Global Antibody Drug Conjugates market valued at $7.6B in 2022, reached $9.7B in 2023, and is projected to grow at a robust 15.2% CAGR, hitting $19.8B by 2028. This rapid expansion is fueled by innovations in targeted therapies, growing oncology prevalence, and advancements in linker and payload technologies that enhance efficacy while minimizing side effects. The market’s trajectory is being shaped by both pharmaceutical giants and emerging biotech players, all racing to develop next-generation ADCs for diverse indications beyond cancer, such as autoimmune and infectious diseases.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=122857391&utm_source=reportsnreports.com&utm_medium=referral&utm_campaign=kk29

1. Expansion of ADC Applications Beyond Oncology

Traditionally, ADCs have been synonymous with oncology, offering precision in delivering cytotoxic agents directly to cancer cells. However, the latest wave of R&D is breaking this mold. Researchers are now exploring ADCs for non-oncological diseases such as autoimmune disorders, chronic inflammatory conditions, and even infectious diseases. This shift is driven by the core advantage of ADCs—selective delivery—which can be harnessed to modulate immune responses or target pathogens without causing widespread toxicity. Several clinical trials are already in mid- to late-stage phases for conditions like lupus, multiple sclerosis, and bacterial infections. Pharmaceutical companies are investing heavily in broadening ADC’s therapeutic scope to capture untapped market potential. Regulatory bodies have also shown receptivity by granting orphan drug designations for ADCs outside oncology. This diversification of indications not only expands market size but also reduces dependency on cancer pipelines, creating a more balanced and resilient industry growth profile. As these new applications mature, they are expected to significantly contribute to the projected doubling of the ADC market size by 2028.

2. Next-Generation Linker Technologies for Enhanced Stability

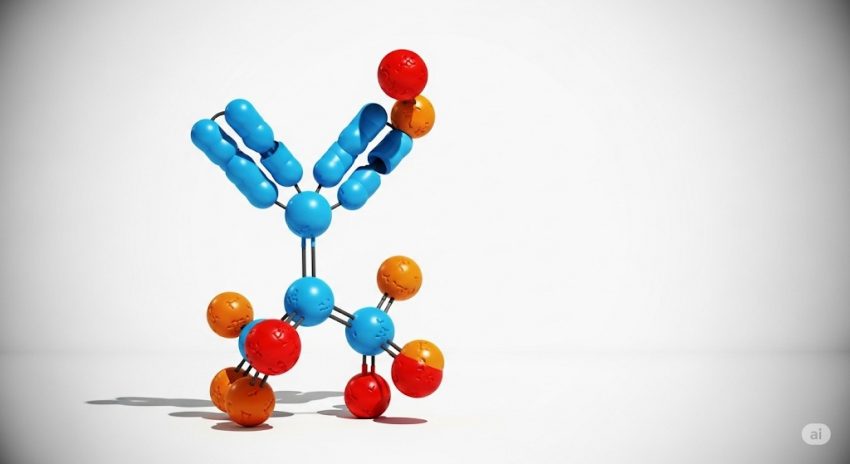

The linker—the molecular bridge between an antibody and its drug payload—has long been a pivotal determinant of ADC performance. Recent innovations are delivering linkers that are more stable in systemic circulation but efficiently release the payload upon reaching target cells. This balance reduces off-target toxicity and increases therapeutic windows, improving patient outcomes. Cutting-edge linker designs now allow for stimuli-responsive release, triggered by pH changes, enzymatic activity, or even light exposure. These advanced linkers are being engineered to handle higher drug-to-antibody ratios (DAR), which can enhance potency without compromising safety. In addition, biodegradable linkers are gaining traction for their ability to minimize long-term toxicity. Such technological improvements not only elevate the efficacy of approved ADCs but also make them viable for treating more delicate conditions that require precise therapeutic dosing. The ability to fine-tune payload release is expected to be a major driver in future FDA approvals and commercial success.

3. Diversification of Payload Mechanisms

Early-generation ADCs primarily relied on potent microtubule-disrupting agents, but the field has now diversified to include DNA-damaging agents, immune-stimulating molecules, and novel cytotoxins. The rationale is simple—different diseases and tumor types respond better to specific mechanisms of action. By expanding the arsenal of payloads, researchers can target resistant cancers, lower dosing requirements, and mitigate the development of drug resistance. Moreover, newer payloads are being designed to modulate immune responses, effectively turning ADCs into combination therapies within a single molecule. For example, immunomodulatory payloads can prime the tumor microenvironment, making it more susceptible to checkpoint inhibitors. This trend is also enabling the development of bispecific ADCs, where dual targeting further refines precision. As payload innovation accelerates, companies are building large IP portfolios around proprietary chemistries, making payload design one of the most competitive areas in the ADC market landscape.

4. Rise of Bispecific and Multispecific ADCs

A transformative trend in ADC development is the integration of bispecific or multispecific antibody engineering. Unlike traditional ADCs that target a single antigen, bispecific ADCs can recognize and bind to two distinct antigens simultaneously. This dual-targeting capability enhances tumor specificity, reduces off-target binding, and potentially overcomes antigen escape—a common mechanism of drug resistance. Multispecific ADCs take this concept further by adding a third or more binding sites, allowing them to target complex diseases with heterogeneous cell populations. The technology also enables simultaneous delivery of multiple payload types, opening avenues for synergistic treatment effects. Several bispecific ADC candidates are currently in Phase I/II trials, showing promising efficacy against aggressive and refractory cancers. If successful, these ADCs could redefine precision medicine, enabling treatment strategies that adapt to tumor evolution in real time. Industry analysts expect bispecific ADCs to become a major commercial segment within the next five years.

5. Strategic Collaborations and M&A Driving Innovation

The ADC market is witnessing a surge in strategic partnerships, licensing agreements, and mergers & acquisitions (M&A). Big pharma companies are actively partnering with biotech firms to access cutting-edge ADC platforms, while smaller players leverage these collaborations for funding, regulatory expertise, and global commercialization channels. Notable deals in recent years have involved billion-dollar acquisitions and co-development agreements focused on expanding ADC pipelines. These collaborations are not just about scale—they also accelerate innovation by combining unique capabilities, such as proprietary linker technologies from one company with advanced antibody engineering from another. In addition, partnerships with contract development and manufacturing organizations (CDMOs) are growing, as the complexity of ADC production requires specialized expertise. This trend is expected to intensify as more ADC candidates progress toward commercialization, leading to a more consolidated yet technologically advanced competitive landscape.