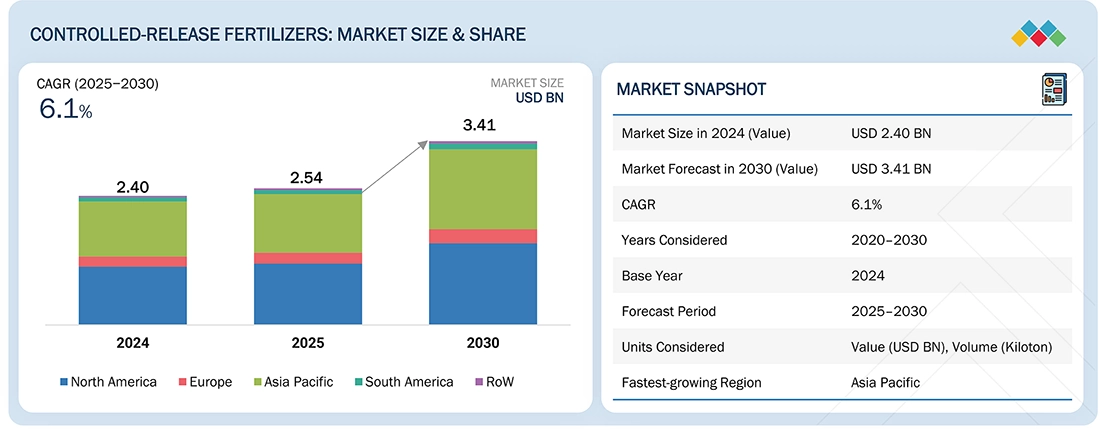

The global controlled-release fertilizers market is on a steady growth path, estimated to rise from USD 2.54 billion in 2025 to USD 3.41 billion by 2030, reflecting a CAGR of 6.1% during the forecast period. As agriculture evolves to meet the challenges of sustainability and productivity, controlled-release fertilizers are emerging as a game-changer. These advanced fertilizers are designed to release nutrients gradually, providing crops with a consistent nutrient supply while minimizing waste and environmental impact.

Controlled-Release Fertilizers Market Growth Drivers

Several factors are fueling the expansion of the CRF market:

- Demand for Higher Crop Yields: Farmers worldwide are adopting controlled-release fertilizers to improve nutrient use efficiency, ensuring crops get exactly what they need when they need it.

- Environmental Sustainability: Rising concerns over soil degradation, water pollution, and greenhouse gas emissions from traditional fertilizers are driving the shift toward eco-friendly solutions like controlled-release fertilizers.

- Technological Innovations: Advances such as polymer-coated formulations and biodegradable release systems are enhancing the performance of controlled-release fertilizers across diverse crops and climates.

- Supportive Government Policies: Regulations encouraging sustainable farming are pushing wider adoption of controlled-release technologies.

- Precision Agriculture & Digital Farming: Modern tools for monitoring nutrient application are making controlled-release fertilizers an integral part of smart farming ecosystems.

Top 10 Companies in the Controlled-release Fertilizers Market

- Yara (Norway)

- Nutrien Ltd. (Canada)

- Mosaic (US)

- ICL (Israel)

- Nufarm (Australia)

- Kingenta (China)

- Scotts Miracle-Gro (US)

- Koch Industries (US)

- Helena Chemicals (US)

- SQM (Chile)

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

Yara (Norway): Yara is a global leader in crop nutrition and industrial ammonia; while best known for bulk mineral fertilizers and agronomy services, it also researches and markets slow/controlled-release solutions and polymer-coated formulations as part of its precision-nutrition portfolio. Yara’s strength is its global distribution network and agronomy services that help position controlled-release options where growers need better nutrient-use efficiency and lower environmental loss.

Nutrien Ltd. (Canada): Nutrien markets Environmentally Smart Nitrogen (ESN), a well-known controlled-release nitrogen technology targeted at large-scale row crops; the company has also partnered with agtech firms to develop more sustainable CRN solutions. Nutrien leverages its retail reach (Nutrien Ag Solutions) to scale the adoption of controlled-release products across North and South America.

Mosaic (US): Mosaic is a major crop-nutrition supplier that offers performance and specialty fertilizer products; while its core is phosphate and potash, Mosaic has been expanding product lines and R&D into enhanced-efficiency and specialty formulations that support controlled-release strategies for growers focused on yield optimization and sustainability.

ICL (Israel): ICL is one of the market leaders in controlled-release fertilizers and specialty fertilizers—it manufactures polymer- and resin-coated controlled-release NPKs (and markets legacy brands such as Osmocote historically through licensing/partnerships). ICL emphasizes long-duration release (months to >12–18 months), biodegradable coating R&D, and targeted solutions for ornamentals, turf, and high-value crops.

Nufarm (Australia): Nufarm’s core business is crop protection, but it also offers controlled-release plant nutrition and specialty fertilizer formulations in some markets (including granular CRF SKUs and foliar controlled-release products). Nufarm’s regional product portfolio and dealer network help position controlled-release fertilizers and complementary solutions to Australian and other regional growers.

Kingenta (China): Kingenta is a major Chinese producer focused heavily on slow/controlled-release and compound fertilizers; it claims one of the world’s largest controlled-release fertilizer production bases and sells polymer-coated and bio-coated slow/controlled-release NPKs for broadacre and specialty markets. Kingenta is important for CRF supply in Asia and for more cost-sensitive, large-volume applications.

ScottsMiracle-Gro (US): Through its Osmocote brand and professional product lines, ScottsMiracle-Gro is a household and commercial leader in consumer and professional controlled-release fertilizer products (polymer/resin-coated granules marketed as long-feed “set-and-forget” solutions). Scotts focuses on turf, garden, and greenhouse markets where single-application controlled-release fertilizers are widely used.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=136099624

Koch Industries (US): Koch (via Koch Fertilizer/Koch Agronomic Services) manufactures and distributes a broad suite of enhanced-efficiency fertilizers (including stabilized nitrogen and slow/controlled-release products) and provides agronomic services. Koch’s strength is industrial scale, logistics, and a suite of proprietary nutrient protection/stabilization technologies for turf and field crops.

Helena Chemical (US): Helena is a distributor and formulator focused on turf, horticulture, and specialty ag markets and offers branded controlled-release foliar and granular products (e.g., CoRoN foliar controlled-release nitrogen) and other specialty nutrient solutions tailored to in-season use by turf managers, horticulturalists, and professional growers.

SQM (Chile): SQM is a global leader in specialty fertilizers (notably natural-source potassium nitrate and water-soluble fertilizers) and provides solutions for protected cultivation and fertigation where controlled-release strategies and precise nutrient programs are required. SQM’s technical agronomy and specialty product focus complement controlled-release fertilizer use in high-value greenhouse and horticulture systems.