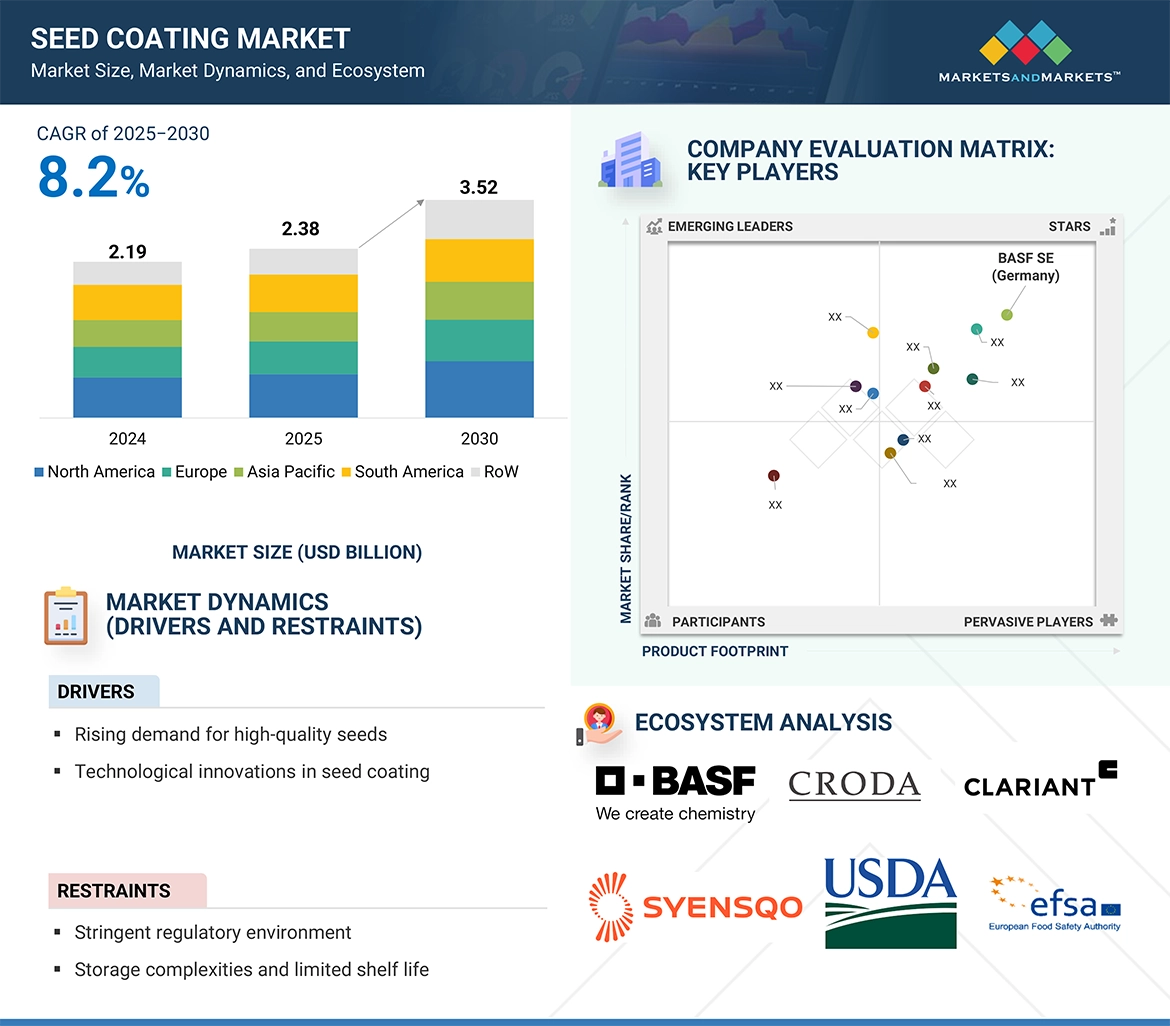

The global seed coating market is on a strong growth trajectory, projected to expand from USD 2.38 billion in 2025 to USD 3.52 billion by 2030, representing a CAGR of 8.2% during the forecast period. This growth is being fueled by increasing global demand for high-yielding crops, technological advancements in agriculture, and a rising emphasis on sustainable farming practices. The current seed coating industry size reflects significant opportunities for growth, particularly in regions with high crop density and technological adoption.

Key drivers supporting this market expansion include the adoption of precision agriculture, the development of innovative seed treatment products integrating nutrients, pesticides, and biological components, and growing farmer awareness about the benefits of seed coatings in enhancing germination rates and crop uniformity. Additionally, regulatory encouragement for green agrochemicals and the need to improve productivity while lowering input costs in large agricultural economies are accelerating the adoption of seed coating technologies.

Attractive Opportunities in the Seed Coating Market

Asia Pacific Leads Adoption

The Asia Pacific seed coating market is driven by the demand for higher agricultural productivity, particularly in densely populated countries like China and India. Farmers increasingly recognize the benefits of coated seeds, including improved germination, nutrient delivery, and protection against pests.

Request Personalized Data Insights for Your Business Goals

The market in this region is projected to grow at a CAGR of 8.2% and reach USD 3.52 billion by 2030. Opportunities are further amplified through collaborations and new product launches. Government initiatives promoting modern farming practices, growing investments in agricultural R&D, and expanding commercial farming activities are additional factors supporting market growth.

Major seed coating companies are investing heavily in new products, fostering competitive advantages and innovation in the region.

Global Seed Coating Market Dynamics

Drivers: Technological Innovations

Technological innovations are pivotal in driving the seed coating industry growth. Advanced seed coatings now combine polymers, active molecules, and biological components to provide enhanced protection against pathogens, pests, and environmental stress while promoting germination and early plant growth.

Emerging technologies such as nano-encapsulation, controlled-release systems, and bio-based materials cater to the needs of both large-scale agribusinesses and smallholder farmers. For instance, Covestro offers high-performance biodegradable polymers compliant with EU Microplastics regulations, suitable for film coating, encrusting, and pelleting applications. These advancements improve seed storage life, sowing accuracy, and support sustainable farming objectives.

R&D investments and strategic collaborations across the value chain—from seed firms to input providers—reflect the growing potential of this market segment for long-term competitiveness.

Opportunities: Customized Crop-Specific Coatings

Tailor-made seed coatings designed for specific crops present a significant opportunity to enhance performance. For example, rice seeds benefit from coatings resistant to flooded conditions, whereas maize thrives with coatings supporting early root development and nutrient uptake.

Crop-specific coatings improve germination, uniform emergence, and stress tolerance while enabling precise delivery of nutrients or biologicals. They also accommodate regional farming systems—rainfed, irrigated, temperate, and tropical—boosting market penetration in high-demand areas like rice in Southeast Asia or pulses in South Asia.

With farms increasingly seeking customized inputs, crop-specific seed coatings are becoming indispensable for achieving optimal crop performance.

Challenges: High R&D and Formulation Costs

Developing advanced seed coatings is capital-intensive. Creating effective coatings requires extensive research into ingredient interactions with seeds, soils, and environmental conditions. Coatings must deliver nutrients, protect beneficial microbes, and withstand heat, moisture, and mechanical stress.

Incorporating biological components adds further complexity, as microbial viability must be maintained throughout shelf life. Combined with rigorous regulatory approvals, these high R&D costs can challenge smaller firms and potentially concentrate innovation among industry giants.

Market Segmentation Insights

Additive Segment: Polymers Lead

Polymers dominate the seed coating market due to their ability to enhance functionality, handling, and performance. They act as binding agents for nutrients and active ingredients, improve seed appearance, reduce dust-off, and support precise application.

Advances in biodegradable and water-soluble polymers, aligned with regulatory requirements, allow environmentally compatible coatings without sacrificing performance. These materials support controlled-release nutrient and microbial delivery, fitting the growing demand for sustainable and precision agriculture.

Crop Type: Cereals & Grains Dominate

Cereals and grains hold the largest seed coating industry share due to their status as staple food crops cultivated globally. Wheat, rice, maize, and barley benefit from enhanced seed treatments for better germination, pest protection, and uniform emergence.

Seed coating technologies scale well for large cereal production, ensuring precision and uniformity. Film coatings and encrustments improve handling, planting efficiency, and compatibility with biologicals or micronutrients, particularly in regions with nutrient-deficient soils or challenging climates.

Regional Insights: North America Leads

North America is expected to dominate the seed coating market, supported by advanced farming infrastructure, widespread adoption of improved farming methods, and the strong presence of seed and agrochemical players. High-value crops such as corn, soybeans, and canola benefit from seed treatments for germination, pest resistance, and nutrient delivery.

Government support for sustainable agriculture, R&D investments, and private–research partnerships further drive adoption. North American farmers prioritize efficiency, productivity, and eco-friendly options, positioning the region at the forefront of seed coating industry trends.

Market News & Developments

- October 2024: Incotec launched Disco Blue L-1523, a microplastic-free film coat for sunflower seeds.

- March 2024: BrettYoung expanded NorthCore with a USD 20 million facility for advanced cleaning, sorting, and packaging of turf seeds.

- February 2024: Milliken introduced Milli Solum and Milli Fusion seed coating polymers in Brazil.

- November 2023: BASF Agricultural Solutions launched Flo Rite Pro 02, a high-performance seed coating polymer.

Top Companies in Seed Coating Market

Some of the leading seed coating companies driving innovation and market growth include:

- BASF SE (Germany)

- Syensqo (Belgium)

- Clariant (Switzerland)

- Croda International plc (UK)

- Sensient Technologies Corporation (US)

- Germains Seed Technology (UK)

- Milliken (US)

- Covestro AG (Germany)

- BrettYoung (Canada)

- Chromatech Incorporated (US)

- Centor Group (Netherlands)

- Michelman, Inc. (US)

- Precision Labs (US)

- CR Minerals, LLC (US)

The seed coating market is rapidly evolving, driven by technological innovations, crop-specific solutions, and global demand for sustainable agriculture. With strategic investments, regulatory support, and continuous product development, the market is set to reach USD 3.52 billion by 2030. Companies that embrace innovation and address both agronomic and environmental objectives will emerge as leaders in this high-growth segment, making the seed coating industry growth promising for years to come.

Frequently Asked Questions (FAQs) on the Seed Coating Market

- What is driving the growth of the seed coating industry?

The seed coating industry growth is primarily driven by increasing demand for high-yielding crops, advances in agricultural technology, and the adoption of sustainable farming practices. Innovations such as nano-encapsulation, controlled-release systems, and biodegradable polymers are also boosting market expansion. - What are the latest trends in the seed coating market?

Current seed coating industry trends include crop-specific coatings, the integration of biologicals and micronutrients, microplastic-free formulations, and precision agriculture technologies that enhance germination and crop uniformity. - Which regions are leading the seed coating market?

North America is expected to lead the global market due to advanced farming infrastructure, widespread adoption of modern techniques, and strong support for sustainable agriculture. Asia Pacific is also witnessing rapid adoption, especially in countries like China and India. - What types of crops use seed coatings the most?

Cereals and grains hold the largest seed coating industry share, as staple crops like wheat, rice, maize, and barley benefit from enhanced germination, pest protection, and uniform emergence. - Who are the key players in the seed coating market?

Some of the leading seed coating companies include BASF SE, Syensqo, Clariant, Croda International plc, Sensient Technologies Corporation, Covestro AG, Milliken, BrettYoung, and SEEDPOLY Biocoatings Private Limited. These companies are driving innovation and shaping the market landscape. - What challenges does the seed coating industry face?

High R&D and formulation costs, stringent regulatory requirements (such as EU microplastics regulations), and the complexity of integrating biologicals and nutrients pose significant challenges for market players, especially smaller companies. - What are the opportunities in the seed coating market?

Tailor-made crop-specific coatings, biodegradable polymers, and advanced nutrient or biological delivery systems present major opportunities to improve crop performance and sustainability, catering to both commercial farmers and smallholders.