The rise in asymmetric warfare, which is marked by scattered fighting groups, unorthodox tactics, and urban battlefields, has increased demand for loitering munitions that can attack targets precisely while causing the least amount of collateral damage. Kamikaze drones, in contrast to traditional missiles or artillery, are capable of continuously monitoring, locating, and destroying valuable targets.

Loitering Munitions: The Future of Intelligent Precision Warfare

The modern battlefield is evolving rapidly, and at the heart of this change lies the emergence of loitering munitions also referred to as attack drones, kamikaze drones, or suicide drones. These systems have redefined the balance between surveillance and precision strike, offering armed forces a flexible, intelligent, and cost-effective alternative to traditional missile or UAV-based combat systems.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=139489979

By combining the endurance of unmanned aerial vehicles with the precision of guided munitions, loitering drones have transformed the way militaries detect, track, and neutralize targets. Their ability to hover or “loiter” above the battlefield, identify threats in real time, and execute pinpoint strikes has made them one of the most significant innovations in modern warfare. As global militaries move toward faster decision-making cycles and autonomous operations, loitering munitions are increasingly seen as critical assets for achieving tactical superiority in complex and dynamic combat environments.

The Strategic Context: Rise of Asymmetric and Hybrid Warfare

The 21st-century defense landscape is marked by asymmetric and hybrid conflicts, where non-linear battlefields, dispersed enemy units, and urban environments dominate. In such situations, conventional artillery or missile systems often lack the flexibility and precision required to minimize collateral damage while maintaining effectiveness.

This shift has fueled demand for loitering munitions—systems that can observe, verify, and engage with surgical accuracy. Unlike traditional munitions, kamikaze drones are designed to orbit a target area, identify high-value threats, and strike only once the target is confirmed. This combination of persistence and precision makes them ideal for counter-insurgency, anti-armor, and electronic warfare missions.

Recent conflicts have proven their tactical value. From neutralizing radar systems to eliminating armored convoys, suicide drones have shown that small, intelligent, and expendable platforms can deliver the kind of battlefield agility once reserved for large-scale operations. Their low noise profile, fast launch readiness, and real-time intelligence capabilities have made them indispensable in both urban combat and peer-to-peer warfare scenarios.

Evolving Alliances and Strategic Investment

Global defense alliances and major OEMs are now driving the next wave of innovation in the loitering munition sector. Through joint research programs and strategic collaborations, they are extending the range, endurance, and adaptability of these systems.

Modern loitering drones can now remain airborne for 1–3 hours and cover operational distances of up to 150 kilometers, giving commanders greater flexibility for both reconnaissance and strike missions. Manufacturers are increasingly designing modular payload architectures, allowing a single platform to switch between explosive warheads, electro-optical/infrared sensors, and electronic warfare packages. This modularity significantly reduces logistical complexity and enables rapid mission reconfiguration in the field.

Meanwhile, ongoing R&D in artificial intelligence, computer vision, and autonomous navigation is transforming loitering drones from operator-dependent assets into self-reliant combat systems. With AI-assisted object recognition and onboard processing, these drones can identify, track, and prioritize multiple targets simultaneously even in GPS-denied or electronically contested environments.

Perhaps the most significant leap forward is the concept of swarm-enabled warfare. Next-generation loitering munitions are being engineered to operate as part of a coordinated drone swarm, sharing data in real time and executing synchronized strikes. This evolution toward AI-coordinated, network-centric warfare marks a defining shift in modern combat strategy, enabling distributed lethality and rapid, collective response capabilities.

This surge in innovation extends beyond defense ministries to leading private defense firms such as AeroVironment, RTX, Northrop Grumman, Lockheed Martin, WB Group, Thales, MBDA, KNDS, Rheinmetall, and UVision. Together, they are building a robust and competitive loitering munition ecosystem that combines industrial scale, R&D investment, and advanced technological expertise.

The Competitive Landscape: Industry Leaders and Collaboration

The race to dominate this market is defined by rapid innovation and cross-border collaboration.

- AeroVironment (U.S.) continues expanding its Switchblade series, introducing longer-range and autonomous variants under the U.S. Department of Defense’s Replicator Initiative.

- WB Group (Poland) has achieved export leadership in Europe with its Warmate family, now operational across NATO and allied Asian defense forces.

- UVision (Israel) and Rheinmetall (Germany) are co-developing the HERO series, a family of modular, multi-domain loitering drones designed for flexibility and precision.

- STM (Türkiye) and IAI (Israel) are integrating AI-based swarm algorithms into smaller, recoverable systems such as ALPAGU and Rotem-L, proving that compact drones can deliver strategic impact.

- Together, these innovators reflect a global movement toward interoperable, AI-powered, and modular designs that blend software intelligence with hardware resilience.

The Road Ahead: Smarter, Connected, and Adaptive Warfare

The evolution of loitering drones reflects the broader shift from platform-centric to network-centric warfare, where every asset contributes to a shared, data-driven picture of the battlefield. Future kamikaze drones will not be one-time weapons but adaptive, semi-autonomous combat partners capable of learning from engagements and collaborating with other unmanned systems.

Integrated into ground vehicles, naval ships, and aerial swarms, these drones will create a connected battlespace defined by real-time intelligence sharing and machine-to-machine coordination. The fusion of AI, autonomy, and connectivity is transforming loitering munitions into key components of next-generation defense architectures balancing precision, affordability, and sustainability.

As global militaries continue to modernize, loitering munitions will remain central to achieving strategic deterrence and battlefield agility. Their blend of intelligence, flexibility, and precision positions them not merely as tools of warfare, but as core enablers of the future combat ecosystem—a future where every decision, every strike, and every movement is informed by autonomous intelligence and executed with unmatched accuracy.

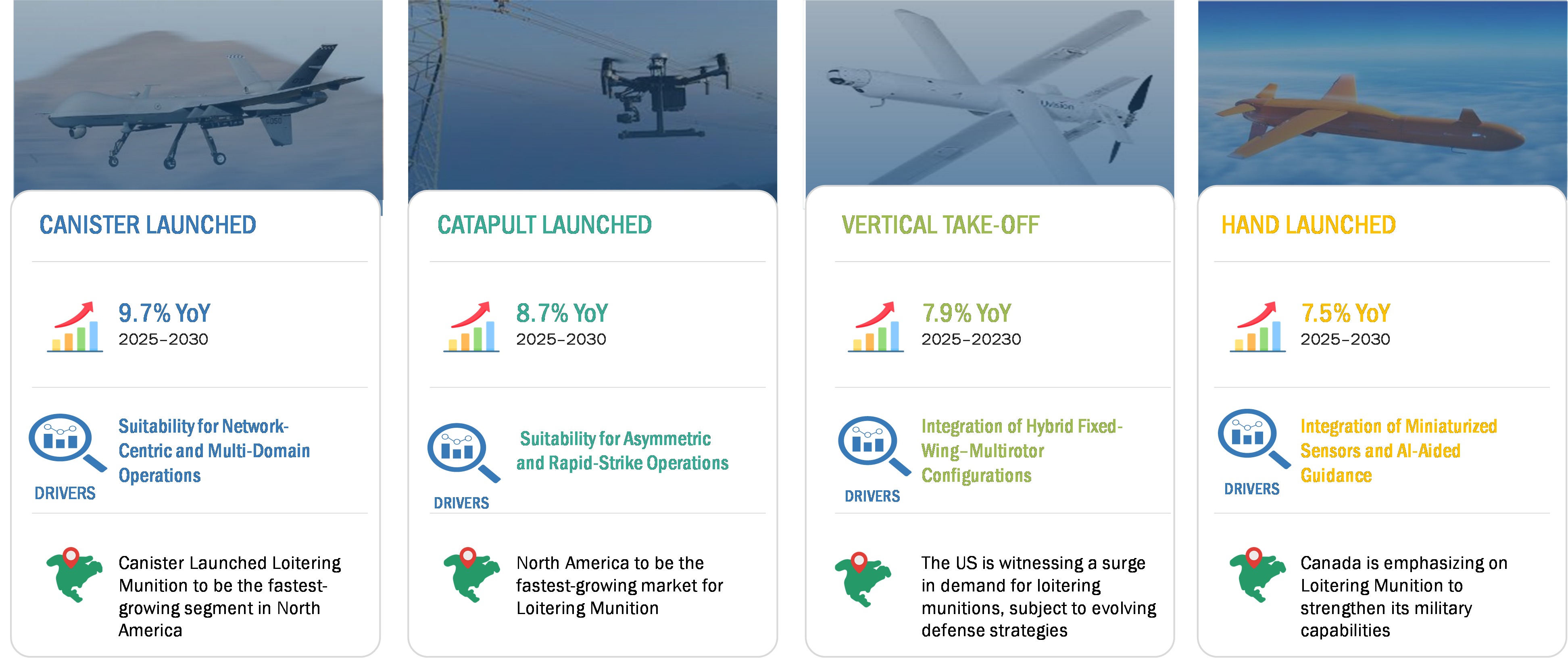

Growth trajectory of the loitering munition market across different launch modes during the forecast period.

The global Loitering Munition Market was valued at USD 529.9 million in 2024 and is projected to grow from USD 576.2 million in 2025 to USD 815.3 million by 2029 at a CAGR of 9.0% during the forecast period.

https://www.marketsandmarkets.com/Market-Reports/loitering-munition-market-139489979.html

The global defense industry is undergoing a dramatic shift as loitering drones—also known as loitering munitions, attack drones, kamikaze drones, or suicide drones emerge as a defining element of next-generation warfare. These autonomous systems are revolutionizing combat operations by seamlessly combining surveillance, target acquisition, and precision strike into one versatile and mobile platform.

In 2025, the canister-launched loitering munition segment continues to dominate the global landscape, recording an impressive 9.7% year-on-year growth (2024–2029). Designed with a sealed, ready-to-launch architecture, these systems are ideal for network-centric and multi-domain missions, allowing rapid deployment across air, land, and naval theaters with minimal setup time.

The catapult-launched category, expected to expand at 8.7% annually, is gaining popularity for its low-cost and highly portable design, making it particularly effective for asymmetric warfare and fast-response missions. Strong industrial involvement from North American defense manufacturers has positioned the region as the fastest-growing hub for this launch mode.

Meanwhile, the vertical take-off (VTOL) segment, growing at 7.9% per year, highlights the rising demand for hybrid fixed-wing and multirotor configurations. These platforms combine vertical lift with extended endurance, offering unmatched flexibility for urban, coastal, and naval operations. The United States is spearheading this transition, driven by large-scale defense modernization programs and an expanding focus on autonomous aerial capabilities.

Finally, the hand-launched segment, growing at 7.5% annually, is evolving rapidly through miniaturization, lightweight construction, and AI-enhanced guidance systems. Nations such as Canada are prioritizing these compact systems to improve tactical surveillance and reconnaissance across dispersed military units.

Together, these advancements signal a global movement toward AI-driven, autonomous loitering drones that feature longer endurance, modular payloads, and multi-domain deployment flexibility. As these technologies mature, loitering munitions are poised to become one of the most disruptive and indispensable innovations in modern warfare reshaping how future conflicts are detected, fought, and won.

Key Developments in 2025: Loitering Drones Reshaping Battlefield

The year 2025 marks a pivotal turning point in the evolution of loitering drones—also known as loitering munitions, attack drones, kamikaze drones, or suicide drones. Around the world, governments are ramping up investments in autonomous, network-integrated systems that merge surveillance, targeting, and strike capabilities into a single, intelligent platform. These drones are becoming critical force multipliers, offering unparalleled situational awareness, precision engagement, and tactical flexibility across air, land, and maritime domains.

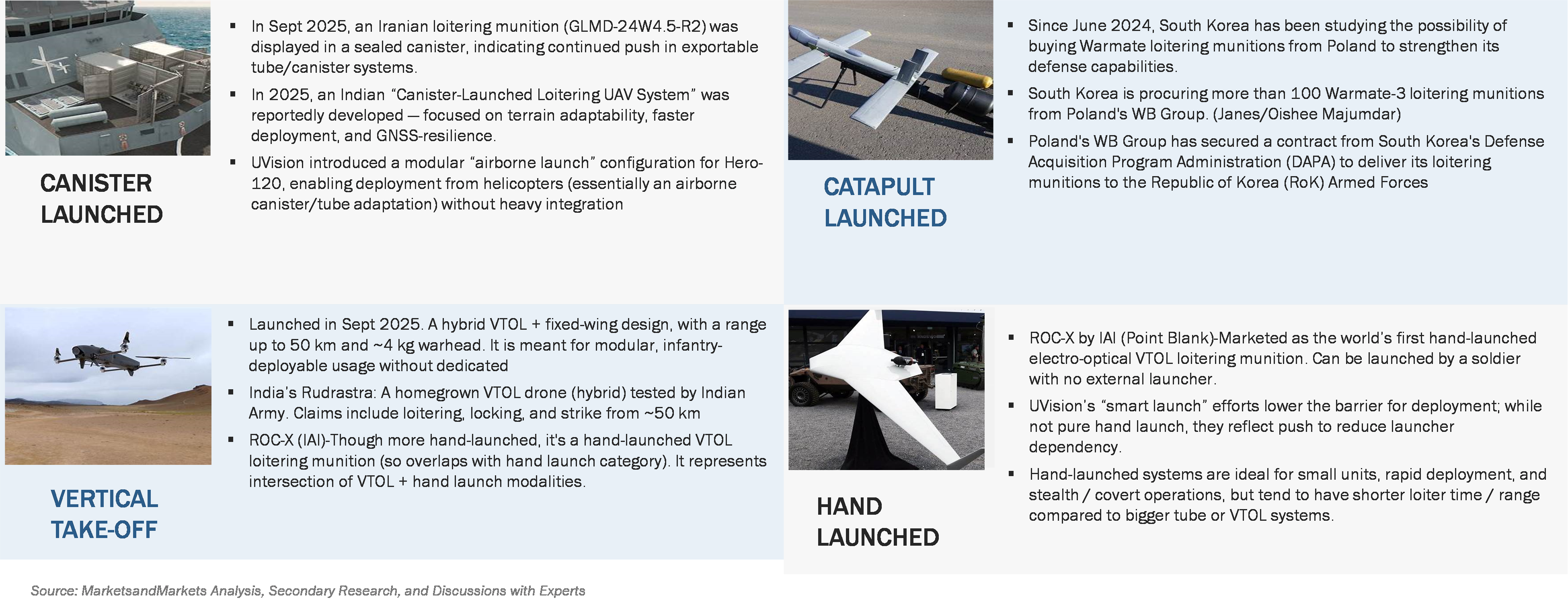

Canister-launched loitering munitions remain at the forefront of defense innovation. In September 2025, Iran introduced its GLMD-24W4.5-R2 system, signaling an ambition to expand into export-ready, canisterized drone munitions. At the same time, India has developed a new Canister-Launched UAV System, built for terrain adaptability, quick deployment, and resistance to GNSS interference making it highly effective in contested environments. Meanwhile, UVision’s HERO-120 airborne canister variant exemplifies the industry’s shift toward modular, helicopter-deployable solutions that require minimal integration, increasing operational flexibility.

Catapult-launched drones are gaining global momentum due to their low cost, ease of operation, and rapid setup. A landmark example came when South Korea procured over 100 Warmate-3 loitering munition systems from Poland’s WB Group, under the supervision of the Defense Acquisition Program Administration (DAPA). This deal not only highlights growing industrial cooperation between Asia and Europe but also signals a trend toward standardized, interoperable defense systems capable of supporting joint military operations.

Ask for Sample Report @

https://www.marketsandmarkets.com/requestsampleNew.asp?id=139489979

The rise of Vertical Take-Off and Landing (VTOL) loitering drones reflects the growing demand for hybrid systems that combine multirotor agility with fixed-wing endurance. India’s Rudrastra, successfully tested in 2025, demonstrates this shift offering the ability to loiter, lock, and strike targets up to 50 kilometers away. Similarly, Israel’s ROC-X (also known as IAI Point Blank) blurs the distinction between hand-launched and VTOL drones, introducing a compact yet powerful platform suitable for infantry-level deployment and precision operations in confined spaces.

The evolution of hand-launched loitering munitions continues at a remarkable pace, driven by miniaturization, AI integration, and enhanced launch technologies. Israel’s ROC-X has become the world’s first hand-launched, electro-optical VTOL loitering munition, offering advanced strike capability without the need for heavy equipment or runways. In parallel, UVision’s next-generation launch systems are reducing operator dependence and enabling faster mission cycles. Despite their smaller payload and shorter range, these lightweight, low-signature drones are proving invaluable to special forces and tactical units, providing real-time intelligence and rapid-response capability in high-risk environments.

How can we help clients capitalize on emerging opportunities in the loitering munition and attack drone ecosystem?

Under the AI-Enabled Systems initiative, we aim to identify the most impactful business functions and emerging applications that generate measurable value for defense and drone solution providers. This effort will be complemented by the Enabling Technology Opportunity program, which focuses on untapped areas such as precision targeting, autonomous mission planning, and AI-driven combat systems helping clients anticipate and adapt to the next wave of technological disruption.

Through comprehensive Voice of Customer and Pain Point Analysis, we will bridge the gap between technology developers and end-users by revealing real-world operational needs, deployment barriers, and innovation priorities. In parallel, Industry Whitepapers and Points of View (POVs) will position client organizations as thought leaders in precision warfare and defense innovation, enabling stronger visibility in high-growth markets.

We will also identify Top Use Cases with the greatest revenue potential across defense and drone segments and facilitate Joint Webinars with our Experts to encourage industry collaboration, cross-sector learning, and knowledge exchange.

The Attack, Avoid & Defend Competition module will provide clients with deep competitive benchmarking and actionable intelligence to refine their strategic positioning in the global market. Finally, ours Partnering Ecosystem Development framework will help clients identify regional collaborators, fostering strategic alliances and manufacturing partnerships that strengthen their footprint across the evolving global defense value chain.