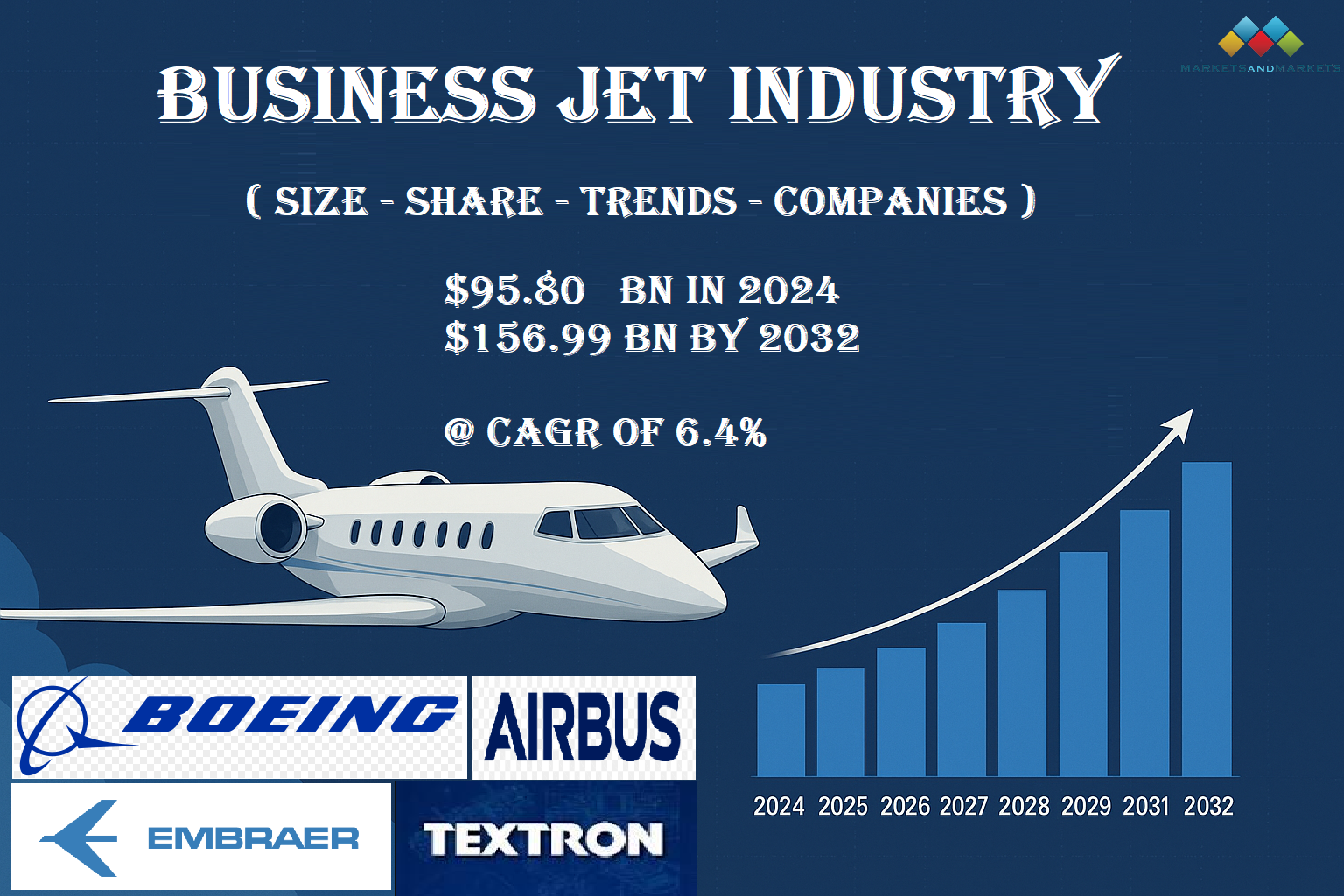

The business jet market is entering a phase of sustained growth driven by the need for time-critical corporate travel, the rising number of high-net-worth individuals (HNWI), and improving aircraft economics. The market is projected to grow from USD 95.80 billion in 2024 to USD 156.99 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.4 percent. Unit delivery volumes support this trend, with new business jet deliveries expected to rise from 662 aircraft in 2024 to 793 aircraft in 2032, while used jet retail transactions are forecast to increase from 2,578 to 3,289 during the same period. Together, these dynamics indicate a healthy balance between new production and the secondary market.

Several factors are driving this expansion. Business jet users continue to prioritize productivity and time efficiency, valuing the ability to access secondary airports and avoid the scheduling limitations of commercial aviation. Advances in hybrid and electric technologies, together with lighter aerostructures and next-generation avionics, are improving fuel efficiency and reducing operating costs. At the same time, the global pool of wealthy individuals is growing, particularly in emerging economies, creating new demand for both ownership and fractional share models. The expansion of aftermarket services and predictive maintenance solutions has further enhanced buyer confidence by improving reliability and reducing lifecycle risks.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=33698426

By aircraft type, the light jet segment is expected to record the second-highest CAGR during the forecast period. This growth is largely attributed to lower acquisition and operating costs, as well as suitability for short regional missions. Models such as the Cirrus SF50, Embraer Phenom 300, and Bombardier Learjet 70/75 Liberty illustrate how this class balances convenience and affordability, appealing both to owner-pilots and corporate shuttle operators. Rising interest in hybrid and electric propulsion is also likely to concentrate in the light jet segment, given the shorter ranges and lower weight requirements. Mid-sized, large, and airliner-based business jets remain important for long-range connectivity and corporate flight departments, though they represent higher-cost segments with lower unit volumes.

When examined by point of sale, the original equipment manufacturer (OEM) category is forecast to experience the second-highest CAGR through 2032. This reflects a sustained appetite for customization, advanced avionics, and comprehensive warranty packages. The introduction of new models is expected to stimulate the market further. Dassault’s Falcon 10X, Bombardier’s Global 8000, and Gulfstream’s G800 are all due to enter service between 2024 and 2025, and they embody the latest in cabin design, flight efficiency, and technology integration. While the aftermarket continues to generate steady revenue from modifications, maintenance, and parts, and the pre-owned segment benefits from high liquidity, the OEM pipeline remains a critical engine for market expansion.

By range, jets with less than 3,000 nautical miles of capability are projected to grow at the highest CAGR during the forecast period. This reflects a preference for fuel efficiency and suitability for short-haul regional flights. The segment appeals to both new buyers and pre-owned customers due to its lower purchase price and greater flexibility. Aircraft such as the Embraer Phenom 300E, Legacy 450, Gulfstream G280, and HondaJet HA-420 are strong representatives of this growing category.

Regionally, Latin America is expected to post the second-highest growth rate in the business jet market. Increasing corporate activity in Brazil, Mexico, Colombia, and Argentina is stimulating demand, particularly for private aviation solutions that support industries such as energy, mining, and agribusiness. The region is also benefiting from aviation infrastructure improvements, including airport expansions and the development of new maintenance, repair, and overhaul (MRO) facilities, which reduce barriers to adoption and strengthen the ecosystem supporting business aviation.

On the supply side, innovation in aerostructures, avionics, and aircraft systems is central to competitive positioning. Composites and lighter materials are reducing weight, while synthetic vision systems, enhanced connectivity, and predictive maintenance are boosting dispatch reliability and safety. Growth in fleet utilization is also spurring demand for robust MRO support, and both OEM and independent providers are racing to expand parts availability and improve response times. Sustainability pressures add another layer of complexity, with sustainable aviation fuel (SAF) serving as the most immediate solution and hybrid-electric propulsion expected to debut in short-range platforms over the coming decade.

The competitive landscape is dominated by a few key players. Airbus and Boeing participate primarily through VIP conversions of their commercial platforms, while Textron Aviation continues to lead in light and midsize jets. Bombardier holds a strong position in the large-cabin and long-range segments, leveraging its Global family of aircraft. Embraer has built a reputation for efficient, reliable light and super-midsize jets that appeal to both private owners and fleet operators. General Dynamics, through Gulfstream, has a powerful brand presence in the ultra-long-range sector, while Dassault is preparing to strengthen its position with the Falcon 10X.

Looking forward, the base-case outlook suggests continued steady growth in line with the 6.4 percent CAGR. Deliveries are expected to rise as supply chains stabilize, while aftermarket revenues outpace fleet expansion thanks to higher utilization and digital services adoption. The upside scenario includes accelerated adoption of hybrid and electric aircraft, coupled with resilient corporate travel and sustained wealth creation, which could lift demand beyond current projections. Risks to the market include certification delays, supply chain disruptions, economic slowdowns, and fluctuations in residual values within the pre-owned market.

Ask for Sample Report @

https://www.marketsandmarkets.com/requestsampleNew.asp?id=33698426

Overall, the business jet market is poised for transformation and steady expansion through 2032. Technology upgrades, evolving customer preferences, regional adoption in Latin America and beyond, and the entry of new models will continue to shape the industry’s trajectory. With growing emphasis on sustainability and efficiency, the next decade is likely to see a more diverse mix of aircraft and ownership structures, anchored by both premium ultra-long-range platforms and high-volume light jets.