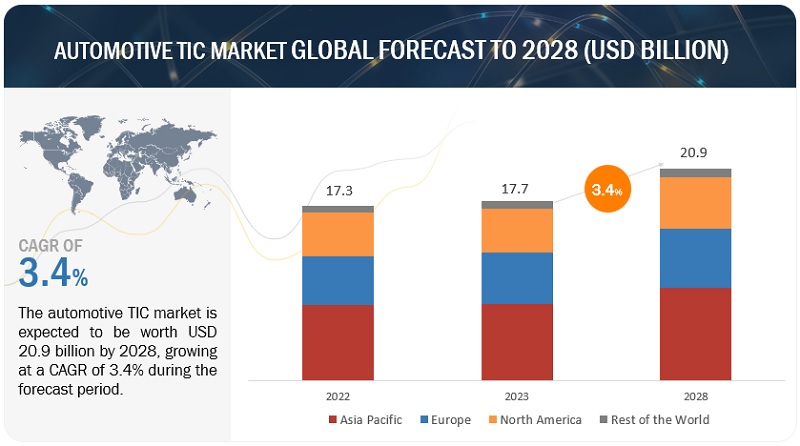

The global Automotive TIC Market Size is projected to grow from USD 17.7 billion in 2023 to USD 20.9 billion by 2028, at a CAGR of ~3.4% during the forecast period.

This growth is being driven by increasing demand for safer, more efficient mobility, especially in electric vehicles (EVs)—where TIC services are needed for battery systems, EV motors, and charging components.

Market Overview: Size & Share Insights

- Market value in 2023: ~ USD 17.7 billion

- Forecast value by 2028: ~ USD 20.9 billion

- CAGR (2023–2028): ~ 3.4%

- Leading Region: Europe is expected to be the largest market for Automotive TIC services.

Key Growth Drivers

- Safety & regulatory compliance: As vehicles become more complex (especially EVs), TIC services ensure component reliability, safety, and regulatory compliance.

- EV adoption: Growing use of EV batteries, motors, and chargers increases the need for TIC services specific to these high-risk, high-cost components.

- Fuel-efficiency & emissions pressure: Automakers are under pressure to deliver efficient, low-emission vehicles—TIC helps validate performance and safety.

- Commercial vehicle demand: The TIC services market for commercial vehicles is expected to grow strongly, given the higher safety, load, and durability requirements.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=175873215

Market Trends & Opportunities

- Service-type segmentation: Key TIC service types include testing, inspection, and certification.

- Sourcing models: TIC can be done in-house or outsourced — many OEMs may prefer a mix, depending on scale and specialization.

- Application in critical EV components: Battery systems, power electronics (inverters, converters), and charging infrastructure require rigorous TIC.

- Adoption for autonomous and hydrogen vehicles: Emerging mobility paradigms (autonomous, hydrogen-powered) present new TIC opportunities.

Regional Outlook

- Europe: Expected to be the largest region for TIC services in automotive, likely due to strict safety/regulatory standards and advanced vehicle manufacturing.

- North America: Strong demand from OEMs, especially for EVs and high-safety / high-reliability validation.

- Asia-Pacific: Potential growth driven by EV adoption, increasing vehicle production, and rising quality-assurance needs.

Challenges & Restraints

- Cost of TIC Services: Testing, inspection and certification involve high operational costs, especially for advanced EV components.

- Complexity of EV Components: Battery packs, inverters, and other EV parts are technically complex, raising the bar for TIC service providers.

- Longer Lead Times: Thorough testing and certification can prolong time-to-market, which may deter OEMs under tight product cycles.

- Regulatory Fragmentation: Different regions may have different standards and certification requirements, complicating global TIC strategies.

Why This Market Matters to Stakeholders

- OEMs & Tier-1 Suppliers: Quality assurance via TIC is critical for safety, especially in EVs. It helps in reducing recalls and strengthening brand trust.

- TIC Service Providers: There is a growing opportunity to specialize in EV component testing, battery cert, power-electronics inspection, etc.

- Investors & Strategic Planners: With TIC being an essential part of EV ecosystem risk-management, identifying high-quality TIC players is a strategic play.

- Regulators & Policy Makers: Understanding the TIC market helps in shaping safety standards, certification regimes, and EV-component regulation.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=175873215

FAQ

Q: What is the size of the automotive TIC market in 2023?

A: Approximately USD 17.7 billion.

Q: What is the forecast by 2028?

A: It is projected to reach USD 20.9 billion.

Q: What is the CAGR from 2023 to 2028?

A: Around 3.4%.

Q: Which region is expected to lead this market?

A: Europe is expected to hold the largest share.

Q: What are the key service types covered in this market?

A: The main service types are Testing Services, Inspection Services, and Certification Services.

Q: Which applications are driving TIC demand?

A: High-risk and high-value components, especially in EVs — such as batteries, EV motors, and EV chargers — are major applications.