mills and integrators.

These benefits have contributed to the widespread adoption of dry synthetic feed additives across global markets.

Competitive Landscape

The global synthetic feed additives market features strong competition among established multinational players focused on innovation, sustainability, and expansion strategies. Key companies profiled in the report include:

- Cargill

- ADM

- Evonik Industries

- BASF SE

- dsm-firmenich

- Ajinomoto Co.

- Novonesis Group

- Adisseo

- Nutreco

- Kemin Industries

- Lallemand

- Alltech

- Bentoli

- Novus International

These synthetic feed additives companies continue to invest in advanced formulations, functional additives, and sustainable feed solutions to meet evolving industry demands.