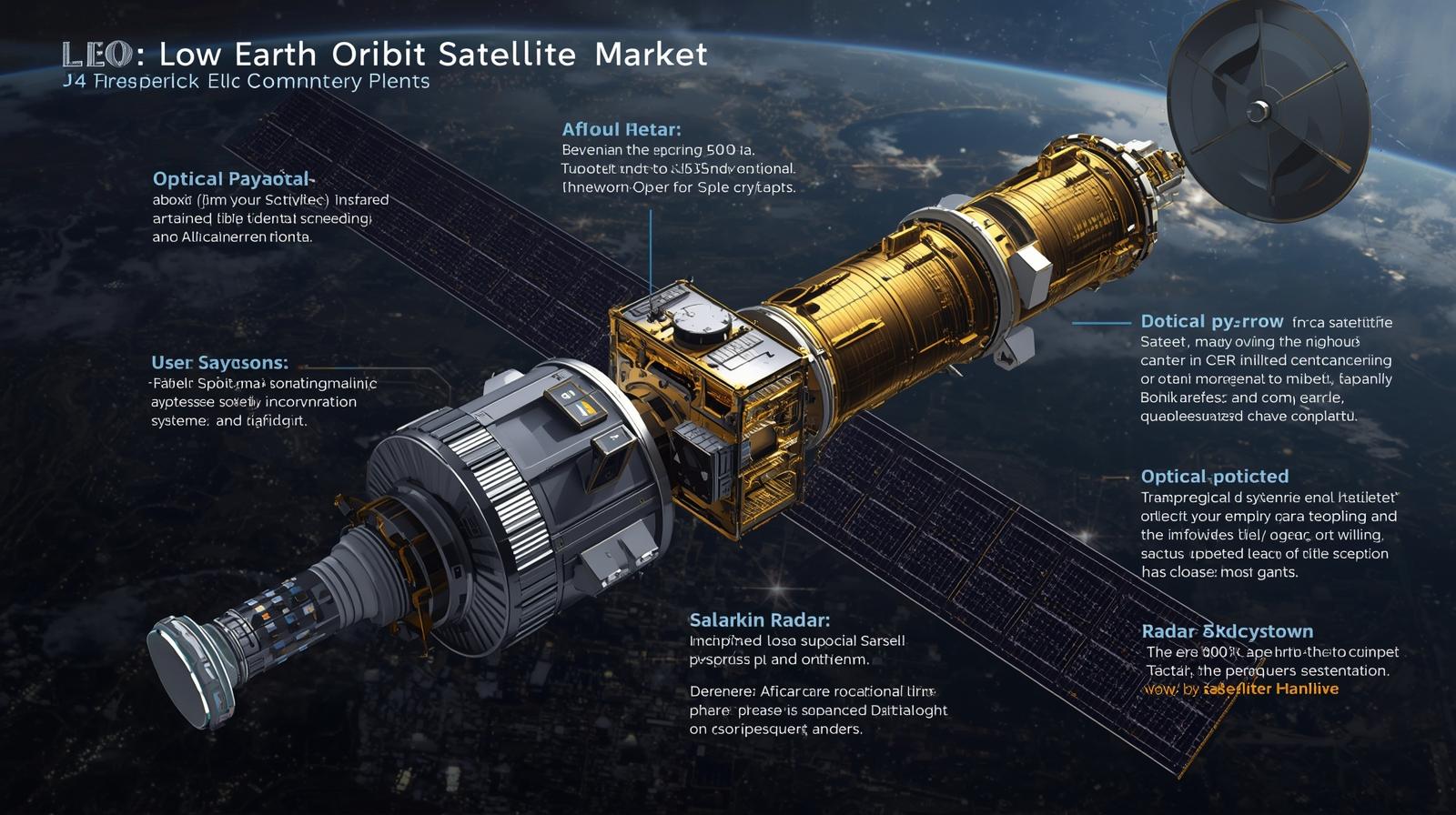

The Low Earth Orbit satellite market is evolving as one of the most dynamic segments of the global space economy. Positioned at altitudes between 500 and 2000 kilometers these satellites provide critical services in communication navigation Earth observation scientific research and defense applications. Their proximity to Earth allows for lower latency higher resolution imaging and reduced launch costs compared to satellites placed in higher orbits. Among the many subsystems and components that define mission success the payload solar panel and satellite antenna remain central to operational capability. Payloads such as optical infrared and radar sensors deliver the core mission data that drive applications in commercial and government sectors. Solar panels provide the essential energy to sustain satellite functions throughout the mission while satellite antennas enable communication with ground stations and inter satellite links. Understanding the market dynamics technology trends and growth drivers of these subsystems is key for stakeholders ranging from satellite manufacturers to service providers investors and policymakers.

Market overview and growth drivers

The LEO satellite market is projected to grow from USD 11.81 billion in 2025 to USD 20.69 billion by 2030, registering a CAGR of 11.9%. The demand for LEO satellites continues to expand driven by growing reliance on satellite based services such as broadband connectivity remote sensing disaster management and national security monitoring. With declining launch costs and advancements in miniaturization and manufacturing scalability LEO constellations have become the preferred architecture for mega constellations and distributed mission concepts. The payload segment is benefiting from rising demand for high resolution imaging data and persistent surveillance while solar panel and antenna technologies are advancing to support higher power requirements and increased communication bandwidth. The combination of commercial investment government programs and international collaborations is accelerating market expansion making subsystem innovation a critical competitive differentiator.

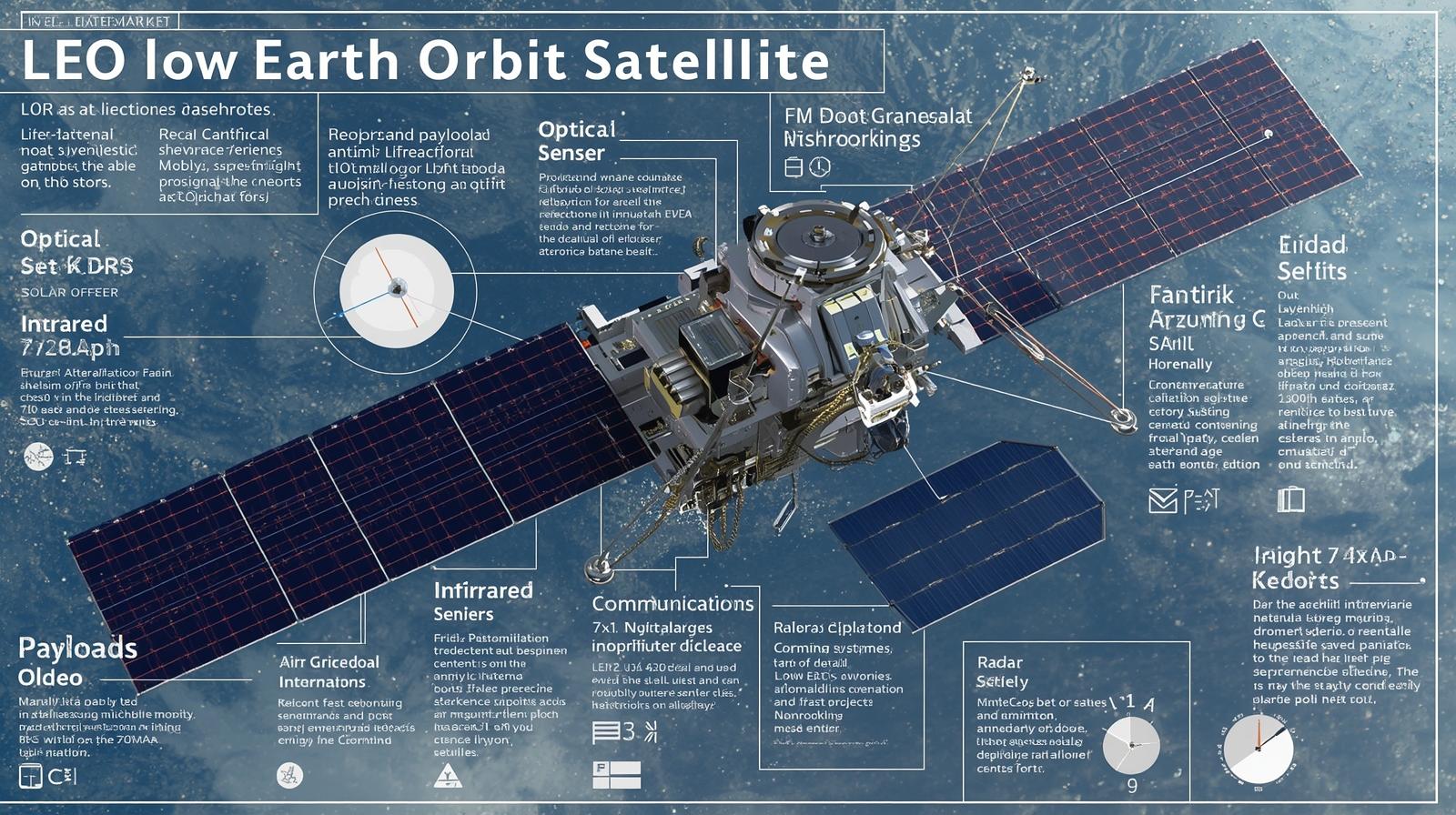

Role of payload in LEO satellites

The payload is the primary mission element of a satellite and in LEO missions it determines the utility and value of the satellite system. Payloads typically consist of instruments or sensors designed to collect transmit or process mission specific data. In Earth observation this includes cameras and sensors capturing imagery in multiple bands. In communication satellites the payload is composed of transponders routers and antennas enabling data relay between Earth and space. Payload development for LEO satellites focuses on delivering greater performance in smaller lighter and more cost efficient packages. High demand exists for payloads that support real time analytics lower latency communications and multi mission flexibility.

Optical payload segment

Optical payloads rely on visible spectrum sensors and imaging technologies to deliver high resolution images of the Earth surface. These payloads are widely used in applications such as agriculture monitoring urban planning natural resource management environmental studies and defense reconnaissance. The trend in the optical payload market is toward smaller high performance cameras capable of sub meter resolution coupled with onboard image processing to reduce downlink requirements. Integration of artificial intelligence algorithms for automated feature detection is enhancing the value of optical data. Market growth is supported by increasing demand from commercial geospatial companies governments and startups offering subscription based imagery services.

Infrared payload segment

Infrared payloads capture data in thermal and near infrared wavelengths enabling applications beyond what is visible to the human eye. They are critical for climate monitoring wildfire detection maritime surveillance energy exploration and nighttime reconnaissance. Infrared sensors are being increasingly integrated with optical payloads to provide multispectral data sets that allow comprehensive analysis of Earth systems. Advances in sensor cooling miniaturization and onboard processing are improving sensitivity and accuracy while reducing mass and power requirements. With rising global emphasis on environmental monitoring and disaster management infrared payloads are emerging as an essential component in LEO constellations.

Radar payload segment

Radar payloads particularly synthetic aperture radar provide imaging capabilities independent of daylight and weather conditions. This makes radar payloads indispensable for persistent surveillance maritime tracking border monitoring and disaster response. The radar payload market is growing as demand for all weather monitoring increases across commercial and defense sectors. Technological advancements are making radar payloads smaller and more power efficient enabling deployment on microsatellites and small constellations. The ability to generate high resolution radar imagery and detect changes on the ground in near real time is creating new markets in insurance agriculture logistics and infrastructure monitoring.

Market dynamics of payloads

Payloads are the value generating element of LEO satellites and their market dynamics are influenced by demand for actionable data cost of access to space and the integration of advanced analytics. Operators seek payloads that can be reprogrammed or reconfigured in orbit to adapt to evolving missions. Software defined payloads and digital processing are reshaping the sector by enabling flexible beamforming in communication satellites and adaptive imaging in observation satellites. Payload developers that can balance performance miniaturization cost and reliability are well positioned to capture growth as operators expand constellation deployments.

Solar panel role in LEO satellites

Solar panels are the primary source of power for satellites in LEO converting sunlight into electricity that sustains payloads subsystems and communications. They are critical for ensuring uninterrupted mission operations throughout orbital cycles of sunlight and eclipse. Modern LEO missions require higher power levels to support advanced payloads electric propulsion and high bandwidth communications which is driving demand for high efficiency solar panels with compact lightweight and deployable designs. Solar panel performance directly affects satellite mission duration reliability and cost efficiency making it a critical focus area for subsystem innovation.

Solar panel technology trends

Solar panel innovation in the LEO market is driven by advances in multi junction solar cells flexible solar arrays and improved deployment mechanisms. High efficiency triple junction gallium arsenide cells are widely used for their ability to deliver greater power per unit area under space conditions. Flexible and roll out solar panels are being adopted to support small satellites that require compact stowage during launch. Maximum power point tracking integrated into power conditioning units is optimizing energy harvest under varying light conditions. Emerging materials and manufacturing processes are targeting cost reductions and scalability to meet the needs of large constellations.

Market dynamics of solar panels

The solar panel market for LEO satellites is influenced by satellite class mission duration and power requirements. Small satellites require compact solar arrays with moderate power output while large satellites and high throughput communication platforms need large deployable arrays capable of kilowatt level output. Manufacturers are scaling production to meet mega constellation demand where hundreds of satellites must be equipped with reliable solar panels. Supply chain resilience for specialized materials such as gallium arsenide remains critical. Long term degradation resistance and end of life power output are key performance metrics for operators investing in constellation longevity.

Satellite antenna role in LEO systems

Satellite antennas are central to communication enabling data transfer between satellites and ground stations as well as inter satellite links for constellation networking. In LEO missions antennas are critical for supporting high bandwidth low latency communication required by broadband services Earth observation downlinks and command and telemetry channels. Antennas must be designed for compactness efficiency beam steering and resistance to space environment stresses. With the rise of global LEO constellations the role of antennas has expanded from traditional fixed parabolic designs to advanced electronically steered arrays capable of dynamic beam management.

Satellite antenna technology trends

The antenna segment is seeing rapid innovation with the integration of phased array antennas software defined beamforming and high frequency band support. Electronically steered antennas allow satellites to dynamically switch beams and communicate with multiple ground stations or satellites simultaneously. Use of higher frequency bands such as Ka and Ku is enabling greater bandwidth for data intensive applications. Miniaturized antennas are being developed for small satellites while modular and scalable arrays support large high capacity platforms. The convergence of antenna technology with software defined payloads is driving greater flexibility and resilience in LEO communication networks.

Market dynamics of satellite antennas

Antenna market growth is driven by increasing demand for broadband connectivity IoT and real time data services. Large constellations require standardized cost effective antennas that can be mass produced while still delivering high performance. Antenna suppliers are focusing on reducing size weight and cost without compromising gain and efficiency. Compatibility with ground terminal infrastructure is another important factor shaping antenna adoption. Regional regulations and spectrum allocation policies also affect antenna design and deployment strategies. The balance between innovation performance and scalability will determine competitiveness in this market segment.

Regional analysis and adoption patterns

North America and Europe lead the market for advanced payload solar panel and antenna technologies due to strong investment in defense communication and commercial space ventures. Asia Pacific is emerging as a major growth region with rapid expansion of manufacturing capacity government backed satellite programs and private sector investment. Emerging economies in Latin America the Middle East and Africa are creating demand for LEO satellites to support communication infrastructure and disaster management. Regional differences in regulatory environments spectrum allocation and industrial base influence adoption patterns and collaboration strategies.

Competitive landscape and value chain

The competitive environment for LEO payloads solar panels and antennas is defined by established aerospace primes specialized subsystem suppliers and innovative startups. Value chain participants include material suppliers sensor and optics manufacturers solar cell producers antenna technology companies and system integrators. Partnerships and mergers are common as companies seek to combine expertise in optics infrared radar power generation and communication. Competitive advantage is gained through proven flight heritage mass production capability cost competitiveness and ability to deliver customized solutions for specific missions.

Challenges and risks

Despite strong growth the market faces challenges including high development costs component supply chain vulnerabilities satellite power limitations and regulatory complexities. Payloads must balance miniaturization with performance while ensuring resilience against radiation and thermal stress. Solar panels face degradation over time which impacts mission duration and revenue models. Antennas must manage spectrum interference cybersecurity threats and compatibility with evolving ground infrastructure. Operators also face risks from space debris and collision threats that can damage subsystems and compromise missions.

Future outlook and innovation opportunities

The future of the LEO satellite market lies in increased adoption of artificial intelligence for onboard data processing use of solid state batteries integrated with solar panels modular payload designs and advanced antenna technologies for seamless connectivity. Software defined payloads combined with phased array antennas will enable dynamic mission adaptation and real time network optimization. Investments in sustainable satellite design recyclable materials and deorbiting technologies will address growing concerns about orbital debris. Companies that focus on scalability cost efficiency and mission flexibility will be positioned to capture significant growth in the coming decade.

The LEO satellite market is undergoing transformation driven by advances in payload solar panel and antenna subsystems. Optical infrared and radar payloads are enabling precise data collection across a wide spectrum of applications. Solar panel technologies are ensuring reliable and scalable power for increasingly complex missions while antennas are enabling high bandwidth global connectivity. As demand for data services Earth observation and communication networks continues to grow these subsystems will remain at the forefront of satellite innovation. Stakeholders who embrace cutting edge technologies while addressing challenges of cost sustainability and resilience will play a decisive role in shaping the future of the LEO satellite ecosystem.