The Trump administration’s tariff wave—especially those targeting imports from China—sparked significant disruption across the electronics industry. For the current sensor market, the impact was direct and deep. Supply chains were upended, manufacturing costs surged, and long-established sourcing relationships were thrown into uncertainty.

Yet amid the volatility, an unexpected silver lining is emerging: opportunity. As the dust settles, the current sensor industry is navigating a path forward—one shaped by localization, innovation, and new regional alliances. What once seemed like a setback is becoming a strategic pivot point for long-term growth.

From Trade Shock to Strategic Realignment

The Trump-era tariffs on Chinese-made electronic components created immediate cost pressures for companies importing current sensors or sensor subcomponents. These pressures pushed manufacturers to rethink their sourcing strategies.

Rather than reverting to business-as-usual, many companies took the disruption as a wake-up call to de-risk their supply chains. The result? A significant shift toward:

- Diversification of manufacturing bases (e.g., India, Vietnam, Mexico)

- Supplier redundancy and regionalization

- Exploration of U.S.-based assembly and testing

While these transitions required upfront investment and planning, they’ve also laid the foundation for a more resilient and responsive current sensor ecosystem.

Request US Tariff Impact Analysis Now @ https://www.marketsandmarkets.com/forms/ctaTariffImpact.asp?id=26656433

New Demand Drivers Emerging

Ironically, the same period of disruption coincided with booming demand in key application areas where current sensors are essential:

- Electric Vehicles (EVs) and battery management systems

- Smart grids and renewable energy installations

- Industrial automation and robotics

- Consumer electronics and IoT devices

These sectors require precise current measurement for efficiency, safety, and performance optimization. As global demand continues to rise, sensor manufacturers that adapted quickly to the new trade reality are now better positioned to serve high-growth markets.

Innovation in the Wake of Pressure

In response to rising costs, companies began rethinking product design and production processes. This led to:

- Development of cost-efficient sensor architectures

- Greater focus on compact, integrated designs to minimize material use

- Investments in automation and AI-driven manufacturing to improve margins

Some U.S. and European sensor firms also seized the opportunity to strengthen IP portfolios and differentiate their offerings, rather than competing purely on price.

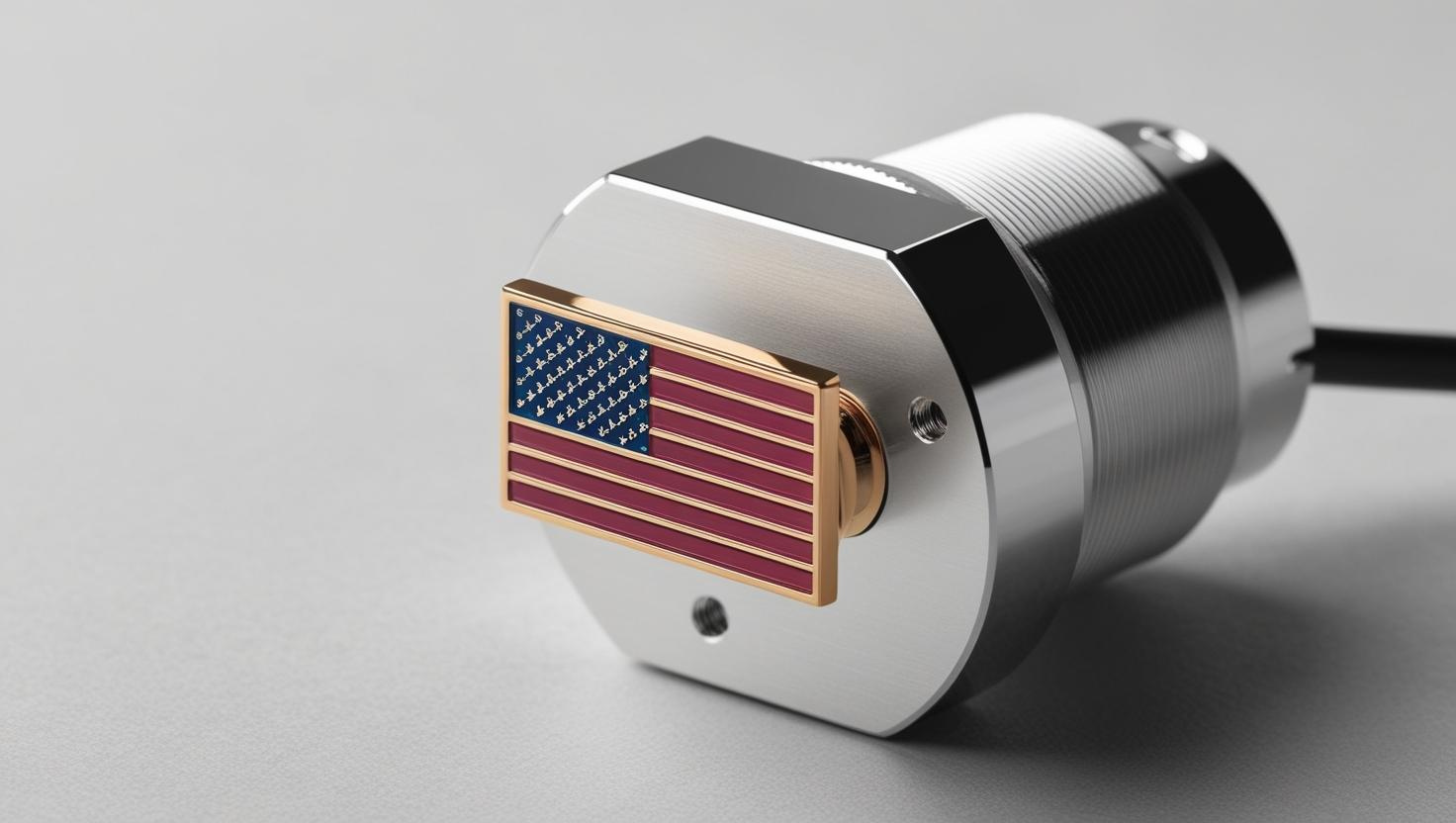

Local Manufacturing as a Competitive Advantage

The Trump tariffs made one thing clear: proximity to customers matters. In sectors like EVs and industrial automation, design cycles are tightening and customization is becoming a standard requirement.

Current sensor companies that established localized production and engineering support are now enjoying:

- Faster turnaround times

- Better integration with customer R&D

- Reduced exposure to geopolitical risks

As reshoring and “friend-shoring” gain momentum in U.S. policy circles, local manufacturers could benefit from government incentives and stronger buyer preference.

The Road Ahead: Growth Through Resilience

What began as a disruptive force is now driving structural improvements in the current sensor market. The Trump tariffs, though initially burdensome, accelerated key shifts that may have taken years otherwise.

Moving forward, market players should:

- Leverage regional manufacturing to support customized, high-performance sensor solutions

- Continue investing in R&D to meet the demands of EVs, renewables, and smart infrastructure

- Monitor policy trends to stay agile and capitalize on incentive programs