The global biofuel market is undergoing major expansion as energy security, sustainability commitments, and emissions regulations drive the adoption of renewable alternatives. Supported by favorable policies and technological advancements, biofuels are reshaping the future energy landscape for transportation and beyond.

Executive Summary

-

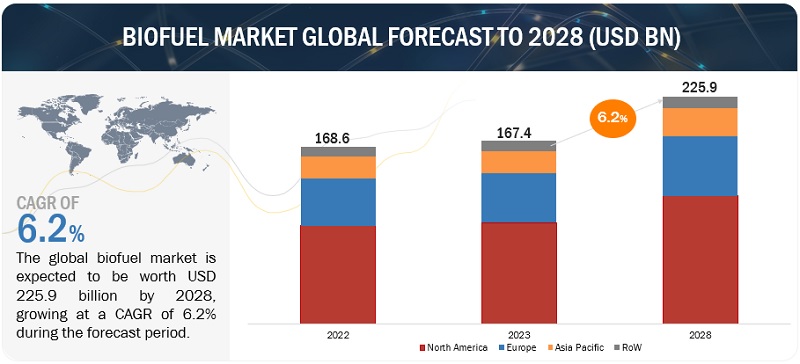

The global biofuel market is projected to reach USD 225.9 billion by 2028 from USD 167.4 billion in 2023, at a CAGR of 6.2%.

-

North America leads the market, followed by Europe and Asia Pacific, with significant investment in production capacity and clean fuel adoption.

-

Regulatory policies and national mandates—such as the EU’s RED and US Renewable Fuels Standards—are among the strongest growth drivers.

-

Transportation is the largest end-use segment, while aviation is the fastest-growing due to surging demand for sustainable aviation fuel (SAF).

-

Key players include ADM, Chevron, Valero, Neste, and Cargill, leveraging global R&D, innovation, and expansion strategies.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=297

Market Table

| Metric | 2023 Value | 2028 Value | CAGR (2023–2028) | Leading Regions | Major Segments | Top Companies |

|---|---|---|---|---|---|---|

| Market Size (USD Billion) | 167.4 | 225.9 | 6.2% | North America | Ethanol, Biodiesel, | ADM, Chevron, Valero, |

| Europe, Asia | Renewable Diesel, Biojet | Neste, Cargill | ||||

| End-Use (2028 Share) | Transportation | Transportation | Aviation (fastest CAGR) |

Go to Market Insights

-

Focus on Sustainable Aviation Fuel: The biojets segment is growing fastest, supported by incentives and mandates to reduce aviation emissions; targeting airlines and logistics firms with next-gen fuels is a high-return play.

-

Geographic Expansion: North America remains the largest, but Europe’s tightening environmental targets and Asia’s rising energy demand create major opportunities for tailored solutions.

-

Cost and Feedstock Strategy: Address feedstock volatility through diversified sourcing and backward integration; innovations in second- and third-generation biofuels can offset price pressures.

-

Partnerships and Technology: Collaborate across the supply chain—from agri-tech to airlines—to accelerate scale, product innovation, and market penetration.

The aviation segment, by end-use, is expected to grow at the highest CAGR during the forecast period.

This report segments the biofuel market based on end use into three segments: transportation, aviation, and others. The aviation segment is expected to grow at the highest CAGR during the forecasted period, owing to the extensive decarbonization efforts in the aviation sector in North America and Europe. One of the major drivers is the usage of biofuels in military aircraft on a commercial scale. Additionally, the rising demand for air cargo transport in terms of volume is one of the drivers for the growth of aviation. The Bioenergy Technologies Office (BETO) of the US Department of Energy empowers energy firms and aviation stakeholders by advancing research, development, and demonstration to overcome barriers to widespread deployment of low-carbon sustainable aviation fuel (SAF).

Europe is expected to be the fastest-growing region in the biofuel market.

Europe is expected to be the fastest growing region in the biofuel market during the forecast period. The European region comprises major economies such as France, UK, Germany, and Poland. The biofuel market in Europe is primarily fueled by the three main types of biofuels, namely ethanol, biodiesel, and renewable diesel. Europe has actively fostered the use of biofuel through various policies and initiatives. The European Union (EU) has established targets for member states to enhance the utilization of renewable energy in transportation, including biofuels like biofuel. The Renewable Energy Directive (RED) and its subsequent revisions have played a pivotal role in shaping biofuel production and consumption in Europe.

Key Takeaways

-

The biofuel market offers a resilient path for energy providers to capitalize on decarbonization and local energy security trends.

-

High capex and feedstock volatility are structural barriers; addressing these through innovation and long-term contracts is critical for growth.

-

Leading companies with robust global networks and innovation pipelines are positioned for outperformance as policy and end-user demand align.