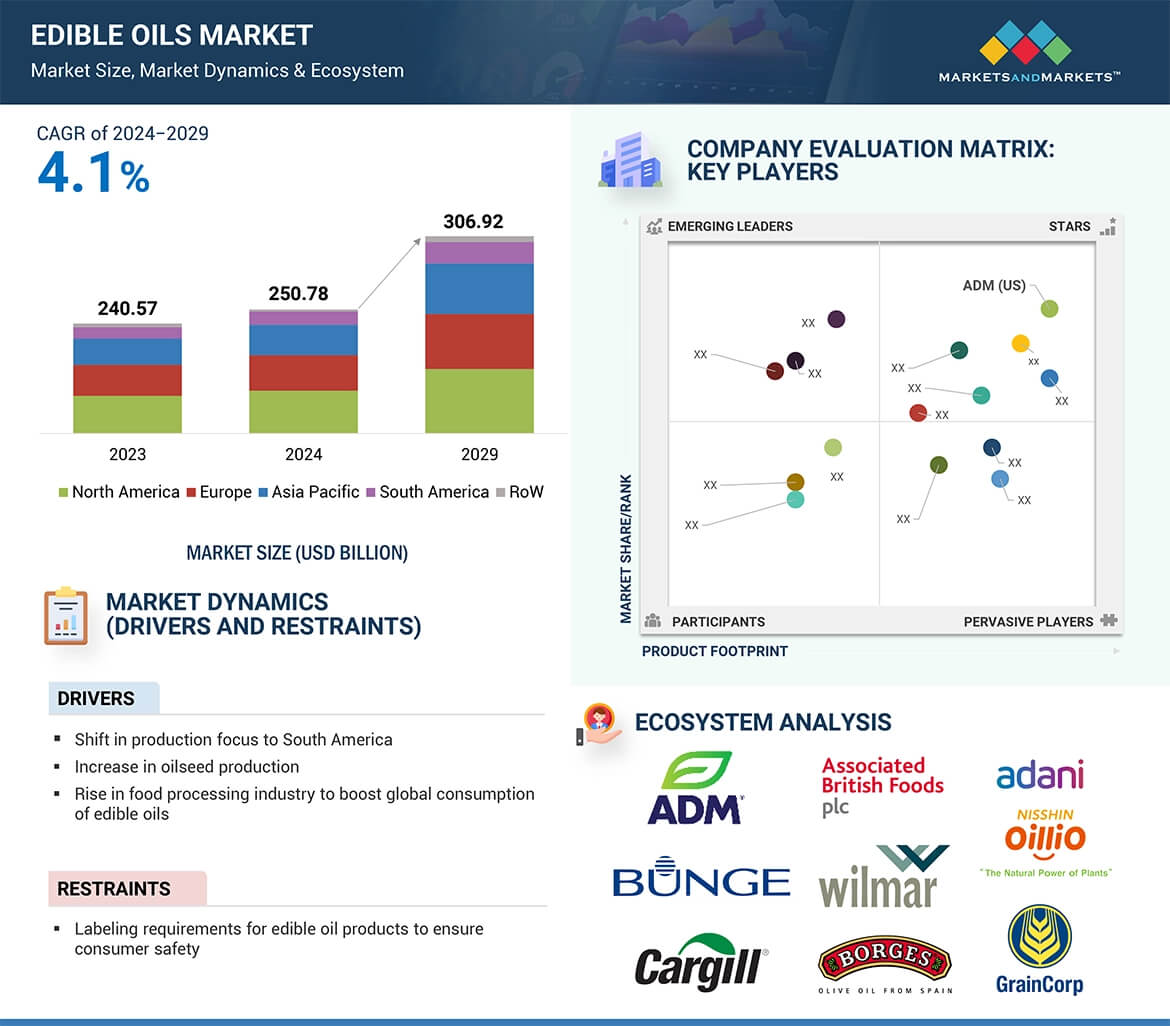

The edible oils market is on a solid growth trajectory, estimated at USD 250.78 billion in 2024 and projected to reach USD 306.92 billion by 2029, at a CAGR of 4.1%. This growth is driven by rising population, increasing disposable incomes, and evolving dietary preferences worldwide.

Food processing, industrial applications, and everyday cooking remain key drivers, with companies such as Wilmar International (Singapore), Cargill Incorporated (US), and Bunge (US) leading the way in expanding their global footprints across soybean, palm, sunflower, and olive oils.

Rising Incomes and Shifting Lifestyles Fuel Demand

Global income growth is strengthening consumer purchasing power and shaping demand for quality edible oils. According to the World Bank, the daily median income in the US grew 25% over the past decade, while countries such as Canada, Germany, the UK, and emerging economies like China are witnessing similar trends.

This economic shift has led to greater consumption of healthier, premium oils like olive, sunflower, and coconut, which are linked to improved digestion, heart health, and overall wellness.

Request Custom Data to Address your Specific Business Needs

Key Growth Drivers in the Market

- Health & Wellness Trend: Consumers are leaning toward oils rich in essential fatty acids, vitamins, and antioxidants.

- Plant-Based Diets: Growing interest in vegan and sustainable lifestyles is fueling demand for healthier oil alternatives.

- Technological Advancements: Innovations in oil extraction and fortification with nutrients are opening new product opportunities.

- Emerging Markets: Rapidly urbanizing regions in Asia-Pacific and Africa are contributing significantly to rising consumption.

These dynamics are well captured in the latest edible oils market report, which highlights evolving consumer preferences and global trade flows.

Spotlight: South America’s Role in Soybean Oil

South America, especially Brazil, is becoming a powerhouse in soybean production, shaping global edible oil supply. Practices like double cropping are boosting yields and efficiency. According to the OECD-FAO Outlook 2023–2032, Brazil’s soybean output is expected to grow faster than that of the US, reinforcing the region’s influence in the global edible oil market size and supply chain.

Sunflower Oil on the Rise

Sunflower oil has emerged as one of the fastest-growing segments, with global production rising 2% year-on-year to 22.13 million metric tons in 2023/24. Russia and Ukraine dominate production, but the European Union, Argentina, and Turkey are also key players.

Its nutritional profile, versatility in cooking, and role in processed foods make sunflower oil a top choice among households and industries alike.

Household Segment Driving Consumption

Household consumption continues to hold a significant share of the market. Growing populations and rising incomes, particularly in countries like India, are boosting demand for edible oils in everyday cooking.

Government data shows domestic consumption of edible oilseeds in India increasing by nearly 10 LMT per year, reflecting a healthy domestic market with expanding production capacities.

Regional Spotlight: Europe

Europe represents a significant share of the market, supported by both household and food service demand. Companies such as Associated British Foods (UK), Borges (Spain), and Louis Dreyfus Company (Netherlands) are driving innovation and capacity expansion.

For example, Borges Agricultural & Industrial Edible Oils invested over USD 25 million to increase production capacity by 30% while focusing on sustainable, environmentally friendly practices—signaling the region’s commitment to long-term growth and efficiency.

Competitive Landscape & Recent Developments

Leading players are focusing on expansions, acquisitions, and fortified product launches to strengthen their positions:

- ADM (US) acquired Vandamme Hungaria Kft (Hungary) in September 2024, expanding its non-GM edible oils capacity in Europe.

- Bunge (US) launched fortified sunflower oil in India in August 2024 to meet rising demand for healthier cooking oils.

- Wilmar International (Singapore) strengthened its presence in Vietnam by acquiring Calofic Corporation in 2023.

- Cargill (US) acquired Owensboro Grain Company in 2022, reinforcing its soybean oil processing capabilities in North America.

These developments reflect major edible oils market trends and strategies adopted by leading players.

With rising health consciousness, income growth, and innovations in oil processing, the industry is poised for sustained expansion. Emerging economies, especially in Asia-Pacific, South America, and Africa, will continue to be growth engines, while developed markets in Europe and North America will drive innovation in fortified and healthier oils.

The market is evolving into a healthier, more sustainable, and globally integrated industry, offering significant opportunities for both established leaders and new entrants.

For businesses and investors tracking edible oils market news, these shifts signal a decade of innovation and strong demand growth.

Key Questions Addressed by Edible Oils Market Report

- What is the growth outlook for the edible oils market from 2024 to 2029?

The market is projected to grow from USD 250.78 billion in 2024 to USD 306.92 billion by 2029, at a CAGR of 4.1%. - Which oils are driving demand globally?

Soybean, palm, sunflower, and olive oils are among the most in-demand, with sunflower oil showing strong growth due to its nutritional profile and versatility. - What are the key factors fueling market growth?

Rising disposable incomes, health-conscious diets, expansion of food processing industries, and growing urban populations are major drivers. - Which regions are leading in edible oil production?

South America (Brazil, Argentina), Europe, Russia, and Ukraine play significant roles, with Asia-Pacific and Africa emerging as key consumption hubs. - Who are the top players in the market?

Some of the leading companies include ADM, Bunge, Wilmar International, Cargill, Associated British Foods, Borges, and Louis Dreyfus Company. - What are edible oils commonly used for?

Edible oils are widely used in frying, baking, salad dressings, marinades, and processed food manufacturing. - Are edible oils healthy?

Yes, depending on type and usage. Oils like olive, sunflower, and coconut are rich in healthy fats, vitamins, and antioxidants that support heart health and digestion.

- How is the quality of edible oils maintained?

Through refining processes, fortification with vitamins, and adherence to global food safety and sustainability standards.