The global data center chip market is undergoing a dramatic transformation, fueled by explosive demand for cloud services, artificial intelligence (AI), and edge computing. As the digital world expands and workloads grow increasingly complex, data centers—the backbone of the internet—require more powerful, energy-efficient, and specialized silicon to keep up.

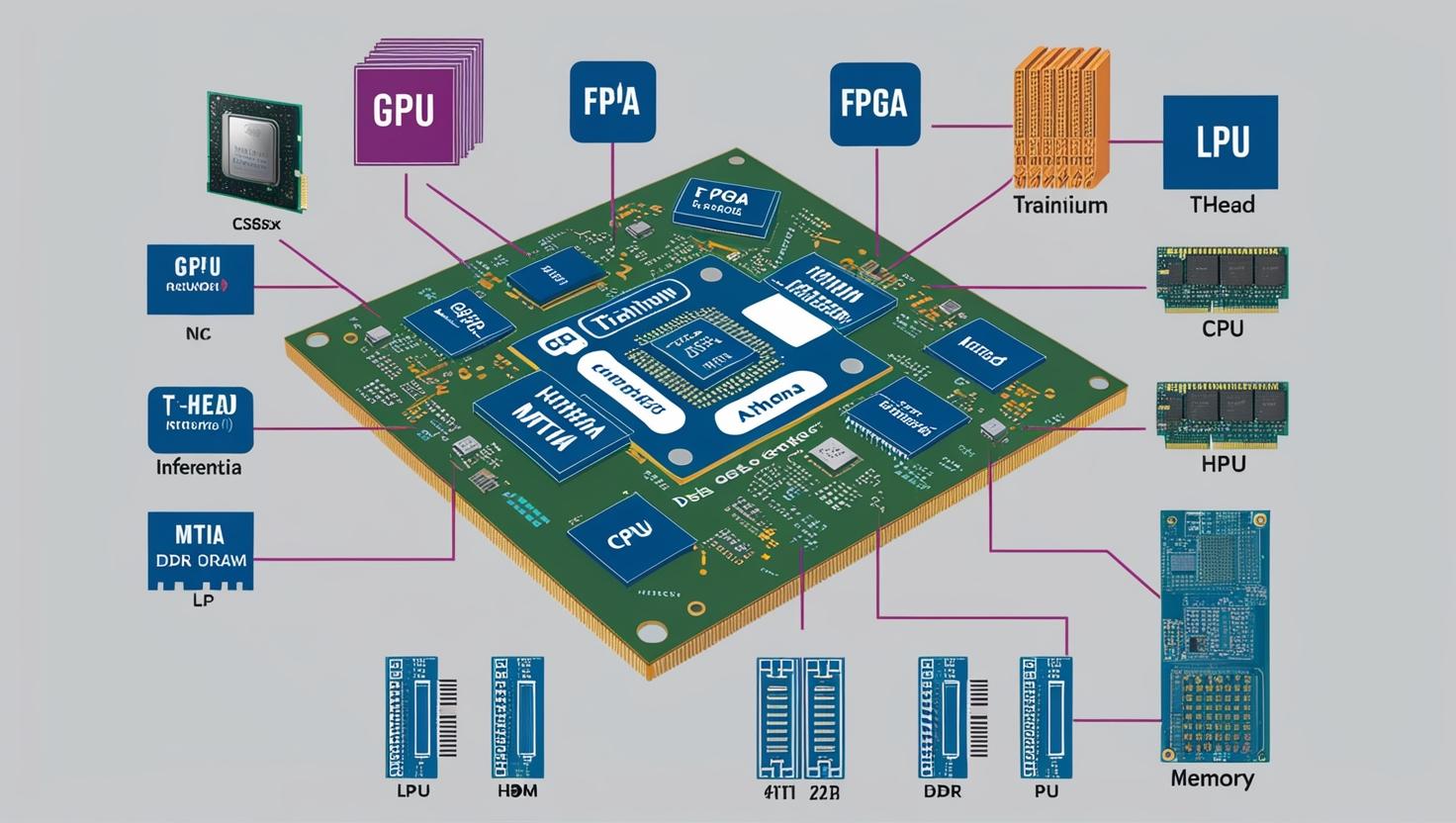

This surging demand is driving rapid innovation in data center chip design, architecture, and deployment. From general-purpose CPUs to purpose-built GPUs, TPUs, FPGAs, and custom silicon, the global data center chip market is expected to reach hundreds of billions of dollars by the end of the decade, redefining the semiconductor landscape and powering the next era of digital infrastructure.

The Core Drivers Behind Market Growth

1. Cloud Computing Expansion

As enterprises shift operations to the cloud, hyperscale data centers are rapidly multiplying across the globe. Cloud service providers like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Alibaba Cloud are investing heavily in data center capacity, requiring high-performance chips to manage millions of virtualized workloads.

These workloads demand scalable compute performance, massive memory bandwidth, and low-latency data access—requirements that traditional CPUs alone can no longer meet. This has opened the door to heterogeneous computing environments, where multiple chip types work in parallel to optimize efficiency and throughput.

2. AI and Machine Learning Workloads

AI is the single most disruptive force in computing today, and AI impact on the data center chip market is profound. Training large AI models—like those used in natural language processing, autonomous systems, and recommendation engines—requires massive parallel computing power.

This has led to a surge in demand for Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), and AI-specific accelerators that can handle complex matrix operations and deep learning algorithms. Companies like NVIDIA, AMD, Intel, Google, and a wave of AI chip startups are racing to develop the next generation of data center processors optimized for AI.

3. The Rise of Edge Computing

Edge computing is pushing data processing closer to the source—whether it’s autonomous vehicles, smart cities, or industrial IoT. This shift requires chips that are powerful yet energy-efficient, capable of handling real-time analytics and machine learning at the edge while still integrating with centralized data centers.

To support this hybrid architecture, data centers need chips that can efficiently handle distributed computing, multi-node orchestration, and data fusion—creating demand for novel chip designs with built-in support for low-power, high-bandwidth, and AI capabilities.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=39999570

Key Trends Shaping the Market

Shift Toward Custom Silicon and Vertical Integration

One of the most notable trends is the move toward custom chips. Tech giants are increasingly designing their own processors to optimize performance for specific workloads. Google’s TPU, Amazon’s Graviton and Trainium chips, and Apple’s M-series are prime examples of how in-house silicon can unlock better cost, performance, and energy efficiency compared to off-the-shelf components.

This trend of vertical integration gives companies more control over the entire stack—hardware, software, and infrastructure—and is reshaping the competitive dynamics of the semiconductor industry.

Energy Efficiency and Sustainability

Data centers are notorious for their energy consumption. As environmental concerns rise and regulations tighten, chipmakers are under pressure to develop greener solutions. The industry is prioritizing chips that deliver higher performance-per-watt, leverage advanced packaging technologies like chiplets, and support dynamic power management.

The emergence of ARM-based architectures in data centers is a direct response to this challenge. Companies like Ampere and Amazon are championing energy-efficient ARM chips as a viable alternative to traditional x86 CPUs.

Security and Scalability

With the increasing volume of sensitive data flowing through data centers, chip-level security features are becoming essential. Hardware-enforced encryption, secure enclaves, and zero-trust architecture support are now standard requirements. Meanwhile, data centers must scale rapidly without sacrificing performance, pushing chipmakers to innovate in multi-core, multi-threaded, and interconnect technologies.

Regional Market Insights

North America

North America remains the dominant force in the data center chip market, led by the U.S. with its concentration of cloud service providers, hyperscalers, and semiconductor innovators. Companies like Intel, NVIDIA, and AMD continue to be central players, while startups and fabless chip designers are emerging rapidly.

Asia-Pacific

Asia-Pacific is growing rapidly, driven by China’s push for semiconductor independence and the expansion of regional cloud services like Alibaba, Tencent, and Huawei Cloud. South Korea, Japan, and Taiwan also play critical roles in manufacturing, foundries, and R&D.

Europe and Other Regions

Europe is investing in sovereign cloud infrastructure and digital transformation, creating new opportunities for local chip designers and green data center initiatives. Meanwhile, emerging economies in Latin America, the Middle East, and Africa are starting to build data infrastructure to support digital services, e-commerce, and fintech.

Leading Players and Competitive Landscape

The data center chip market is highly competitive and fragmented, with established giants and emerging startups both playing key roles:

- Intel remains a dominant force in x86 CPUs but faces mounting pressure from AMD and ARM-based competitors.

- NVIDIA is the leader in GPU-powered AI acceleration and continues to innovate with its Hopper architecture and data processing units (DPUs).

- AMD has gained market share with its EPYC processors, offering high core counts and energy efficiency.

- Google, Amazon, and Microsoft are building custom chips for AI inference and training, bypassing traditional suppliers.

- AI chip startups such as Cerebras, Graphcore, and SambaNova are introducing radically new chip architectures tailored for specific workloads.

- The result is a rich ecosystem of innovation, with competition pushing performance boundaries and bringing down costs.

Challenges and Considerations

Despite the growth, the data center chip market faces significant challenges:

Supply Chain Disruptions: Geopolitical tensions, chip shortages, and manufacturing bottlenecks continue to impact timelines and pricing.

Heat and Power Management: As chips grow more powerful, thermal management and energy efficiency remain major design hurdles.

Ecosystem Compatibility: New chip architectures must support existing software stacks, requiring robust developer ecosystems and backward compatibility.

Capital Investment: Building or upgrading data centers to accommodate advanced chipsets requires massive investment in cooling, networking, and infrastructure.

The Road Ahead: What’s Next for Data Center Chips

The future of data center chips will be defined by modular design, AI-native architecture, and software-hardware co-optimization. Technologies like chiplets, 3D stacking, and photonic interconnects will become more mainstream, enabling greater performance scaling without traditional silicon limitations.

We will see a shift toward disaggregated computing, where CPUs, GPUs, memory, and storage exist in separate modules but are tightly integrated via high-speed fabrics. This will create more flexible and efficient data center architectures.

Additionally, the rise of quantum computing, neuromorphic chips, and DNA-based storage are on the horizon—emerging technologies that could further revolutionize data center design in the long term.

The data center chip market is at the epicenter of the digital economy. As cloud computing, AI, and edge technologies continue to accelerate, the demand for smarter, faster, and more efficient chips is set to grow exponentially.

Fueled by innovation and strategic investment, this market is not just about silicon—it’s about building the digital foundations for everything from virtual reality and autonomous driving to fintech and generative AI. As we enter a new era of computing, the race for the future of data center chips is only just beginning.