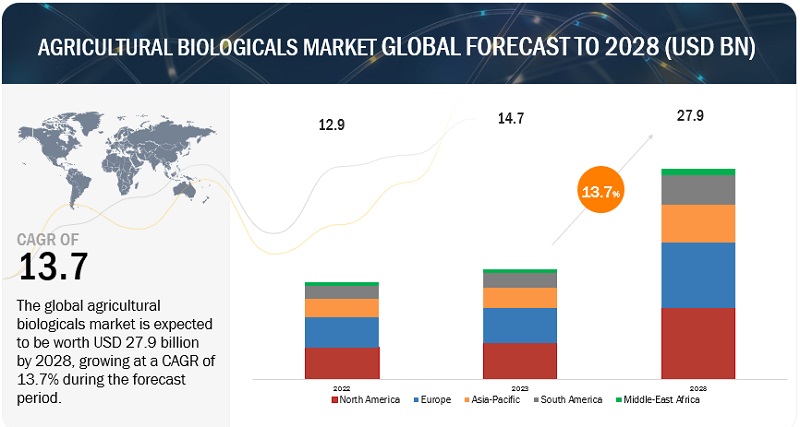

The global agricultural biologicals market is on a strong upward trajectory, projected to grow from USD 14.7 billion in 2023 to USD 27.9 billion by 2028, at a CAGR of 13.7%. This surge is fueled by the growing awareness of organic food, environmental safety concerns, and favorable regulatory frameworks across key regions. Agricultural biological products have become an essential part of modern integrated pest management practices (IPM), complementing synthetic crop protection methods to achieve sustainable farming goals.

What’s Driving Growth in the Agricultural Biologicals Market?

A key driver behind this growth is the rising global preference for organic and residue-free food products. Consumers are increasingly aware of the harmful impacts of chemical pesticides and fertilizers, prompting a shift toward organic alternatives. This shift has amplified the demand for biologically derived crop protection and enhancement products.

Request Personalized Data Insights for Your Business Goals

European countries, including Denmark, Sweden, Switzerland, and Austria, have witnessed a surge in organic retail sales, underlining a broader global move toward sustainable food systems.

The Challenge of Low-Quality and Counterfeit Products

While the market outlook is promising, commercialization of low-quality biological products poses a major challenge. Limited patent transparency and fragmented regulation have allowed the entry of substandard and duplicate products, especially in developing markets. These counterfeit products—often indistinguishable from genuine ones—create distrust among farmers and harm the credibility of established brands.

The lack of uniform regulatory frameworks further complicates market development. For instance, agricultural biologicals are categorized differently across Asian countries, being treated as fertilizers in China but as plant growth regulators in Japan and South Korea.

Opportunities Emerging from Broad-Spectrum Formulations

Innovation in broad-spectrum biological formulations presents a significant opportunity for market players. Essential oils such as rosemary, thyme, and clove are proving highly effective in pest management and disease control. These plant-based biopesticides not only enhance yield but also align perfectly with organic certification standards.

Companies like Marrone Bio Innovations have already capitalized on this opportunity. Its flagship product, Grandevo, approved by the US Environmental Protection Agency (EPA), is a groundbreaking microbial insecticide offering flexible, broad-spectrum pest control suitable for both field and greenhouse applications.

The Rise of Biocontrols, Bionematicides, and Bioinsecticides

Among product segments, biocontrols are projected to dominate due to their eco-friendly nature and role in improving crop quality and yield. As pest resistance to chemical pesticides increases, biocontrol products provide safer and sustainable solutions.

The bionematicides segment is emerging as the fastest-growing category. With global crop losses caused by root-knot nematodes rising, biological nematicides are gaining traction as effective and environment-safe alternatives.

The bioinsecticides segment is also on the rise, driven by the need to mitigate production losses caused by climate-related pest outbreaks. These biologicals are being increasingly adopted for their cost-effectiveness and contribution to sustainable farming systems.

Regional Outlook: North America Leads the Way

North America currently holds the largest share in the agricultural biologicals market. This growth is supported by the region’s strong organic industry, emphasis on soil health, and active research and development ecosystem. The United States, in particular, is witnessing rapid adoption of biopesticides, biofertilizers, and biostimulants as farmers transition toward sustainable practices.

In the US, biopesticides are gaining ground due to concerns over chemical residues and environmental toxicity. Biofertilizers are being integrated into conventional farming for improved soil fertility, while biostimulants are helping farmers enhance nutrient uptake and plant resilience. Key companies such as Bayer CropScience, BASF SE, Corteva Agriscience, Syngenta AG, Marrone Bio Innovations, and Valent BioSciences are investing heavily in R&D to expand their portfolios and meet this growing demand.

Key Players in the Global Agricultural Biologicals Market

Leading companies shaping the global market include BASF SE (Germany), Syngenta AG (Switzerland), Pro Farm Inc. (US), Isagro S.p.A. (Italy), UPL (India), Evogene Ltd (Israel), Bayer AG (Germany), and Vegalab S.A. (US). These players are focusing on innovation, partnerships, and regional expansion to strengthen their competitive positions.

Make an Inquiry to Address your Specific Business Needs

FAQs on the Agricultural Biologicals Market

- What are agricultural biologicals?

Agricultural biologicals are naturally derived products such as biopesticides, biofertilizers, and biostimulants used to enhance crop protection and productivity without harming the environment. - What is driving the growth of the agricultural biologicals market?

Rising consumer demand for organic food, regulatory support for sustainable farming, and increasing awareness about soil health are the main drivers. - Which region leads the market?

North America currently leads due to strong R&D activity, favorable regulations, and growing organic agriculture. - What are the biggest challenges facing the market?

The main challenges include counterfeit and low-quality products, lack of standardized regulations, and limited farmer awareness in emerging economies. - Which segment is expected to grow the fastest?

The bionematicides segment is projected to grow the fastest, driven by rising awareness of soil health and the need to control nematode-related crop damage.