Scaling Sustainable Flight

The Sustainable Aviation Fuel Market (SAF Market) stands at a transformative juncture. Despite growing policy support and significant innovation, sustainable aviation fuel still accounts for less than 1% of global jet fuel use. For the Sustainable Aviation Fuel Industry to fulfill its net-zero ambitions, large-scale production must overcome several technical, economic, regulatory, and infrastructural hurdles. This blog provides a comprehensive analysis of these challenges, alongside the trends and strategies reshaping the path forward.

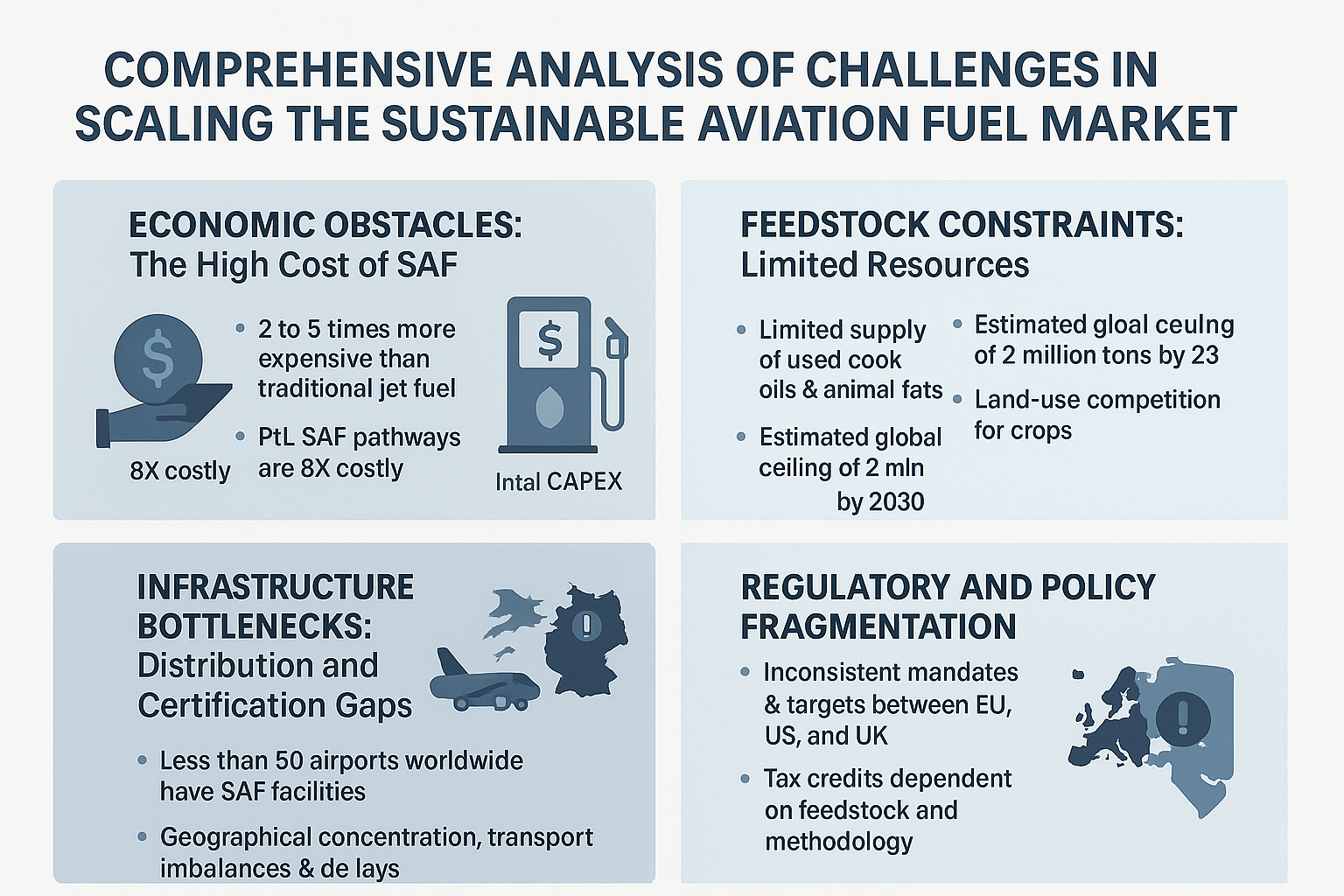

Economic Obstacles: The High Cost of SAF

The greatest barrier to scaling the SAF Industry is cost. SAF is currently 2 to 5 times more expensive than traditional jet fuel. Advanced pathways such as power-to-liquid (PtL) can be 8 times costlier.

Initial capital expenditure (CAPEX) for SAF production plants typically ranges between $200–400 million per facility. These first-of-a-kind plants face long payback periods, deterring investors. Meanwhile, volatile feedstock and hydrogen prices contribute to fluctuating production costs. Without stable, long-term offtake agreements, project developers struggle to secure financing, stalling growth across the Sustainable Aviation Fuel Market Size.

Feedstock Constraints: Limited Resources

Feedstock availability is a growing bottleneck for the SAF Industry. The dominant production method HEFA (hydroprocessed esters and fatty acids) relies on used cooking oils and animal fats, which are limited in global supply. Estimates suggest a global ceiling of approximately 2 million tonnes by 2030.

Transitioning to feedstocks like municipal solid waste (MSW), agricultural residues, and algae introduces new challenges. These require complex logistics, quality control mechanisms, and sustainability assessments. Additionally, land-use competition between food crops and energy crops presents ethical and environmental trade-offs, threatening long-term feedstock viability in the SAF Market.

Infrastructure Bottlenecks: Distribution and Certification Gaps

Current fuel infrastructure is insufficient to support widespread SAF use. Fewer than 50 airports globally have SAF blending or delivery capabilities. Retrofitting existing airport infrastructure for SAF is capital-intensive, slowing progress on Sustainable Aviation Fuel Market Trends.

Geographically, most SAF production is concentrated in North America and Europe, leading to supply chain imbalances in Asia-Pacific, Latin America, and Africa. Transporting SAF over long distances adds logistical complexity and cost.

Compounding this are fragmented certification processes. SAF must meet strict standards, including ASTM D7566. But overlapping regional mandates like the EU’s ReFuelEU, the UK SAF Mandate, and CORSIA create a complex web of compliance requirements. Each new facility can face 6–12 months of lead time just for certification, further delaying market entry.

Regulatory and Policy Fragmentation

While policy support has grown, inconsistencies between global mandates hinder investment and adoption. The EU’s ReFuelEU Aviation initiative targets a 2% SAF blend by 2025, rising to 6% by 2030. The UK mandates similar goals. In contrast, the United States has only voluntary targets supported by tax credits.

These inconsistencies generate uncertainty across the SAF Market. For instance, the U.S. Inflation Reduction Act offers tax credits up to $1.75 per kilogram of CO₂ avoided. However, credits vary widely depending on feedstock and methodology. This lack of harmonization discourages cross-border trade and investment, restricting Sustainable Aviation Fuel Market Share growth.

Technology Readiness and Risk

Emerging SAF technologies such as Alcohol-to-Jet (ATJ), Fischer-Tropsch, and PtL are promising but not yet commercially mature. LanzaJet’s Soperton plant in Georgia, producing 10 million gallons of ATJ fuel annually, marks a milestone but remains the exception rather than the rule.

Scaling these technologies requires not only CAPEX but robust research, skilled labor, and regulatory approvals. Hybrid production models that co-produce SAF alongside renewable diesel may improve economics, but introduce complexity. As of now, only a handful of modular or mobile units exist that reduce financial and operational barriers.

Recent Trends and Innovations

Despite these hurdles, there are signs of progress. Modular ATJ and PtL plants are emerging as a solution to capital intensity. Companies like Norsk e-Fuel and Ineratec are pioneering compact PtL projects using green hydrogen and captured CO₂. These models allow distributed production closer to feedstock sources, reducing logistics costs.

New feedstock pathways are under rapid development. Algae-based SAF, while still in early stages, offers high yields with minimal land use. MSW-based Fischer-Tropsch fuels, demonstrated in pilots by Shell and SkyNRG, are gaining traction.

Financial innovations such as Contracts for Difference (CfDs) are being explored, especially in the UK, to guarantee stable revenue for SAF producers. Blended finance models are helping de-risk SAF projects in emerging markets, especially in Africa and India.

Sustainable Aviation Fuel Market, Request Pdf Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=70301163

Market Outlook and Expansion Opportunities

Opportunities for scaling the Sustainable Aviation Fuel Market lie in three key areas:

Policy Alignment: A globally harmonized SAF certification standard would eliminate confusion and accelerate facility approval. Converging ASTM, ReFuelEU, and CORSIA standards is essential by 2026.

Corporate Offtake Agreements: Airlines like Delta, Lufthansa, and British Airways are committing to long-term SAF purchases. These agreements help producers secure financing and scale production.

Emerging Markets: Countries like India offer untapped SAF potential. India could produce up to 40 million tonnes of SAF by 2050, with co-benefits in rural development and carbon reduction. Strategic investments and partnerships here can unlock significant Sustainable Aviation Fuel Market Share.

Key Industry Players

Neste (Finland): Global leader in HEFA production with strong international supply networks.

World Energy (USA): First commercial SAF producer; leveraging renewable diesel platforms.

Gevo (USA): ATJ innovator with a target of 1 billion gallons by 2030.

LanzaJet (USA): Commercializing modular ATJ facilities globally.

TotalEnergies (France): Leading co-processor integrating SAF into traditional refineries.

These companies are redefining Sustainable Aviation Fuel Market Trends and creating scalable, economically viable models.

Strategic Recommendations

Align Global Policies: Create consistent SAF mandates and definitions across jurisdictions.

Expand Incentives: Increase availability and consistency of tax credits, CfDs, and grants.

Invest in Feedstock Innovation: Scale non-HEFA feedstocks like algae, MSW, and DAC.

Enhance Infrastructure: Support SAF blending facilities at major airports worldwide.

Foster Industry Partnerships: Strengthen airline-producer collaborations for offtake security.

Unlocking SAF’s Full Potential

The Sustainable Aviation Fuel Industry is on the cusp of exponential growth, but success depends on solving the complex challenges of cost, feedstock, infrastructure, and policy. Stakeholders must act in concert governments, producers, investors, and airlines to remove barriers and foster innovation. Only through strategic investment and policy harmonization can the SAF Market scale sustainably and meet aviation’s net-zero targets.