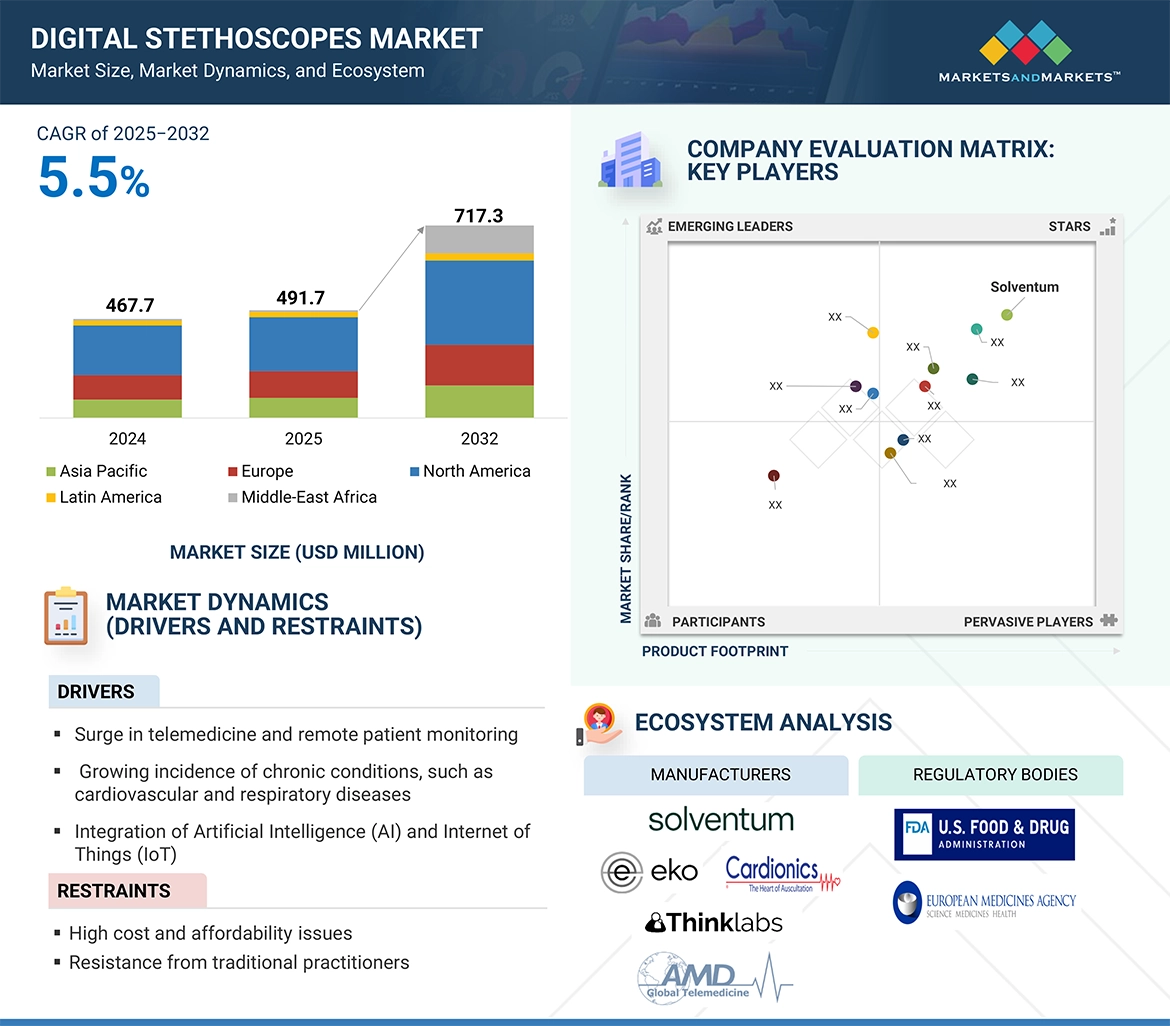

In an era where remote care, precision diagnostics, and real-time patient monitoring are becoming the norm, digital stethoscopes are emerging as a pivotal technology reshaping clinical practice. With the global digital stethoscopes market projected to grow from US$491.7 million in 2025 to US$717.3 million by 2032 at a CAGR of 5.5%, healthcare leaders are taking notice of the disruptive potential these advanced auscultation tools offer.

What Are Digital Stethoscopes and Why Are They Gaining Momentum?

Digital stethoscopes are electronic auscultation devices designed to convert acoustic sounds into digital signals. These signals can be amplified, filtered, visualized, and shared—making them ideal for remote diagnostics, AI analysis, and telehealth.

The increasing burden of chronic diseases such as cardiovascular and respiratory conditions, especially in aging populations, is driving the need for accurate and remote monitoring tools. Unlike traditional models, digital stethoscopes can record, store, and transmit patient data wirelessly via Bluetooth or Wi-Fi, enhancing their utility in telemedicine and home care.

A leading example, the Eko CORE 500, offers 40x sound amplification, noise cancellation, and AI-driven murmur detection, illustrating how these tools are elevating diagnostic precision.

Why Should Healthcare Executives Prioritize Digital Stethoscopes?

- Telemedicine & Remote Patient Monitoring (RPM) Integration

Telehealth is no longer optional—it’s a core component of hybrid care delivery models. Digital stethoscopes enable real-time auscultation during virtual consultations, allowing clinicians to assess heart, lung, and bowel sounds with precision.

- The UK’s NHS used digital stethoscopes to support over 487,000 patients between 2020 and 2023.

- In the US, telehealth visits have soared, and tools like Eko’s FDA-cleared AI software are now standard in remote cardiac assessments.

- AI-Enabled Clinical Decision Support

The integration of AI allows digital stethoscopes to detect abnormalities like murmurs or arrhythmias early, reducing reliance on subjective auscultation skills. This is particularly impactful in rural clinics and emerging markets, where specialist access is limited.

- Strategic Value in Population Health Management

With cardiovascular disease projected to affect 45 million US adults by 2050, digital stethoscopes offer scalable tools for early detection and proactive intervention. They also support longitudinal care by enabling data sharing across care teams, fostering value-based care.

Where Are the Most Lucrative Opportunities?

North America currently leads the digital stethoscopes market, with the US projected to reach US$363.39 million by 2032, growing at a CAGR of 5.7%. Favorable reimbursement policies, high digital health literacy, and strong infrastructure are key drivers.

Asia Pacific, however, is the fastest-growing region, fueled by:

- Government initiatives like India’s Ayushman Bharat Digital Mission (ABDM).

- Public-private partnerships, such as the WEF–Apollo Hospitals Digital Healthcare Transformation Initiative.

- Startups like Ayu Devices and Practo, which are revolutionizing care delivery through AI-integrated auscultation tools.

What Challenges Must Be Overcome?

Despite their promise, digital stethoscopes face adoption barriers, especially in resource-limited settings:

- High Cost of Devices and Subscriptions

- Entry-level analog stethoscopes cost ~$100.

- Digital models like Littmann CORE and Eko CORE 500 range between $379–$429.

- AI subscriptions can cost $50–100/month, creating affordability issues in regions where healthcare workers earn modest incomes.

- Battery Life and Reliability in Unstable Power Environments

Rural areas with inconsistent electricity can render battery-dependent devices unreliable. This has been highlighted in Bangladesh, where clinicians reported digital stethoscopes unusable during power outages.

Manufacturers are now innovating with low-power modes, auto shut-off, and longer-lasting batteries, but a more sustainable solution is needed for widespread adoption.

Who Are the Key Players Driving Market Growth?

The global digital stethoscopes ecosystem is being shaped by a collaborative mix of medtech innovators, software developers, and healthcare delivery platforms. Key players include:

- Eko Health, Inc. (US) – AI-integrated auscultation and FDA-cleared diagnostics.

- Solventum (US) – Known for advanced acoustic technologies.

- Thinklabs (US) – Focused on high-fidelity sound recording.

- Ayu Devices Pvt. Ltd. (India) – Innovating low-cost solutions for emerging markets.

- AMD Global Telemedicine (US) – Integrating stethoscopes into telehealth ecosystems.

- TaiDoc (Taiwan), Linktop (China), and Visionflex (Australia) – Leaders in wireless and portable stethoscope models.

When Is the Right Time to Invest in Digital Stethoscopes?

Now is the opportune moment for C-level leaders to consider integrating digital stethoscopes into clinical workflows. With rising emphasis on:

- Remote diagnostics

- AI-assisted decision-making

- Value-based care

- Hybrid health models

…these tools are not just accessories—they’re enablers of clinical excellence, operational efficiency, and scalable outcomes.

Conclusion: Are You Ready to Amplify Your Diagnostic Strategy?

Digital stethoscopes are no longer a niche product—they’re central to the future of patient-centric, data-driven, and digitally connected healthcare. As chronic disease rates climb and global care models evolve, the organizations that invest in this innovation now will be best positioned to enhance ROI, expand access, and deliver superior outcomes.