The data center chip market is entering an unprecedented growth phase, driven by the global surge in cloud computing, artificial intelligence, and big data analytics. Investors are increasingly turning their attention to this sector, recognizing the immense potential in powering the backbone of modern digital infrastructure.

Cloud Computing: The Primary Growth Driver

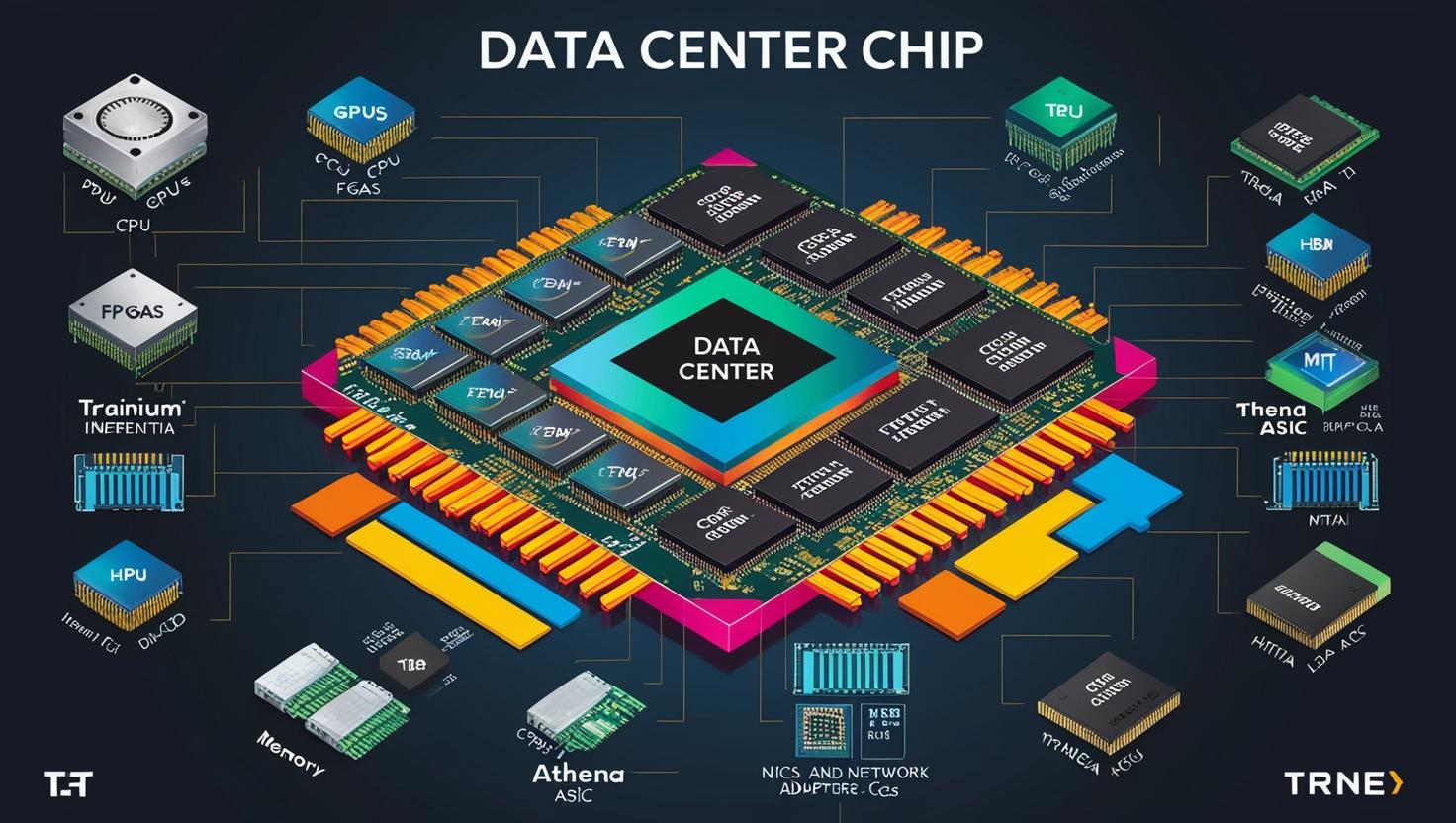

The exponential growth of cloud computing services has placed unprecedented demands on data centers worldwide. Enterprises, governments, and startups alike are moving workloads to the cloud, requiring high-performance servers capable of handling massive data processing. This shift has directly fueled demand for advanced data center chips, including CPUs, GPUs, FPGAs, and AI accelerators, which are designed to deliver speed, reliability, and efficiency at scale.

Innovation in Chip Technology

To meet these demands, chipmakers are investing heavily in innovation. Modern data center chips are no longer just about raw processing power—they are designed for energy efficiency, AI optimization, and scalability. AI-focused processors, for example, enable faster machine learning model training, while energy-efficient chips reduce operational costs and carbon footprints for large-scale data centers. Companies that successfully integrate high performance with sustainability are particularly attractive to both investors and enterprise customers.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=39999570

Market Size and Investment Potential

The global data center chip market is projected to reach tens of billions of dollars within the next five years, with double-digit annual growth. Venture capital and private equity firms are increasingly funding startups that specialize in next-generation chips, edge computing solutions, and AI accelerators. Publicly traded chipmakers are also seeing strong investor interest, fueled by the sector’s resilience and strategic importance in the digital economy.

Risks and Considerations

Despite strong growth prospects, investors must navigate certain risks. Intense competition, rapid technological obsolescence, and supply chain dependencies can impact profitability. Additionally, geopolitical tensions and semiconductor manufacturing constraints may create volatility in pricing and availability. Careful evaluation of companies’ R&D capabilities, partnerships, and production strategies is critical for informed investment decisions.

The Road Ahead

The data center chip market is poised for continued expansion as cloud adoption, AI applications, and data-driven technologies proliferate. Investors who strategically position themselves in this sector stand to benefit from both the growth of global digital infrastructure and the ongoing push for high-performance, energy-efficient computing solutions. With innovation at the forefront, the next decade promises to be a transformative period for data center technology and its investors.

Data Center Chip Market FAQ for Investors

1. What is driving the growth of the data center chip market?

The primary drivers are the surge in cloud computing, big data analytics, artificial intelligence, and enterprise digital transformation. Increased demand for high-performance servers and energy-efficient chips is fueling market expansion.

2. Which types of chips dominate the data center market?

The market is led by:

-

CPUs (Central Processing Units) for general-purpose computing

-

GPUs (Graphics Processing Units) for AI, ML, and parallel processing

-

FPGAs (Field-Programmable Gate Arrays) for customizable workloads

-

AI accelerators for deep learning and high-performance tasks

3. What regions offer the best investment opportunities?

North America and Asia-Pacific lead in data center adoption due to technological infrastructure, cloud services penetration, and high investment in AI. Europe is also growing steadily, driven by enterprise digitalization and sustainability initiatives.

4. How do AI and cloud computing impact investment potential?

AI workloads and cloud services require high-speed, energy-efficient processing. Companies producing AI-optimized chips or scalable solutions are likely to see strong demand, creating attractive opportunities for investors.

5. What are the key risks for investors in this market?

-

Rapid technological obsolescence

-

High competition among chipmakers

-

Supply chain disruptions and semiconductor shortages

-

Geopolitical risks affecting manufacturing and trade